It's been a flaming hot period now for Gunung since the turn of the year of 2020.

Its CEO and largest shareholder Datuk Syed Abdul Hussin started to pare down his entire 28% stake and exited the company.

Its second & third largest shareholders Erayear Equity Sdn Bhd and Ooi Hock Lai with 11.8% and 10% stake respectively also ceased to be a substantial shareholder.

It is reported that former owners of Kumpulan Powernet (KPower) led by Datuk Chew Kam Wah will become major shareholders of Gunung, who will change its name to G Capital Berhad.

Kumpulan Powernet was taken over by Serba Dinamik's Datuk Abdul Karim & OHP Ventures's Mustakim Mat Nun last year and the group's name has been changed to K Power (Karim's Power?)

Relatively young Datuk Yap Yee Ping at 45 years old became the new executive director of Gunung, along with Tan Sri Dr Ali.

Gunung's past financial records were pathetic with 5 consecutive years of loss. Most recent FY2019 whole year revenue was just RM16.8mil, with a net loss of RM11.6mil.

In short, Gunung's main business is to provide land-based transportation to the school children of armed forces personnel who stay in 77 camps nationwide.

Previously it also provided transportation for PLKN (National Service Training Program) but this has been terminated since 2018.

It has just been awarded a new contract worth RM44.2mil for such purpose by the Ministry of Defense in Dec 2019 after the old contract expired. This 3-year contract will run until Dec 2022 so it will contribute an average of RM3.7mil revenue per quarter. Revenue might fluctuate due to school holidays.

From its latest FY20Q1 ended in Mac20, this transportation segment generates RM4.2mil of revenue but suffers operational loss if we exclude the RM3.1mil gain on disposal of assets.

The jewel of Gunung is its small-hydropower renewable energy segment. In 2013, Gunung acquired a 51% stake in Perak Hydro Renewable Energy Corp Sdn Bhd (PHREC) who is involved in developing, maintaining and operating small hydropower plants in Perak.

Forty percent of PHREC is held by Perak state government through MB Incorporated (Perak).

PHREC is granted the right to build, operate and own (BOO) small hydro plants for 21 years at 31 pre-identified sites in Perak.

Though the acquisition of PHREC was 7 years ago, this small hydro segment still does not contribute a single cent of revenue to Gunung up to FY20Q1. It registered operating loss of RM0.9mil in FY2019.

From FY2019 annual report, there are total 10 active small hydro sites with total estimated installed capacity of 84.1MW.

-

2 sites (Sg Slim & Sg Kerian) with total 20MW have been commissioned and delivering energy to the National Grid

-

4 sites (Sg Geruntum, Sg Korbu, Sg Kampar & Sg Selama) with total 23.3MW are under construction

-

4 sites (Sg Pelus, Sg Geroh, Sg Gedong & Sg Perak) with total 40.8MW are under design and planning stage

Since there are 2 sites which have already been commissioned (Sg Kerian has started to deliver energy since 2018), it's weird that there is still no revenue to small hydro segment and also no earning from associates recorded in FY2019 and the latest FY20Q1 report.

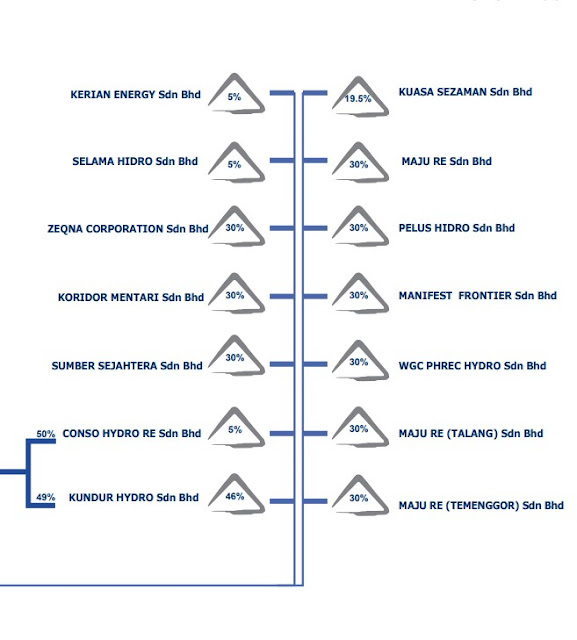

The management mentions that earning from 30% or lower joint ventures will be classified into associate level.

I'm not sure how many percentage Gunung has in those Sg Slim & Sg Kerian hydro plants. Gunung's shareholding in all those small hydro plants are a bit complicated, as below:

From annual report, it is stated that there are a few projects which are being "developed" by Gunung.

