Data centre-linked stocks gain traction on news flow

savemalaysia

Publish date: Mon, 20 May 2024, 02:17 PM

This article first appeared in Capital, The Edge Malaysia Weekly on May 13, 2024 - May 19, 2024

AS more investments continue to pour into the data centre (DC) industry, companies are looking to tap opportunities in either the DC construction, fit-out or testing and commissioning segments.

Notably, the artificial intelligence (AI) boom has spurred demand for digital infrastructure, including the internet, cloud computing and other IT services, with DCs being the crucial components that support digital infrastructure where digital data is stored, managed and processed.

Apart from DC owners such as Time dotCom Bhd (KL:TIMECOM), Telekom Malaysia Bhd (KL:TM) and YTL Power International Bhd (KL:YTLPOWR), who are the indirect beneficiaries of the DC boom and what is their upside?

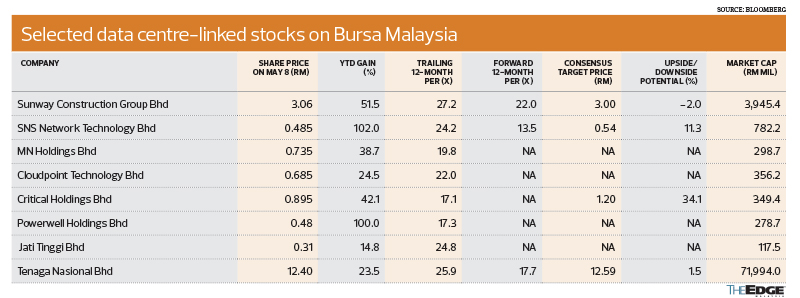

Fund managers say interest in DC-linked stocks has been predominantly driven by news flow, with their prices having risen substantially since the start of the year. The counters include SNS Network Technology Bhd (KL:SNS) (+102%) and Sunway Construction Group Bhd (KL:SUNCON) (+51.5%).

William Ng, chief investment officer of LeInves PLT, is of the view that DC jobs are more about providing an additional revenue stream and it remains to be seen whether DC-linked contracts really offer high margins.

“For example, margins in the construction sector are quite standard — unless you are the DC owners, then you can get better margins,” he tells The Edge. Having said that, he is positive on companies that provide maintenance and service jobs to DCs over a long-term period.

“DCs are a trend, and Malaysia has the advantage of low operating cost. But it really depends on companies that have bagged the DC contracts,” he says.

Peter Lim Tze Cheng, founder and chief research officer of Trident Analytics Sdn Bhd, says investors should be vigilant when digesting the news flow considering that some ventures may not materialise. “We still have to see which ones will materialise, so I think it is a bit too early to jump on the DC bandwagon.”

Under the Malaysia Digital Economy Blueprint (MyDIGITAL) 2021-2025, one of the targets listed is to build an enabling digital infrastructure and environment for local DC firms to specialise in high-end cloud computing services. Revenue-wise, the goal is for the country’s DC industry to achieve RM3.6 billion by 2025 from RM2.09 billion in 2022.

