Good Articles to Share

Prestariang 柏斯達亮 (PRESBHD) FY2013 Q4 Update - chyithong

Tan KW

Publish date: Thu, 20 Feb 2014, 11:29 PM

Thursday, February 20, 2014

Prestariang just released its 4th quarter result for financial year 2013 la ~~

A slightly better result in terms of net profit compared to Q4FY12.

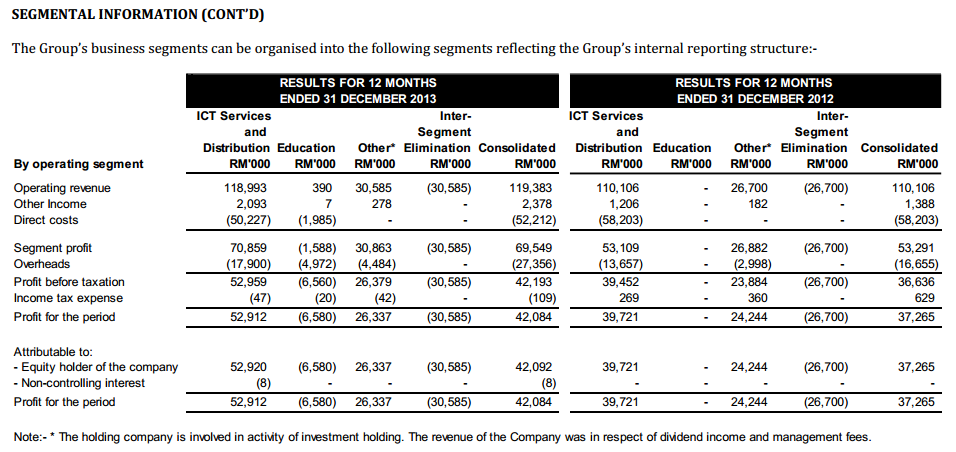

Revenue increased 25.5% y-o-y but net profit only able to increased around 3.4% thanks to lower gross and profit margin. Furthermore, a higher administrative expenses was spent on education arm for the newly open university is also another cause that contributed to lower net profit margin.

Its training and software distribution especially for those program like 3P and IC Citizen have some cyclical effects which depends on the institutions schedules and experience high classes conducted during semester breaks. For the past 1 year, the training arms conducted more classes during first and third quarter.

In terms of balance sheet, it still looks good. Cash balance on the rise with RM26 mil is put into short term investments. Borrowings is reducing and consider negligible while retain earnings keep improving. Full year ROE is 43.4 given its light asset structure.

For the full year of 2013, ICT services and software distribution actually improved a lot with 33.2% growth. The new university which opened at the mid of last year failed to lift up the expectation as the result of poor showing of student intake and also additional marketing costs. However, the management team did point out last time that they target to breakeven for the education arm for financial year 2014. This will at least help to increase the overall net profit assumed the ICT services and distribution remain strong.

Apart from that, the management also did point out in the notes that they remain positive on future business contribution from the oil & gas sector after realized the profits from 2 training courses conducted earlier to oil & gas sector.

Lastly and as usual 3 cents dividend was declared which bring up a total 12 cents dividends for full year 2013, 2 cents increases from 10 cents last year.

And what's more. A bonus issue of 1 to 1 is being announced too. This will probably help to increase the share liquidity and improve the institutions involvement in future.

Overall, Prestariang still looks good, just a little bit pricey now. Haha. A PE of 17 based on today price of Rm3.29.

http://chyithong.blogspot.com/2014/02/prestariang-presbhd-fy2013-q4-update.html

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Good Articles to Share

Elon Musk vows 'war' over H-1B visa programme amid rift with some Trump supporters

Created by Tan KW | Dec 29, 2024

Trump sides with Musk in H-1B visa debate, says he's always been in favour of the programme

Created by Tan KW | Dec 29, 2024

Plane drives off runway and crashes at airport in South Korea, Yonhap reports

Created by Tan KW | Dec 29, 2024

Where K-pop idols learn to dance: Inside 1Million, South Korea’s biggest dance studio

Created by Tan KW | Dec 29, 2024

Discussions

1 person likes this. Showing 2 of 2 comments

Ini lah satu pakar konon harga saham sudah mahal. Tapi harga makin naik, nanti akan tukar cerita ini adalah saham berpatutan. Kalau ikut bulat bulat pakar pakar macam ini cakap, itu sebab tak dapat cari rezeki

2014-02-21 08:26

tewnama

Kena banding Q4 dengan Q4. Baru ada nampak peningkatan yg jelas. Dan bukan nya Q4 dengan Q3 dlm tahun yg sama

2014-02-21 08:24