-

Sg Geruntum (2MW) by Conso Hydro RE Sdn Bhd (indirect 50% owned), expected completion FY21Q1

-

Sg Geroh by Kundur Hydro Sdn Bhd (indirect 49% owned)

-

Sg Perak by Gunung Hydropwer Sdn Bhd (direct 90% owned)

Gunung Hydropower Sdn Bhd is a direct 90% subsidiary of Gunung but Gunung still hold 10% of it through PHREC which is a 51% subsidiary. So the effective stake in Gunung Hydropower Sdn Bhd is 95%.

Does it mean that Gunung does the EPCC job for those small hydro plants it "develop"? It will be great if it is but so far I can't see any contribution of revenue from its under constructed Sg Geruntum project.

For comparison, KPower bagged EPCC contracts for 5 mini hydro plants in Perak with total capacity 32.47MW in Mac20 and they are worth RM354mil.

I'm not sure how much Gunung will earn in the form of concession income from its 2 small hydropower plants with total capacity of 20MW which are said to be commissioned.

The bid tariff for mini hydro is around 23-29sen per kWh. I don't know how to calculate the potential revenue to Gunung and I don't know how many percentage Gunung holds in those small hydro plants.

MFCB has a 260MW Don Sahong hydropower plant in Laos. It has started full commercial operation on 7 Jan 2020 at tariff of 6.15 US cents per kWh. In FY20Q1 it ran at 71% and generated RM103mil in revenue and RM64.7mil in PBT.

Lets say Gunung's tariff is similar at US 6.15 cents per kWh (~26sen per kWh), its 20MW mini hydro plants may generate RM8mil a year at 71%.

If it can run at maximum capacity which is unlikely, potential revenue might reach RM11mil a year. PBT might be around RM5-6mil a year.

However, Gunung does not hold 100% of those hydro plants. Some are held more than 50% and some are as low as 10%. So the profit might be cut into half.

This is a very very rough estimation of small hydro plants profit. Comparison between gigantic and mini plants in different country might not be appropriate and there are many other factors which can affect the profitability.

If any readers know how to calculate the profit accurately from such concession, kindly enlighten me.

Transportation and small hydropower segment are old existing businesses of Gunung. With the introduction of new management and new shareholders, surely something new are going to happen.

Gunung has been accumulating ACE market-listed company LYC Healthcare's shares and emerged as substantial shareholder with 6.16% stake as in July 2020.

LYC has been loss-making in the past 8 years. It is involved in healthcare business which includes confinement service and nursing homes. It recently acquired 51% stake in Singapore-based T&T Medical Group for RM22.3mil. T&T recorded a net profit of RM3.3mil for its FY19.

Besides LYC Healthcare, Gunung also accumulated another listed company Yi Lai's shares and became a substantial shareholder with 13.75% stake as in July 2020.

Yi Lai is involved in manufacturing, sale, trading and distribution of Alpha brand tiles. It also suffers loss in its past 3 financial years.

Why did Gunung invest in loss-making companies such as LYC & Yi Lai? Surely they think that those companies are undervalued. Does the management see something good which ordinary people don't see?

Gunung is currently in "advanced talk" to acquire a substantial over 20% stake in a new full-fledged commercial bank in Cambodia for more than USD25mil.

If this deal materializes, then Gunung will set its footing into five different industries namely transportation, renewable energy, healthcare, manufacturing and banking.

So, 2020 is an eventful year for Gunung. The new management acts like a fund manager investing the cash in various businesses without really running it. Will it be another iCapital?

Anyway, it might be better than depending solely on the transportation business.

Of course it will be a brand new page to Gunung, or G Capital. Its mini hydro plants might start to contribute to its revenue soon, though I guess the amount might not be big in initial stage.

Its investment in those loss-making companies might not see a quick turnaround.

Gunung's share price has started to move north from its base of 30sen since the change in shareholders occurred in Dec19. It reached over 60sen before MCO in Mac20.

MCO pulled it back to 30sen level before recovering and jumping to 80sen recently.

Many investors will ask: Can I buy now? Well, I don't know.

At share price of 80sen now, its EPS must be 8sen if I were to give it a PE ratio of 10. Thus, it must have a net profit of at least RM20mil per year base on outstanding shares of 246mil.

It still has 57.8mil warrant B which are going to expire in 2 months time. It's a potential 23% dilution to earning if all warrants are converted to ordinary shares.

If the overall ordinary shares reach 300mil later after warrant conversion, its PATAMI must be RM24mil to give it an EPS of 8sen.

I opine that G Capital's will turn profitable and grow its profit slowly when more and more small hydropower plants start to operate.

However, I think that it needs a few more years to achieve RM20mil PATAMI, unless the Cambodia bank deal closed and contributes big to its bottom line, or its hydro plants contribute more than I expect, or it does the hydro plants EPCC job itself, or it sells the shares of its investment at a gain.

abang_misai

seriously, do you want to chase high especially for the stocks with so many questionable acquisitions? When fund is not a constraint, the company tends to make purchases without much thinking, thus can make mistakes in the process.

2020-08-03 07:02