[KAYAPLUS]: BRITISH AMERICAN TOBACCO (MALAYSIA) BERHAD

mykayaplus

Publish date: Wed, 06 May 2020, 12:45 PM

Business Summary

British American Tobacco (Malaysia) Berhad is a Malaysia-based tobacco company that deals with the sale of cigarettes. Since the delisting of Japan Tobacco Inc in 2014, BAT is the only listed tobacco company in Malaysia.

BAT has key brands in all three cigarette product segments in Malaysia:

Premium segment– DUNHILL

Aspirational premium segment – PETER STUYVESANT and PALL MALL

Value-for-money segment - ROTHMANS

Years ago, BAT was a darling stock. It was a stable stock to hold with good dividend yields in the range of 5-6%. Sadly, a lot has changed since then. BAT had a market capitalization of RM 20.8 billion in Jan 2014. In the year 2020, we have seen RM 17.2 billion of its market cap wiped off, where it is now trading at around RM 3.6 billion. How much is RM 17.2 billion? It is more than the combined market capitalization of alcohol manufacturers Carlsberg Brewery Malaysia Bhd and Heineken Malaysia Bhd.

BAT has since been removed from the FBMKLCI index and the MSCI Global Standard Index.

So, what went wrong in the past 6 years that led to this >80% loss in value?

Last update: 01.05.2020

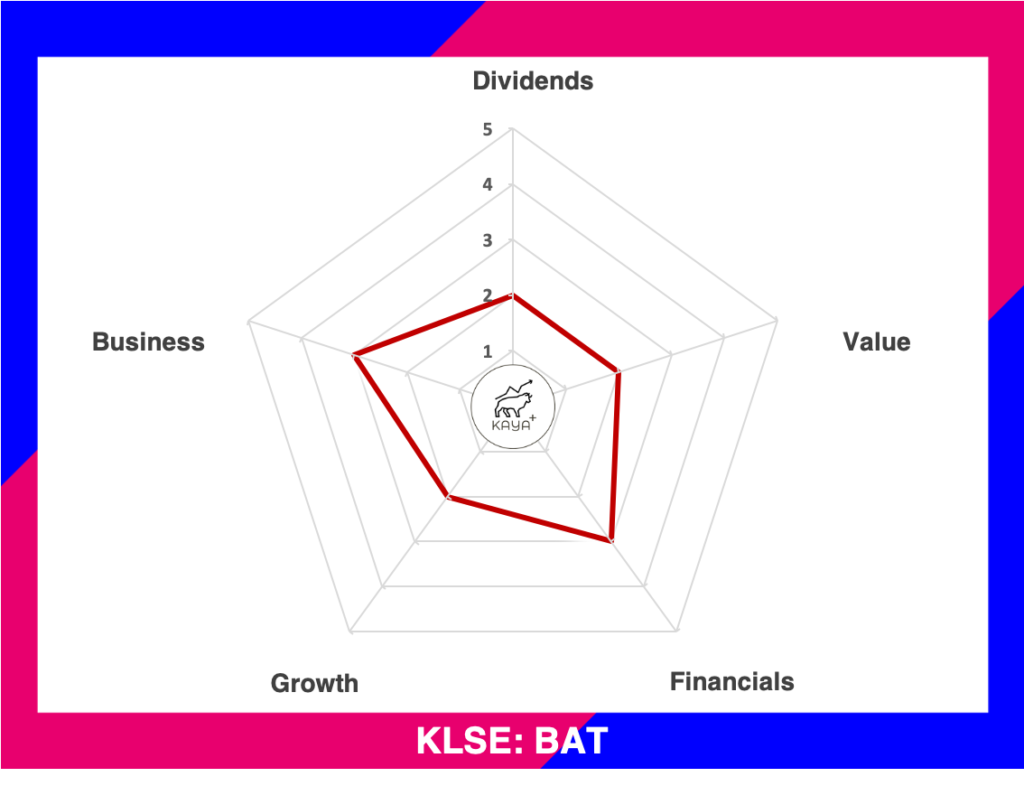

Dividends (2/5): ⭐ ⭐

Value (2/5): ⭐ ⭐

Financials (3/5): ⭐ ⭐ ⭐

Growth (2/5): ⭐ ⭐

Business (3/5): ⭐ ⭐ ⭐

Reference: (i) MyKayaPlus Metrics Definition (ii) MyKayaPlus Metric Evaluation Scale

