To recap 2016, one of the hottest super star in the KLSE could not be completed without the presence of Ekovest Berhad (Ekovest 8877) as one of the top 3 star, if not, Ekovest could potentially be the no.1 top star in 2016. Albeit taking a slow start in the 1st quarter of 2016, Ekovest started it's throttle in 2nd quarter of 2016, and the momentum continue towards November 2016, which saw the share price picking up from a lowly RM 1.00 to peak of RM 2.60 in just 8 months, chalking up 260% in capital appreciation.

Now what had Ekovest got to do with me? To recall the event, I had been been putting Ekovest as a prime target since August 2015. Yes, I am telling you that it is August 2015. And that is the period of time where Ekovest do not have any good earning, no trading volume. And to make it brutal, technically nobody is giving me a "hoot" on what I am talking about on Ekovest during that period of time, because it is apparently a dead stock without player, without volume, without excitement and a dull flat laying counter.

At this instant, you could be wondering, where the heck did Mr.Bone talk about Ekovest ? It is not even being featured inside his personal blogging journal. Little do I need to inform you that I actually do have a small group chat that talk about stocks. And apparently, I had been "promoting" on Ekovest during that period (All the way back starting from August 2015). Of course, some of them are smart enough to take my word seriously and caught a good journey later on. However, I would lament that they deserve it and should be rewarded with this good profit for their patient on holding into this stock for almost 1 year.

Now that Ekovest had become a full blown flower, it could technically take some time for adjustment and consolidation after a series of projects and asset sale that help boost up the share price of Ekovest. While this is a good event after all, I do feel a little bit incomplete due to the fact of me missing a small writing on Ekovest in my blogging journal, probably I had gone lazy and have it auto running. As for Gunung, now I will not want to waste this journey again.

So by now, you would be wondering what does Ekovest had to do with Gunung ?

What if I am going to tell you that Gunung could be the "Ekovest" of 2017 - 2018 ?

Firstly, both of them have corporate exercise to enlarge outstanding share. For the case of Ekovest, it is a share split for 1 to 2, putting it's par value to RM 0.50. As for Gunung with RM 0.40 in par value, it is a bonus issue of 2 to 3.

Secondly, both of them have right issue with free warrants. Right issue to raise fund for new undertaking and compensate with warrants to avoid instant dilution. So that is why you see Ekovest having Ekovest-WB, and for Gunung is Gunung-WB.

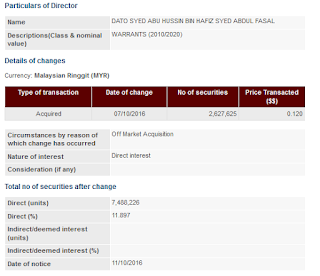

Third commonality is both are well connected politically with the ruling government. Like it or not, I definitely have to tell you that politics play a large influence in company performance. And having your foot with the ruling government definitely put you in the upper hand. For Ekovest, Datuk Haris Onn Hussein, which is the brother of Datuk Seri Hishammudin (Defense Minister), having 20% stake in Ekovest. As for the case of Gunung, Dato Syed Abu Hussin (UMNO Division Chief of Bukit Gantang) also have more than 20% of stake in Gunung.

Fourthly, both company have asset generating recurring revenue. I would highlight this being a very important point, as this is one of the major fundamental backing the business, attracting institutional fund and investor to invest in the company. And EPF had announced recently that they are looking for more recurring income base investment. For the case of Ekovest, they have DUKE Highway, which is suitable for the investment portfolio of EPF. The purchase of DUKE highway from Ekovest is also one of the major factor on why Ekovest saw it's share price spiraling upwards without brakes. What about Gunung? With approximately 140MW of renewable energy through mini hydro electric from streams of river in Perak, a 21 years REPPA (Renewable Energy Power Purchase Agreement) concession is definitely an infrastructure that will generate solid recurring income.

So since both of them have so much identical trend, I would like to put this in a similar time frame comparison, what is going to happen to Gunung in 2017 would be looking to take your breath away!

Boombastic Projection!!! If this is all accurate, this is the start of the fire cracking point.

Now that Prime Minister had asked all UMNO members to prepare for GE14, this is the one last piece for the puzzle that we need to see for Gunung to be completed in 2017!

Now, what are you waiting for? I am definitely excited for Gunung coming 2017. For first instance, 60 cents perhaps? Don't hesitate anymore, if not you could become another batch of sour grapes.

