Hidden Gem of Glove company - UG Healthcare Malaysia company listed in SGX

bryan2003

Publish date: Mon, 01 Jun 2020, 10:08 AM

If you guys do a deep research on UG Healthcare (Malaysia’s company listed in Singapore), you guys will realize that it is quite similar to Malaysia listed Supermax and Top Glove. The reason Supermax and Top Glove up alot since Supermax release their quarter report is because these 2 companies are distributing their own brand of glove which lead to higher profit margin. You guys can understand further from the video as per below link. After watching, you guys can go read UG's report and you guys will realize that UG has their own distribution center at China, Nigeria, UK, German, US and Brazil. Despite UG didnt own 100% of share of these companies, but definitely it helps UG to have better profit. Also, these coutries are badly affected by Covid-19.

https://klse.i3investor.com/blogs/kianweiaritcles/2020-05-28-story-h15...

Also, not to neglect that Ug Healthcare German is also selling mask, PPE, disinfection, protective clothes etc. All these products are high demand product during this Covid-19. Please refer to the link to understand better.

Besides, UG Healthcare Nigeria is also very interesting distribution center as it is selling the similar products that UG Healthcare German is selling but on top of that, it is also selling infra-red thermometer which is also high demand. Please refer to the link below.

https://www.unimedicalhealthcare.com/aboutus.html

The link below will enable you to understand better about Uniglove UK. Even though it is old news but it definitely will be benefited during this pandemic as it is Europe’s first antimicrobial nitrile glove.

https://www.hsmsearch.com/page_960209.asp

https://unigloves.co.uk/fortified-biocote-antimicrobial-gloves

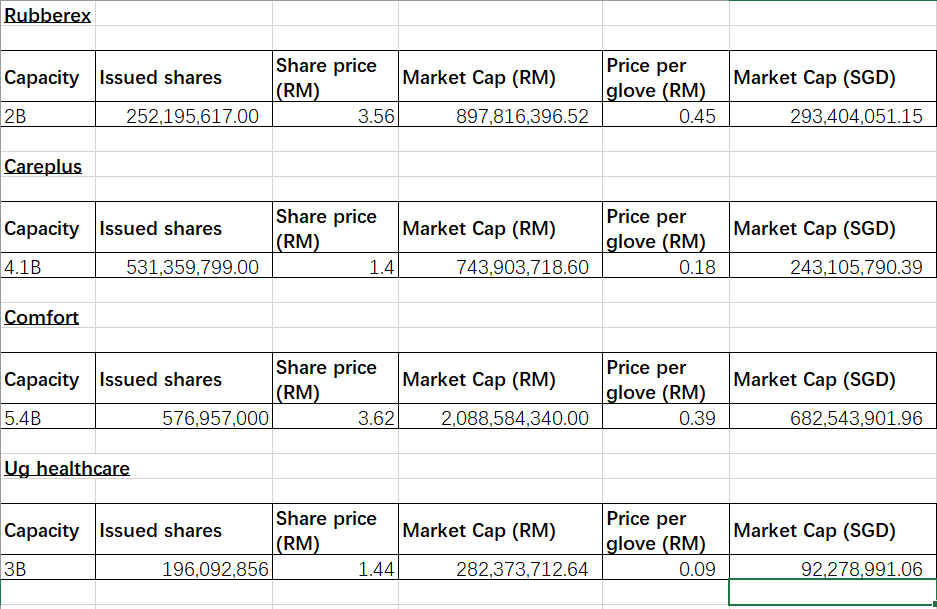

If we do comparison between Rubberex Malaysia and UG Healthcare. UG healthcare is lagging behind.

Rubberex market cap = (rm3.56/3.06) * 252195617 = SGD 293,404,051

UG heathcare market cap =(SGD 0.47 * 196092856)= SGD 92,163,642

UG yearly capacity is around 3B where Rubberex only 2B.

So if we use production capacity ratio to market cap as below calculation. UG should worth SGD

(293404051 (Rubberex’s market cap) * 3B (UG’s capacity)) / 2b (Rubberex’s market cap) = 214685891

UG’s potential share price = 214685891 / 196092856 (no of UG’s issued share)= SGD 1.09

If we do comparison between Careplus Malaysia and UG Healthcare. UG healthcare is also lagging behind.

Careplus market cap = (rm1.40/3.06) * 531,359,799 = SGD 243,105,790

UG heathcare market cap =(SGD 0.47 * 196092856)= SGD 92,163,642

So if we use production capacity ratio to market cap as below calculation. UG should worth SGD

(243105790 (careplus’ market cap) * 3B (UG’s capacity)) / 4.1B (careplus’ capacity) = 177882285.4

UG’s potential share price = 177882285.4 / 196092856 (no of UG’s issued share) = SGD 0.907

Even though careplus produce 1B pcs extra compared to UG healthcare, but UG healthcare will benefitted from it’s own brand of glove as well as it’s distribution centers in UK, Brazil and Nigeria are selling others PPE and tools which are badly needed during this pandemic.

If we use the method of one of the Malaysia’s famous investor to calculation the price per glove, UG healthcare is on 0.09 per glove which is much more cheaper compared to peers.

Even though the last quarter report seems like “poor”, but it was mainly affected by the production modification cost where the board has decided to on hold the modification in order to cope with the sudden spike of demand. Do take note that the modification at the end will benefit the group as well. UG has reported positive earning for the last 3 FY. In fact, increase of marketing expenses is good for the company in long run as once everyone know about “Uniglove”, the marketing expenses eventually will come back and profit will go up.

Most likely August report will have flying colour result.

Stay tuned!!!

More articles on Hidden Gem of Glove company - UG Healthcare

Created by bryan2003 | Oct 19, 2023