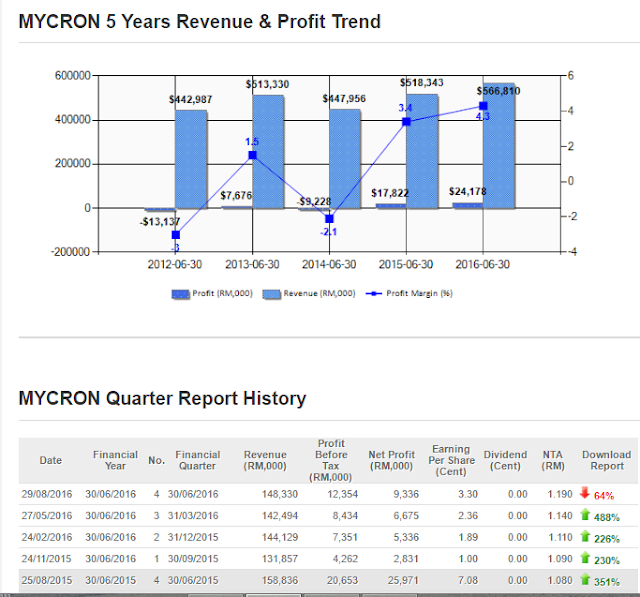

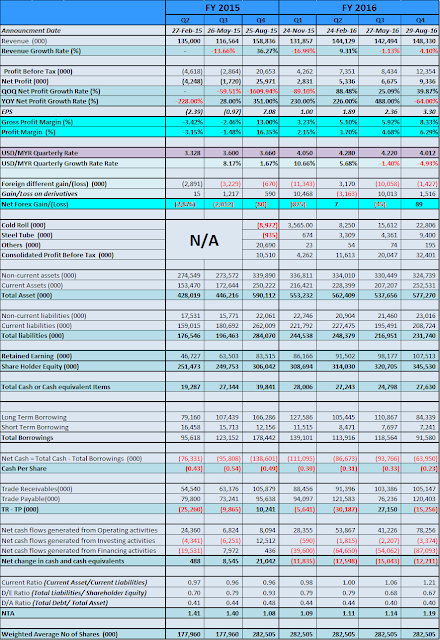

- 公司最新4个季度的Net Profit Margin不断走高,主要是Steel tube贡献了新盈利以及钢铁价走高。

- 此外,公司在FY16上半年Coll roll部门贡献了8.25 mil,但是Q3和Q4却分别贡献了7.3262 mil以及7.194 mil。

- 而FY2015买进的Steel tube业务在16Q4单个季度贡献了5.039 mil的PAT, 1个季度超过了Q1 - Q3三个季度的4.361 mil。

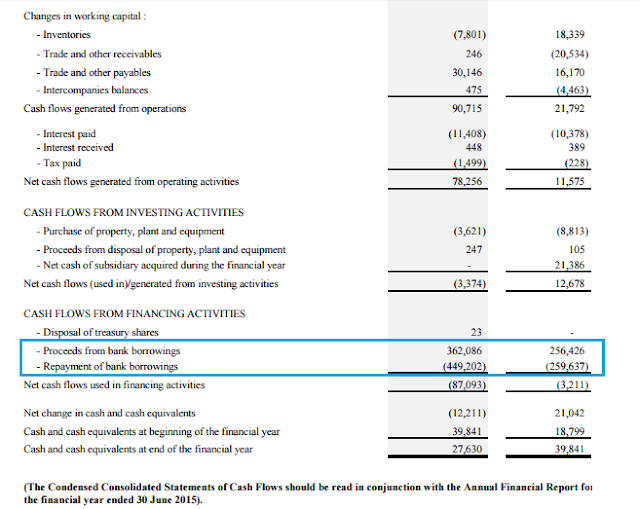

- 公司的Total Borrowing年底因为买新产线而暴增到178 mil,不过FY2016全年清还了87 mil的债务,现在公司还欠银行91.58 mil。

- MYCRON手持27.63 mil,所以Net Debt = 63.95 mil,处于两年来最低水平,Gearing ratio从巅峰期的0.93下跌到0.67.

从上图可以看到公司很积极地清还债务,假设FY2017公司继续保持盈利,债务是很有可能继续减低的。

虽然明年还是充满挑战性,公司还是会努力在FY2017交出不错的业绩。现在公司PE = 12.19, 在众多钢铁股还亏钱的情况下,难怪今年股价可以上涨292.45%。

追高的风险大家都知道,MYCRON已经是今年的神话,不过在这个价格买进,我囧!除非投资者坚信MYCRON未来每个季度可以维持每季度3.3仙的EPS, 全年盈利来个13仙以上。

其实笔者主要是想要看戏,MYCRON每上涨27仙就是100%。

假设上涨到RM1.08, 全年涨幅 = 300%。

假设上涨到RM1.35, 全年涨幅 = 400%。

假设上涨到RM1.62, 全年涨幅 = 500%。

不过股市没有绝对,以上的资料只是供给大家参考。

以上纯属分享,买卖请自负。

Harryt30

21.20p.m

2016.10.20

probability

thanks for the info Harryt30...even myself missed seeing that information at B3 - Prospect for next Financial year. Especially on the Constraint faced by the Steel Tube Segment...

2016-10-20 22:46