Financial Performance

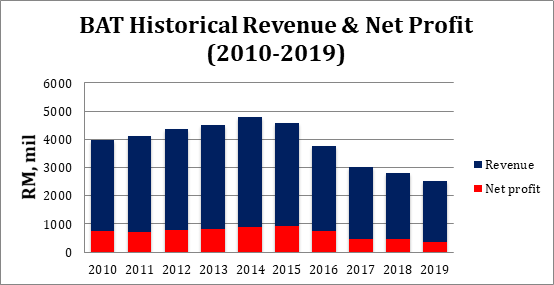

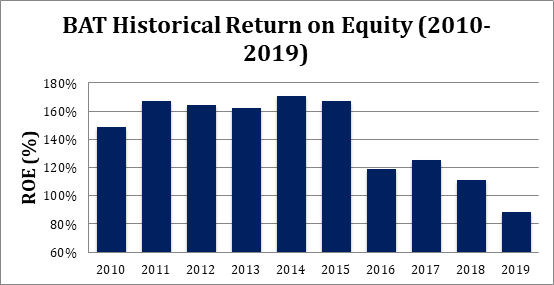

After achieving historical high revenues and net profits in 2014, BAT went on consecutive year-on-year decreases up till the latest fiscal year 2019. As for FY2019, BAT’s revenue is almost half of its peak at RM 2.5 billion while its net profits are down more than 60% to RM 343 million. Similarly, its Return on Equity has also trended significantly lower over the past 4 years. This means the company is less efficient or less capable to generate profits from the equity it employs.

| Year | Assets (RM, mil) | Liabilities (RM, mil) | Equity (RM, mil) | Current Ratio | Debt to Equity (%) |

| 2019 | 1,028 | 640 | 389 | 0.86 | 114% |

| 2018 | 1,101 | 679 | 423 | 0.90 | 97% |

| 2017 | 1,045 | 662 | 382 | 0.84 | 98% |

| 2016 | 1,196 | 582 | 613 | 1.26 | 21% |

Balance Sheet

Over a 4 years period, there has been a substantial decrease in Equity (Assets – Liabilities) from RM 613 mil to RM 389 mil. This is due to a decrease in its Assets and an increase in Liabilities during the period. Its current ratio has also been trending downwards, latest at 0.86. The current ratio indicates a company’s ability to repay short-term dues (<12 months). This is particularly important at times like this during the COVID-19 outbreak, where businesses and cash flows are generally muted. Lastly, BAT’s debt to equity or gearing ratio has an 80% increase to 114% over the 4 years period. While having some leverage is good, a 114% gearing ratio does appear to be on the high side and puts BAT at greater financial risks.

