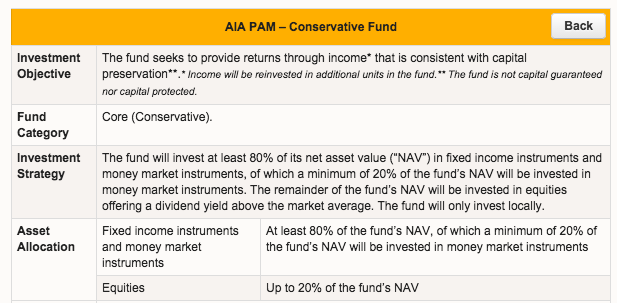

This year though, I wanted to take a back seat and be conservative (to also balance my investment in fund). This means that for this year I am for conservative funds perhaps. Taking a cue from AIA's Conservative funds (as below), a conservative fund basically invests 80% of the money into fixed income and money market instruments and remaining 20% into equity.

Fixed income as in the name is most of the time investment into bonds (usually high grade) while money markets are securities which are shorter time in nature and these are high grade securities. All in all, I expect to secure decent and above fixed deposit rates return. Add in the tax incentives, it should be good savings and return.

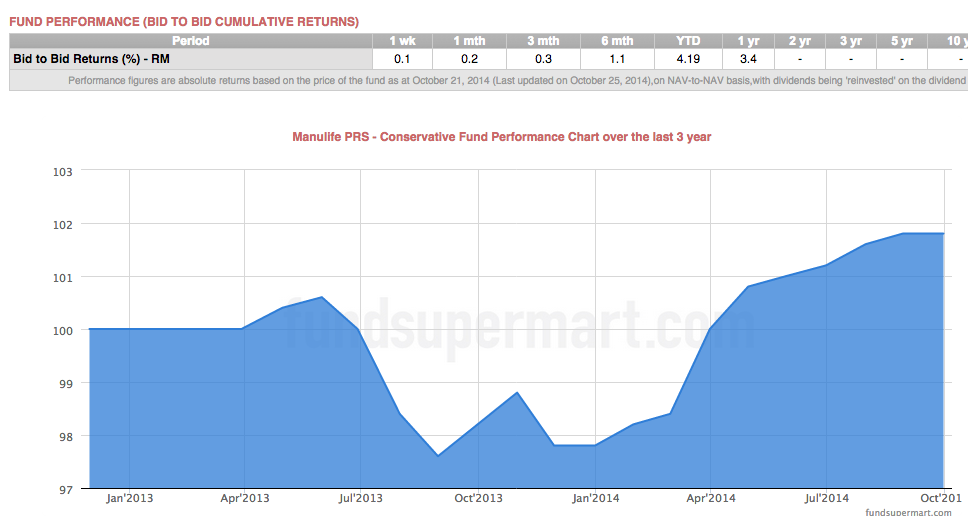

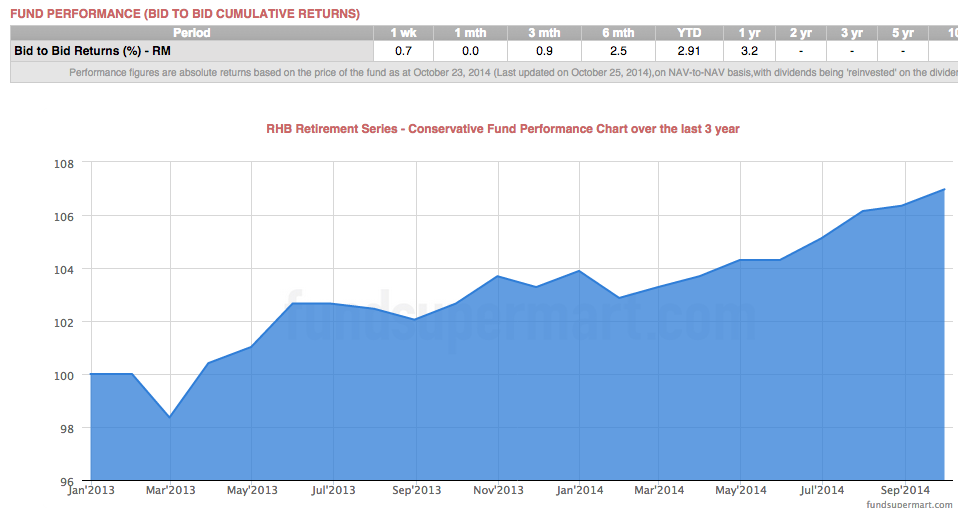

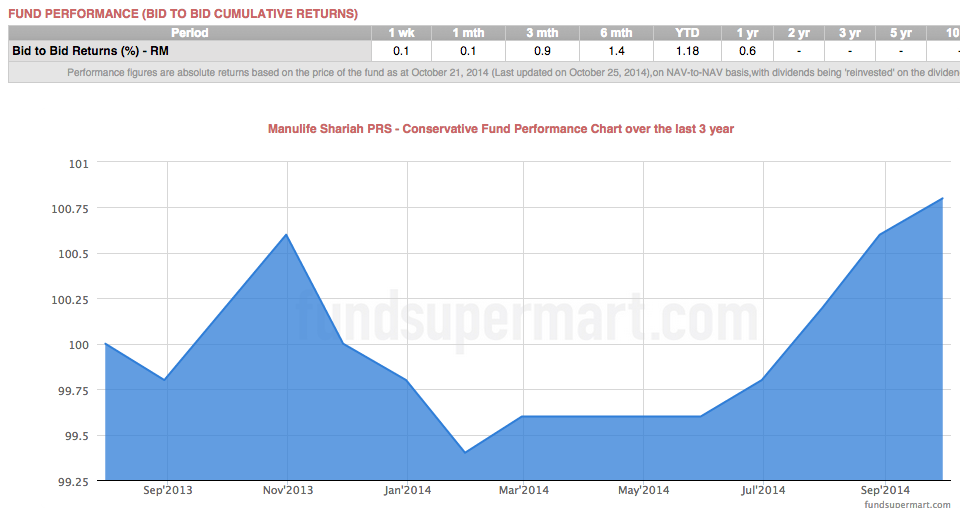

One way to look at the which fund to choose is to look at its past performance. As PRS scheme is a new scheme for most of the funds, they have been in existence for slightly more than a year. These are what I have found - which is quite surprising. (Remember me saying I expect above FD type of return.)

|

| CIMB Plus Islamic Conservative - 1 year return 2.8% |

|

| AMPRS - CONSERVATIVE FUND - CLASS D - 1 year return 1.6% |

|

| Affin Hwang Conservative - 1 year return 3.6% |

|

| AIA PAM - CONSERVATIVE - 1 year return 2.7% |

|

| Manulife Conservative PRS - 3.4% |

|

| RHB Conservative - 1 year return 3.2% |

|

| Manulife Shariah PRS - Conservative - 1 Year return 0.6% |

Based on the above, among the conservative funds, it can be said that over a short 1 year period, the best performing one at 3.6% return is Affin Hwang while worst performing one is Manulife Shariah at 0.6% return.

The worrying thing is that these funds does not create much value, except for the government's incentive of tax deduction up to RM3000 invested. One can argue that we should not look at these funds over the short term. I agree as I myself pitch long term. But these are funds that largely invested into fixed income securities.

They are not creating value!

P.s. I did not include some of the funds e.g. Public Bank's but I hear that they do not perform well too despite the entrance fees of 3%.

Also the fund management guys will not like me, but these are FACTS!

regnig

Very conservative and safe but still have to pay manager fees

2014-10-25 16:03