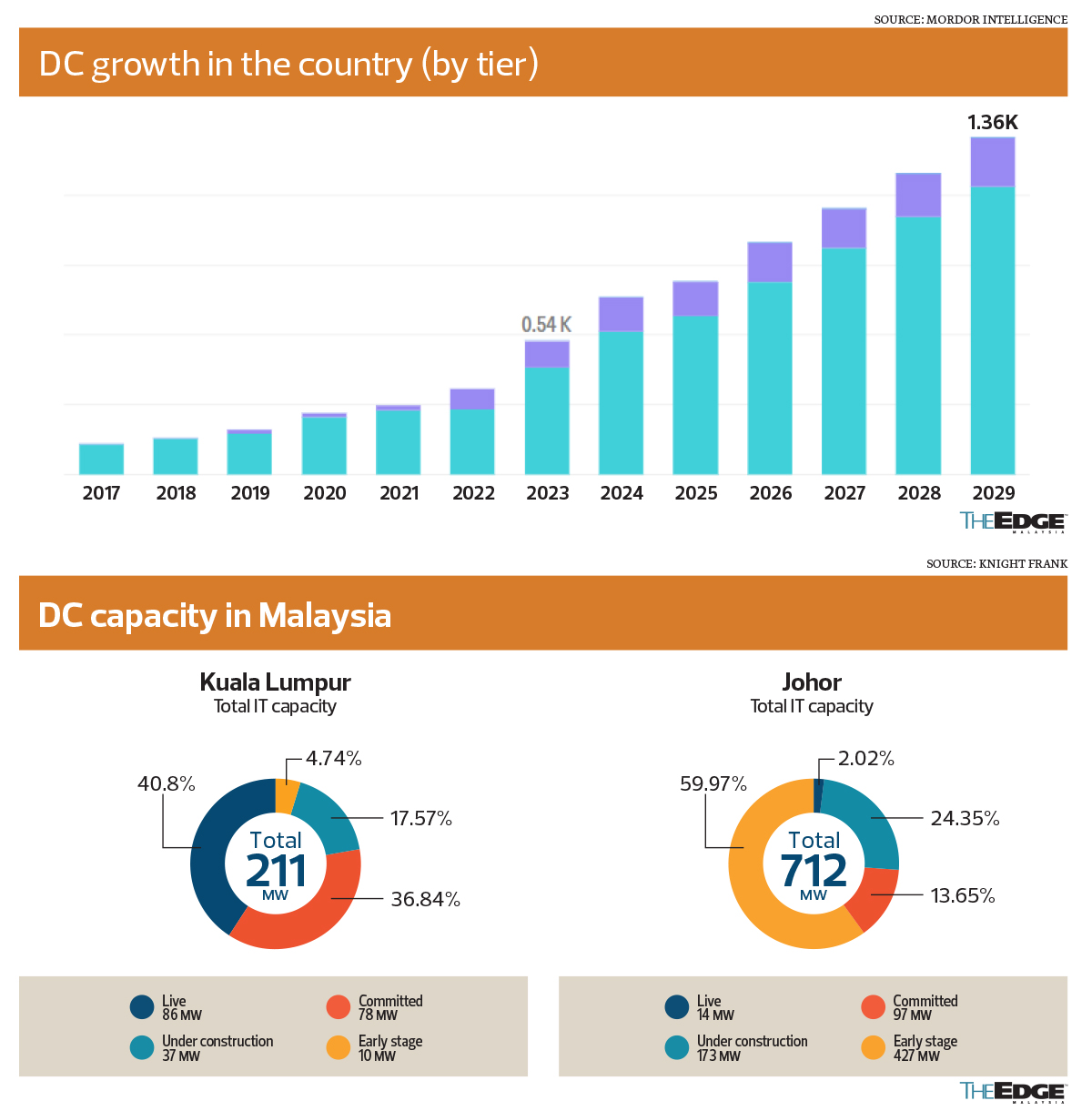

According to research firm Mordor Intelligence, the Malaysian DC market will see a compound annual growth rate of 17% from 2023 to 2029, from 540mw to 1,360mw.

“Tier 3 DCs currently account for the majority of the local market share with 10 to 15 DCs currently under construction in Malaysia. The total floor space is expected to grow from three million sq ft in 2023 to 7.7 million sq ft by 2029. Concurrently, the number of installed racks is projected to grow 2.5 times from 154,000 in 2023 to 388,000 by 2029,” it says.

Tier classification determines the preparedness of a DC facility to sustain the operation. A DC is classified as Tier-1 when it has a non-redundant power component, cooling components and power distribution system, with an uptime of 99.67% and an annual downtime of less than 28.8 hours.

Tier-2 DCs have redundant power and cooling components and a single non-redundant distribution system. They have an uptime of 99.74% and an annual downtime of less than 22 hours.

A DC with redundant power and cooling components and multiple power distribution systems is referred to as Tier-3. The facility is resistant to planned and unplanned disruptions, with an uptime of 99.98% and an annual downtime of less than 1.6 hours.

Tier-4 DCs are the most tolerant as they have multiple, independent redundant power and cooling components and multiple power distribution paths. All IT equipment are dual-powered, making them fault tolerant in case of any disruption, thereby ensuring interrupted operation. These DCs have an uptime of 99.74% and an annual downtime of less than 26.3 minutes.

YTL Power is developing the YTL Green DC Park in Kulai, Johor. Having secured Singapore-based Sea Ltd and its subsidiaries Shopee and Garena as anchor customers, the first phase of the project is expected to accommodate a capacity of up to 72mw.

Time dotCom still has equity interest in AIMS Data Centre Holding Sdn Bhd after disposing of a partial stake to DigitalBridge Group Inc for RM2 billion in April 2023.