Operating Cash Flow & Dividend Payout

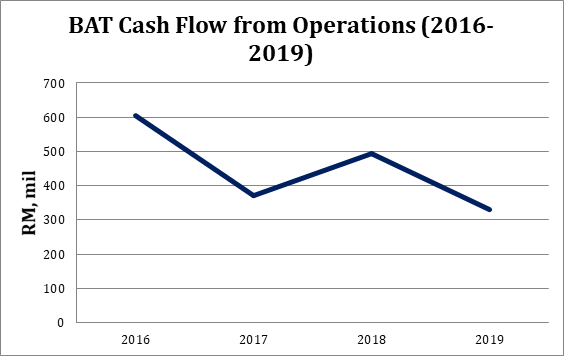

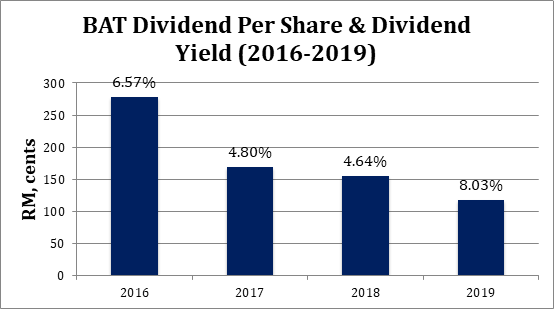

Trending with its decline in sales and profits, BAT's cash flow from operations has also been on a declining trend in the 4 years period of 2016-2019. Also, with fewer profits, BAT’s dividend payout per share has declined more than half from RM 2.78 per share in 2016 to RM 1.18 per share in 2019. This is a classic example that higher dividend yields are not necessarily good. In this case, a higher trailing dividend yield of 8.03% at the expense of rapidly falling share prices and lower dividends distributed per share.

Future Prospects for BAT

The fall of BAT did not happen overnight. But the turning point for BAT was the 30% increase in excise duties for cigarettes in Nov 2015 (after a 12% hike in 2014). When cigarette prices in the market increased suddenly, this encourages smokers to move towards the cheaper illicit cigarettes. Based on BAT’s 2019 annual report, it is estimated that the legal industry volume has halved post-2015 and the illegal cigarette trade is standing at 68% of the total consumption volume. This means that approximately 7 out of 10 packs of cigarettes sold or consumed in Malaysia today are illegal. Putting aside BAT’s interests, illicit cigarettes have caused approximately RM 25 billion loss in government tax revenues since 2015. Apart from illicit cigarettes, BAT also faces other challenges like the rise of vaping, ban of public place smoking and SST led pricing.

Based on its latest financials presentation, there are 4 key areas that BAT will be working on:

-

Move the government for action

- Intensify enforcement to crackdown illicit trades

-

Drive commercial growth within the legal segment

- Drive growth across all 3 product segments (premium, aspirational premium and value-for-money)

-

Drive opportunity for new revenue pool

- Regulate vaping and expand further tobacco heating product

-

Stabilize and energize a new organizational model

- Lean organization to reduce cost

Despite initiatives to crackdown illicit cigarettes, it has been recording double-digit increase year-on-year for the past 5 years. Hence unless there are drastic and firm measures, it is difficult to see the situation improving.

The ROTHMANS brand under the value-for-money segment for BAT has good growth, doubling its market share in just about a year. At this moment, this gain was not at the expense of BAT’s premium segment so this is a positive sign.

A change in trend also sees smokers shifting their preference to either vape or tobacco heating product like e-cigarettes. BAT has its own non-combusted tobacco product called GLO. Due to the proclaimed less harmful proposition, it is touted as a “healthier” alternative.

Verdict

All in all, the make or break factor of BAT's prospect would rest heavily on the illegal cigarette trade. Without any clear indications on how to improve the situation, it is foreseen that BAT will have troubles to catch up with its sales and profits. It is difficult to find any long-term value in BAT at this moment. Again never jump into dividend stocks solely base on the high dividend yield. Rather, it is far better to go for reasonable but steadily growing yield returns instead.

DISCLAIMER

The information available in this article/report/analysis is for sharing and education purposes only. This is neither a recommendation to purchase or sell any of the shares, securities or other instruments mentioned; nor can it be treated as professional advice to buy, sell or take a position in any shares, securities or other instruments. If you need specific investment advice, please consult the relevant professional investment advice and/or for study or research only.

No warranty is made with respect to the accuracy, adequacy, reliability, suitability, applicability, or completeness of the information contained. The author disclaims any reward or responsibility for any gains or losses arising from direct and indirect use & application of any contents of the article/report/written material

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on https://www.mykayaplus.com/

Created by mykayaplus | Apr 05, 2020

Created by mykayaplus | Feb 07, 2020

Created by mykayaplus | Jan 19, 2020

Created by mykayaplus | Jan 14, 2020

Created by mykayaplus | Dec 23, 2019

Created by mykayaplus | Dec 23, 2019

RainT

long term of BAT still looks very bleak

2020-05-07 19:13