Not a PPAP, but PA in Gunung

Of course, there are a lot of well known investor in the world. High profile names in the equity market like Warren Buffet, Jesse Livermoore do not need much introduction. On the local Malaysian scene, there too are a few mention like Koon Yew Yin, Fong Si Ling nicknamed Coldeye and Dr Neoh Soon Keat.

So if today I am going to write about all this well known people, I will be wasting your time reading all these information because all their tactics and investing fundamental are already well known to the majority public. In fact, most of their investment method are well easily available in book stores and even online. For me to write and publish them here will be altogether redundant, and I would dare to take it up as you will agree to what I am saying, right?

Liken to my stock pick, I would always like to pick on something that is not heated up so much in the market.

So let me show you some proof of my picks based on the recent heatedly discussed counter

1. Gadang

This is a much over heated discussed and debated counter in 2016. Due to the fact that Koon Yew Yin had publicly promoted this company on it's future prospect. So what about me?

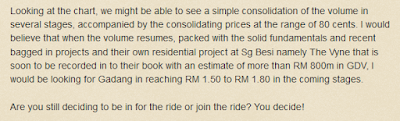

On the 5th of July 2013, I had written on Gadang - Ripe for Ride. That time, Gadang is just RM 0.80. You would be saying, I could be just lucky to be able to poke my nose here. But I am here to tell you that all these are no luck, because I am well involved in some sale and marketing of Gadang project. I am involved in the sale of the maiden project of Gadang - The Vyne at Sungai Besi. Block A was fully sold internally by staff and their relatives, and Block B is fully sold in just 2 weeks to the public. Back then, prices are selling at 500 psf, but the frantic buyers are rushing just to buy with eyes close. Due to the fact that a few of my friends are in construction line, they informed me that at RM 500psf, the real construction cost is just 50%. And that is the time I took Gadang seriously, and gave him a good ride with long term TP RM 1.50 to RM 1.80.

However, due to the fact that Gadang plan for bonus issue, the counter got over hype and shot through RM 3.00 in 2016.

Of course at the high price of RM 2.00 and RM 3.00, I will not ask people to invest in Gadang already. Albeit the heated discussion and promotion, that is just not me doing a promotion at such a high price.

2. Ulicorp

Another worthy mention of my selection in Ulicorp on 12th February 2014, Ulicorp - Towards An Ultimate Front. That time, it was just swinging at the range of RM 1.05.

Yet another coincident? That's rightfully wrong to say that. This is no coincident because at that point of time, I can see that the local construction scene is taking up a boom due to massive new development taking up, buyer rushing in frantically and pushing up demand. So as a sensitive investor that can smell Gadang, Ulicorp is nothing to be missed due to the fact that this company work hand in hand with most of the developer in providing cabling services that is totally essential for any new development.

The rest is history, Ulicorp took away until a peak of RM 6.50. Despite a recent huge drop to RM 3.50, that is still 350% in record for 2.5 years holding.

3. KESM

So let's put aside construction, I too look into electronics like semiconductor. So I recommended KESM at the range of RM 5.30 before a equity shake up (KESM - Burning Higher) and reinfornce a buy call to add RM 4.30 (KESM - The Rose Among Thorn) as well. Despite some asking member to cut their KESM during highly pressured moments, this counter is now in great blossom, trading at the range of RM 10.00.

Well I have a lot more, and that will take you up more than 3 week to finish it.

So back to my main point, I know many are preaching FA (Fundamental Analysis), TA (Technical Analysis), but I would like to share to you my approach on Personality Analysis in Gunung now.

So who is worth a good mention in Gunung now?

For this, I will not talk about Gunung first, but guide you into Appasia, one of the latest hot mention in KLSE. So how hot it is?

Not very hot, just from 10 cents to 35 cents 4 months. Good enough? Can it get hotter?

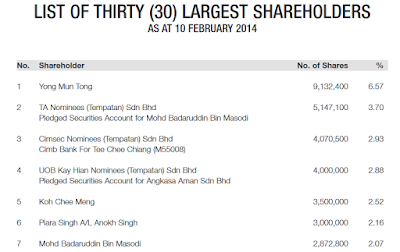

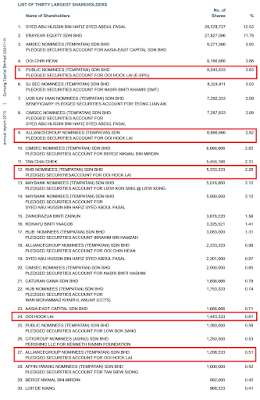

Wow, look at this. We had got Nazifuddin on board this boat. You know what magic can Nazifuddin (son of prime minister) do in the market, right? Then Ooi Hock Lai as the 4th largest shareholder? Wow, who is this Ooi Hock Lai?