As for TM, it is said to be exploring plans to build a new hyperscale DC in Malaysia, expanding its capacity from its existing DCs in Cyberjaya, Selangor, and Iskandar Puteri, Johor.

Clearly, as there will be substantial demand for electricity from DCs, Tenaga Nasional Bhd (KL:TENAGA) has guided for electricity demand growth of 2.5% to 3% in 2024, more than the 1.7% embedded in incentive-based regulation, underpinned largely by new data centres, according to Kenanga Research’s March 4 note.

SunCon is the key winner in the construction of DCs, having bagged three jobs since early 2023 for a combined contract value of RM2.64 billion, which is a substantial portion of its all-time-high order book of RM6.9 billion. Its year-to-date contract wins has increased to RM1.6 billion, after winning a DC contract worth RM747.8 million from a US-headquartered multinational technology firm in March.

Its first DC win was in January 2023, when it entered into a RM1.7 billion contract to provide general contractor services for a DC construction project in Sedenak Tech Park in Johor. This was followed by a RM192.8 million contract from K2 Strategic Infrastructure Malaysia Sdn Bhd in October 2023 for the development of a DC in Johor.

Its peer Gamuda Bhd (KL:GAMUDA) is also keen to take up DC construction jobs. According to Kenanga Research’s March 29 note, Gamuda is set to secure two DC building jobs, but it has no intention to own DCs at this juncture.

“It quoted high capex and potential oversupply at some point in the future as its key concerns. Nonetheless, it holds the belief that the data centre business is still in the early stages of its up cycle and the upward momentum could last at least another five years,” the research house added.

Apart from construction, the DC fit-out business segment is another area of interest. SNS recently ventured into this segment by selling AI super servers, as well as providing testing, commissioning and operation and management on the premises of DCs.

The ICT systems and solutions provider told The Edge in a recent interview that it expected meaningful contribution from this foray. A unit of its AI super server is sold at RM1.5 million, with an estimated gross profit margin of 15%, well above the 5% from its existing core business.

Underground utilities and substation engineering specialist MN Holdings Bhd (KL:MNHLDG) has been diversifying its business to include DC jobs. A key deal is its partnership with China-based Shanghai DC-Science Co Ltd to develop Shanghai DC-Science’s first high-performance DC outside China in Sedenak Tech Park in Johor. The project is estimated to have a value of more than US$600 million (RM2.65 billion).

In February this year, Cloudpoint Technology Bhd (KL:CLOUDPT) announced that it would be acquiring 75% equity interest each in Unique Central Sdn Bhd (UCSB) and Uniqcen Sales & Services Sdn Bhd (USSSB) for RM26.78 million cash. UCSB is involved in the supply, delivery and installation of DCs, data cabling, fibre optic works, as well as mechanical and electrical services, while USSSB is an electrical contractor.

The IT solutions provider said the deal would allow the group to offer end-to-end DC, hybrid cloud and multi-cloud solutions, as well as green and sustainable DC solutions to its customers.

Listed in December last year, Critical Holdings Bhd (KL:CHB) is seen as a strong beneficiary of the huge influx of DC investment in Malaysia. In March, Phillip Capital initiated coverage on the company with a target price of RM1.20, suggesting an upside potential of 34.1% based on last Wednesday’s closing price of 89.5 sen.

“The group is aggressively expanding in the Klang Valley and Johor to capture the booming DC opportunities surrounding Cyberjaya, Sedenak and Nusajaya Tech Parks as well as YTL Green DC Park,” the research house said in a March 26 note.

Back in 2020, Powerwell Holdings Bhd (KL:PWRWELL) bagged a data centre project in Cyberjaya worth RM1.4 million, but without further details. Another company, Jati Tinggi Bhd (KL:JTGROUP), clinched its maiden DC-linked job worth RM22.06 million two months ago, to lay underground cables for a DC in the southern region of Peninsular Malaysia.

It is worth noting that two newly listed ACE Market companies are eyeing DC jobs. KJTS Group Bhd (KL:KJTS) — which made its debut on Bursa Malaysia in January — has said it is in talks with data centre owners and main contractors for the supply of its cooling system. The building support services firm specialises in providing cooling energy, cleaning and facility management services, primarily to the property industry. Cooling systems are a major component of DCs due to heat generated by their hardware.

