APOLLO FOOD - Q2 FY25 Earnings Analysis

KingKKK

Publish date: Thu, 05 Dec 2024, 09:43 AM

Source: Bursa website

https://www.bursamalaysia.com/market_information/announcements/company_announcement/announcement_details?ann_id=3506594

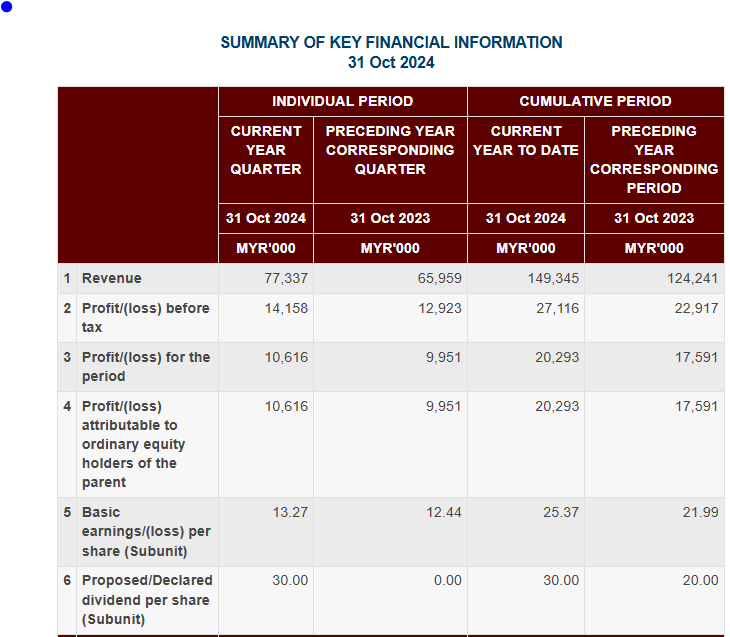

1. Strong Quarterly Growth:

Revenue: RM77.3m (+17% YoY, +7% QoQ), supported by robust demand in both domestic and export markets.

Profit Before Tax (PBT): RM14.2m (+10% YoY, +9% QoQ), driven by higher sales despite an uptick in operating costs.

Net Profit: RM10.6m (+7% YoY, +10% QoQ).

The earnings growth reflects Apollo's strategic efforts to deepen market penetration and bolster brand equity.

2. Consistent Dividend Policy:

Declared a 30 sen interim dividend for FY2025. This reinforces management's commitment to shareholder returns.

3. Healthy Balance Sheet:

Net Cash Position: RM141.6m (as of 31 Oct 2024).

Net Asset Per Share: RM3.06 (vs. RM2.81 in April 2024).

This solid cash buffer provides flexibility to manage raw material costs and undertake capacity enhancements.

4. Operational Efficiency and Mitigation Measures: Apollo's ongoing initiatives to streamline operations and enhance efficiency are expected to counter rising input costs and safeguard margins.

Key Risks

Rising input costs remain a concern, but Apollo’s cost-management measures and pricing strategies are mitigating the impact. Export-driven revenue (approximately 38%) exposes Apollo to foreign exchange risk

More articles on Stock Market Enthusiast

Created by KingKKK | Feb 05, 2025

Created by KingKKK | Feb 01, 2025

Created by KingKKK | Jan 31, 2025

KingKKK

APOLLO FOOD - Q2 FY25 Earnings Analysis

https://klse.i3investor.com/web/blog/detail/bestStocks/2024-12-05-story-h475736794-APOLLO_FOOD_Q2_FY25_Earnings_Analysis

2 months ago