According to Annual Report, as of 10 Feb 2014, there are no mention of Ooi Hock Lai as one of the large substantial shareholder.

So in 2016, Ooi Hock Lai shareholding is standing side by side with Nazifuddin in Appasia. If it takes a lot of your study to invest RM 100k into a counter, then for Ooi Hock Lai to invest approx 2 to 3 million should not be a blind bet after all, right? So to put it forward, I would have high credible assumption that Ooi Hock Lai is well connected and also well knowing on the underlying development of a company once he is invested into it.

So where are the other traces of Ooi Hock Lai ?

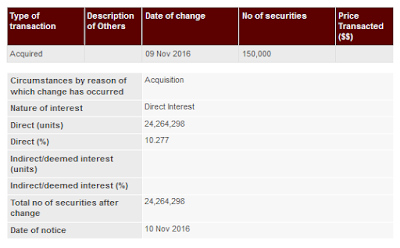

24.26 millions of share in Gunung, and that is like 10.27% stake!

So now that you had seen how Appasia throttling 350% in just a short time frame, I don't know what magic can do to Gunung in 2017.

By now, you can see I am on a very hard sell mode on Gunung. But is alright, I am hard selling it when it is still low, and there are still margin for appreciation. After all, what is share market? This is a market where you share, share out your thoughts, share out your points. But of course, the most important is to share something beneficial at the right time.

Just 3 Simple Reasons For You to "Hoot" Gunung

Basically, Gunung is engaged in land logistic chartering business, which provides buses to national services and several local universities. However, the future long term business will be the largest mini hydro renewable energy player in Peninsula Malaysia, with all the sites in Perak. Gunung will also be the master developer of all mini hydro renewable energy site in Perak through it's 51% effective stake in PHREC (Perak Hydro Renewable Energy Corporation).

Now, I would want to list down to you why you should get your position in Gunung before this counter explode above RM 0.50. Gunung had closed at RM 0.475 on 28th November 2016.

Here is a simple 3 reason for you to hoot Gunung into your portfolio.

Reason 1 - Selling Renewable Energy is liken to IPP

The first reason is there are still many retailer in the public that do not know Gunung had a change of business direction. Even if they know, they could had forgotten about this because this news is much highlighted then during 2013, 2014. Back then, the hype of the news is not backed with earning from the division. However, right now at the end of 2016 and going into 2017, Gunung already invested into the infrastructure, and these mini hydro are going to turn the inertia of the flowing waters that flows from the river stream in Perak into electricity, and then sells it back to TNB through a REPPA (Renewable Energy Power Purchase Agreement), which is then the revenue for Gunung.

While renewable energy do not come in a large scale like coal fire power plant which can generate capacity up to 900MW, Gunung is considered not bad after all, with installed capacity of up to 140 MW (according to Annual Report 2015). For 140MW, we are talking about RM 150 million in annual recurring revenue from PPA, now this is something commendable.

So, if TNB, YTLPower and Malakoff is so sought after by institution because of their defensive nature of revenue through generation of electricity, now Gunung is a company with multiple PPA with 21 years feed in tariff signed, right in front of you. What are you waiting for?

Reason 2 - Dato Syed Abu Hussin Took Position at RM 0.52

The second reason is based on major shareholder and executive chairman, Dato Syed Abu Hussin purchase price of RM 0.12 in Gunung warrant (Gunung-WB), I am definitely looking at him putting in RM 0.40 exercise price per share in the coming future to reap dividend benefits. That would priced his purchase of the mother share at RM 0.52.

With the price now being at RM 0.475, it would definitely be a good buy for a long haul.

Reason 3 - Gunung Break Out from Long Term Downtrend

The third reason is that Gunung had broken away from it's long term downtrend line after 2 years. This is something not to be overlooked as the break out is backed with the commencement of the mini hydro renewable energy.

While the break out can be accommodated by buying from institution, emerging market funds, syndicate or high profile investor, however, you must know that who is behind the break out is not a very important question.

The most important question is, are you inside Gunung during the breakout and uptrend?

While I had laid my 3 simple reason for you to see the future prospect of Gunung, the rest is up to you to decide.

wecan2088

GUNUNG (7676)

Chart Analysis

GUNUNG has been trading above its upward sloping 20-Day Moving Average which is a good sign. Furthermore, the next resistance level is quite far at 0.49.

2016-12-18 14:35