Meanwhile, HE Group Bhd (KL:HEGROUP), an electrical engineering service provider, is targeting to set up DCs in the Johor-Singapore Special Economic Zone. It was listed early this year.

https://theedgemalaysia.com/node/711335

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-01-22

SNS2025-01-22

SNS2025-01-22

SUNCON2025-01-22

SUNCON2025-01-22

TIMECOM2025-01-22

TM2025-01-22

YTLPOWR2025-01-22

YTLPOWR2025-01-21

SNS2025-01-21

SNS2025-01-21

SUNCON2025-01-21

SUNCON2025-01-21

SUNCON2025-01-21

SUNCON2025-01-21

SUNCON2025-01-21

TIMECOM2025-01-21

TM2025-01-21

TM2025-01-21

TM2025-01-21

TM2025-01-21

YTLPOWR2025-01-21

YTLPOWR2025-01-20

SNS2025-01-20

SNS2025-01-20

SNS2025-01-20

SNS2025-01-20

SNS2025-01-20

SNS2025-01-20

SNS2025-01-20

SUNCON2025-01-20

SUNCON2025-01-20

SUNCON2025-01-20

SUNCON2025-01-20

TIMECOM2025-01-20

TM2025-01-20

TM2025-01-20

TM2025-01-20

TM2025-01-20

TM2025-01-20

YTLPOWR2025-01-20

YTLPOWR2025-01-20

YTLPOWR2025-01-20

YTLPOWR2025-01-20

YTLPOWR2025-01-17

SNS2025-01-17

SNS2025-01-17

SNS2025-01-17

SNS2025-01-17

SNS2025-01-17

SNS2025-01-17

SNS2025-01-17

SNS2025-01-17

SNS2025-01-17

SNS2025-01-17

SNS2025-01-17

SNS2025-01-17

SNS2025-01-17

SUNCON2025-01-17

SUNCON2025-01-17

SUNCON2025-01-17

TIMECOM2025-01-17

TM2025-01-17

TM2025-01-17

TM2025-01-17

TM2025-01-17

TM2025-01-17

YTLPOWR2025-01-17

YTLPOWR2025-01-17

YTLPOWR2025-01-17

YTLPOWR2025-01-17

YTLPOWR2025-01-17

YTLPOWR2025-01-16

SNS2025-01-16

SNS2025-01-16

SNS2025-01-16

SUNCON2025-01-16

SUNCON2025-01-16

TIMECOM2025-01-16

TIMECOM2025-01-16

TM2025-01-16

TM2025-01-16

TM2025-01-16

TM2025-01-16

TM2025-01-16

TM2025-01-16

TM2025-01-16

TM2025-01-16

YTLPOWR2025-01-16

YTLPOWR2025-01-15

SUNCON2025-01-15

TIMECOM2025-01-15

TM2025-01-15

TM2025-01-15

TM2025-01-15

TM2025-01-15

TM2025-01-15

TM2025-01-15

YTLPOWR2025-01-15

YTLPOWR2025-01-15

YTLPOWR2025-01-15

YTLPOWR2025-01-14

TM2025-01-14

YTLPOWR2025-01-14

YTLPOWR2025-01-14

YTLPOWR2025-01-14

YTLPOWR2025-01-14

YTLPOWR2025-01-14

YTLPOWR2025-01-13

SNS2025-01-13

SNS2025-01-13

TIMECOM2025-01-13

TM2025-01-13

TM2025-01-13

TM2025-01-13

TM2025-01-13

TM2025-01-13

TM2025-01-13

YTLPOWR2025-01-13

YTLPOWRMore articles on save malaysia!

Created by savemalaysia | Dec 31, 2024

Created by savemalaysia | Dec 31, 2024

Created by savemalaysia | Dec 31, 2024

Created by savemalaysia | Dec 31, 2024

Discussions

Correction

Seagate stated that HDD (hard disk drive) will be an important part of Data Centers for the next 10 years

2024-05-21 00:00

calvintaneng

In the very core (heart) of a DC (Data Center) is the Storage of Data

And To Store Data you need

Hdd (hard disk drive)

Ssd (solid state drive)

All others are supports for these to operate in the storage of data

So must go for the stocks that produce Hdd parts like

Notion

Jcy

Dufu

Seagate which need supplies from these is a major producer of Hdd drives which command 90% of all Data Center storage needs

And Seagate started Hdd (hard disk drive) will be s vital need of Data Centers for the next 10 years

Source: Seagate

World largest manufacturer of Hdd for DC

2024-05-20 23:32