Because of Petronas's RM300bil capex from 2011-2015, Oil & Gas sector has been tipped to have a very good prospect ahead.

True enough, many Oil & Gas stocks in Bursa Malaysia have made handsome gain in 2013.

This positive trend is widely believed to continue in 2014, and personally I believe so.

At the moment I do not own any O&G related stocks in my portfolio. I just sold Pantech, which has an indirect exposure to the O&G field, in January.

I wish to have a good O&G stock to keep throughout year 2014. The problem is, I find it difficult to value an O&G company, as my current knowledge in O&G is very limited.

As the share price of most O&G stocks have rallied, most of them seem to be traded at high PE now. Is it too late to go in?

However, many of those O&G companies have acquired new contracts or made new acquisition for the past one year. Surely their profits are going to rise in the near future.

Most companies have billions worth of contracts on hand. But I don't know when & how the contracts turn into profit and what is the profit margin.

In other words, it's hard for me to predict the future earning of an O&G company. Thus, I don't know its fair value base on my style of valuation and investment.

If I really want to own an O&G company's shares, I think I have to follow analyst's recommendation.

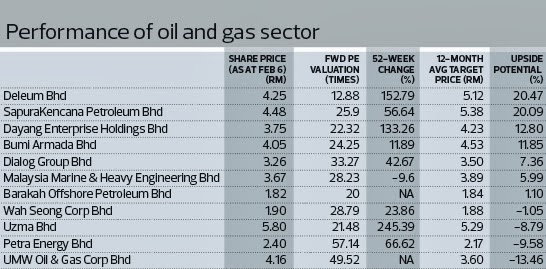

From The Edge, Feb14

From the table above, Deleum & SKPetro have the most upside potential, which is about 20%. Since SKPetro is a big cap company with recent big acquisition, should I just put my money in SKPetro?

Another table below represents a simple comparison between most O&G companies in Bursa Malaysia. Forward PE are derived from annualized net profit.

For consistency, I'll use the target price by RHB as reference, unless RHB's target price is too outdated or if no RHB coverage, I'll get the latest or median value among the target prices.

|

|

Price |

DY% |

PE |

Fwd PE |

NTA |

Order book |

TP |

|

ALAM |

1.57 |

0.2 |

20.9 |

13.1 |

0.75 |

1.4bil (Nov13) |

2.25 (RHB Feb13) |

|

ARMADA |

3.98 |

0.8 |

30.2 |

25.4 |

1.46 |

12.0bil (Feb14) |

4.50 (RHB Jan14) |

|

BARAKAH |

1.81 |

NA |

27.4 |

27.4 |

0.36 |

2.3bil (Jan14) |

1.85 (MB Feb14) |

|

COASTAL |

4.45 |

1.3 |

18.2 |

15.3 |

1.97 |

2.5bil (Feb14) |

4.51 (KNG Feb14) |

|

DAYA |

0.44 |

0.6 |

31.4 |

24.4 |

0.20 |

2.1bil (Dec13) |

0.42 (RHB Nov13) |

|

DAYANG |

3.84 |

2.6 |

24.3 |

19.8 |

1.17 |

5.0bil (Jan14) |

4.48 (RHB Dec13) |

|

DELEUM |

4.75 |

3.2 |

16.0 |

14.3 |

1.52 |

3.4bil (Nov13) |

5.12 (ALA Nov13) |

|

DIALOG |

3.35 |

1.0 |

42.4 |

34.2 |

0.60 |

|

3.71 (RHB Feb14) |

|

MHB |

3.64 |

2.7 |

24.6 |

24.6 |

1.62 |

2.6bil (Feb14) |

3.60 (KNG Feb14) |

|

PENERGY |

2.37 |

0.4 |

103.0 |

50.4 |

1.50 |

3.0bil (Nov13) |

2.45 (RHB Nov13) |

|

PERDANA |

1.92 |

NA |

NA |

25.6 |

1.04 |

1.4bil (Feb14) |

1.90 (RHB Jan14) |

|

PERISAI |

1.67 |

NA |

19.6 |

19.1 |

0.82 |

|

1.62 (RHB Feb14) |

|

SCOMIES |

1.13 |

NA |

NA |

26.5 |

0.27 |

5.3bil (Feb14) |

1.02 (HLG Feb14) |

|

SKPETRO |

4.45 |

NA |

50.9 |

26.6 |

1.64 |

25bil (Jan14) |

6.75 (CIMB Feb14) |

|

TAS |

1.22 |

1.6 |

16.3 |

7.3 |

0.92 |

401mil (Oct13) |

1.57 (RHB Oct13) |

|

TGOFFS |

0.61 |

NA |

NA |

22.6 |

0.55 |

|

|

|

UMWOG |

4.38 |

NA |

NA |

49.8 |

0.68 |

1.4bil (Dec13) |

4.80 (MB Feb14) |

|

UZMA |

6.40 |

0.3 |

37.6 |

23.7 |

0.93 |

1.3bil (Nov13) |

6.16 (HLG Jan14) |

|

WASEONG |

1.95 |

2.7 |

28.7 |

75.6 |

1.26 |

1.7bil (Nov13) |

2.25 (RHB Jan14) |

|

YINSON |

7.77 |

0.2 |

58.9 |

33.3 |

1.67 |

7.5bil (Dec13) |

7.32 (KNG Jan14) |

From the table above, most of the companies are traded either very close or above their target prices, except those companies marked in red.

Among all those which are still "undervalued", Alam Maritim (43%) & Sapura Kencana (52%) have the most upside potential.

So, it is clear that SKPetro, who also has the largest value of contracts (a mammoth RM25bil), is the one that stands out.

Others that worth to study further include Alam Maritim, Deleum & Tas Offshores.

The analysis above do not include other important valuation such as ROE, debt analysis, profit margin, future growth potential etc.

Anyway, I don't think I will study all these companies in detail. May be I'll concentrate on the 4 mentioned above.

The blogger of

十面埋伏 has done a great job with numerous

articles (in Chinese) related to Oil & Gas industry and its related companies. I have gained a lot from those articles, but still not fully confidence in investing in O&G yet...

If I already have other stock that I think can fetch higher return compared to all these O&G stocks, should I still waste my time to study O&G stocks and buy just for the sake of buying?

Or the opportunity in O&G is something that should not be missed?

TomJerry

How about the TTHE valuation !

2014-02-18 18:01