Will There Be a Market Crash? - netnethunter

Tan KW

Publish date: Tue, 12 Jul 2016, 10:06 PM

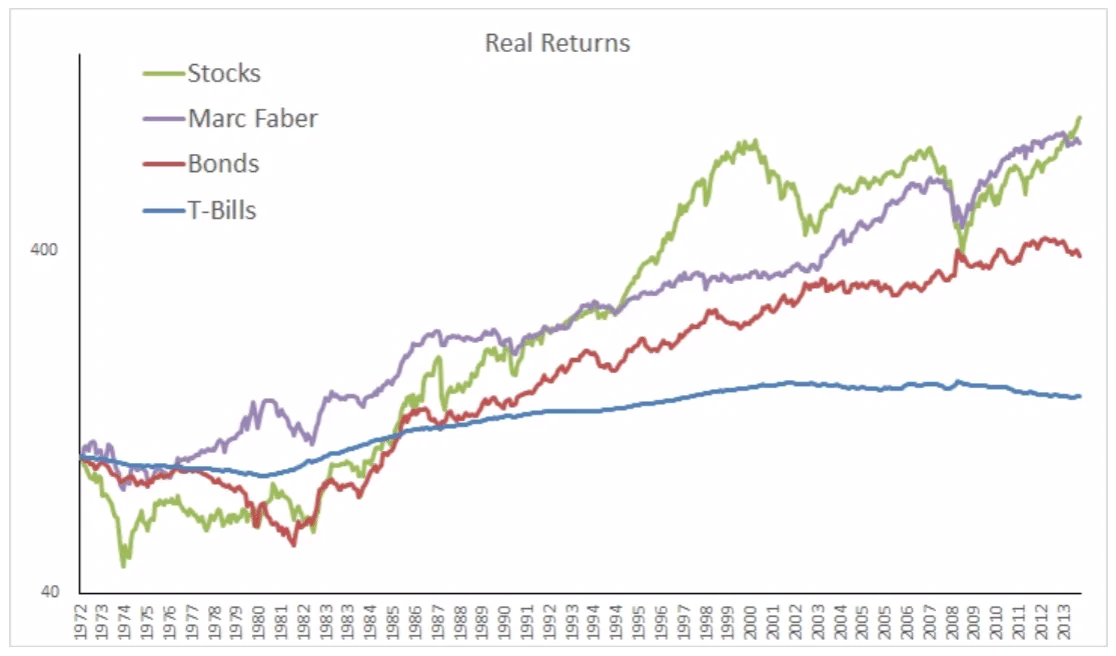

Source: Global Financial Data

Warren Buffet said : "When dumb money acknowledges it’s limitations, it ceases to be dumb."

Dollar Cost Averaging

By going all-in at once, especially as a retiree and at the lofty valuation levels of 1989 in Japan, Mr. Sato fails to take advantage of another possibility to diversify – the diversification of entry points. By committing to a dollar cost averaging approach, with means investing fixed amounts at regular intervals, rather than investing all at once, one could have forgone the possibility of entering the market exactly at the wrong time.

Dollar cost averaging seems to be a bit of a controversial topic in the financial community, the main counter-argument against it being that in most scenarios an investor will have lower returns by dollar-cost averaging because he has to much cash on the sidelines.

When an investor goes all-in though, his entry point can be important. Just because you can’t time the market, doesn’t mean that it won’t make a difference. When the all-in entry point is right before a drastic decline like in Japan at the end of 1989, he might still be worse off after many years than a dollar cost averager. If an investor feels paralyzed by the possibility of a crash, it might still be a viable option to be partially invested and/or moving into the market gradually, rather than contemplating forever back and forth between the two extremes, 100% in stocks or 100% in cash.

Conclusion

You might have noticed a common theme by now: managing and reducing risk, rather than guessing about the future. Benjamin Graham said, that successful investing was "about managing risk, not avoiding it".

You might say at this point, "But I want to be 100 % safe, I’ll keep everything in cash." Paper money, available in endless quantities, printing press running 24-7, backed by nothing but good faith - that kind of safe?

Risk in the specific context of this article means reducing the danger of big drawdowns in the event of a once-in- a-lifetime crash. In the case of our retiree, who wants to invest in Bubble Land, it makes sense to take that scenario into consideration. However, Mr. Satos risk isn’t your risk. The word risk can’t be taken out of context. Or can it ? To be continued…

And by the way, the answer to the title is : YES. As it has always been and always will be…

https://www.netnethunter.com/will-market-crash-2016/

More articles on Good Articles to Share

Created by Tan KW | Jul 05, 2024

Created by Tan KW | Jul 05, 2024

cstrader

Yes a mini crash is just round the corner.

2016-07-13 20:52