The change in government is going to see changes in Ekovest from a company perspective which is from largely construction based (from government related contracts) to more of its dependence on its long term assets - toll and land. I know many would be concerned on the toll assets as the new government is looking at ways to eliminate toll but lets face it, this is going to be difficult as the country juggles with our finances and continuous development. Toll over the period like it or not it is still an asset which is generating very good cashflow.

For the next 3 years the consistent revenue that is to be generated is going to come are mainly from construction (SPE highway) and toll (DUKE 1 and 2).

Property business as one know is going to be sporadic until it manages to obtain consistent revenue from its property investment - which potentially will come from EkoCheras mall.

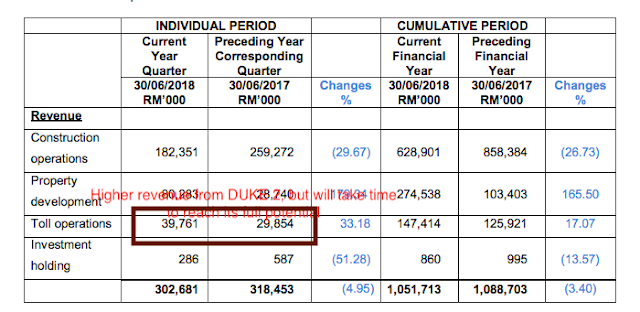

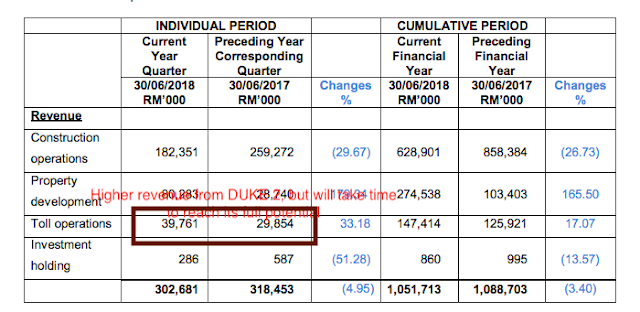

The below is a pick from its latest 4Q18 quarter results, and as we see there is new revenue from DUKE 2 (which increases the contribution from toll) since December 2017. However, in accounting for concession assets, this is also the start where it is starting to recognise the interest expense from the toll assets (see Figure 2).

|

|

Figure 1 |

Hence, profitability from toll concession will not be good, but that is a different story when concerning cashflow. Its cashflow will be good and when the third highway is completed - i.e. the SPE it is all full throttle for the company. Again, I am not worried when it comes to abolition of tolls, it is very hard for the government to do that. Otherwise, they would have contacted the concessionaires and discuss. So far, the only concession that they have contacted is their own - PLUS which is owned Khazanah and EPF. The way I see it is that the current government is trying to avoid the topic until when they are ready to discuss about this.

|

|

Figure 2 |

The concern over the losses for 4Q18. As mentioned in Figure 3 below, part of the losses is due to costs of the failed acquisition of IWCITY - turns out to be a blessing in disguise and its provisioning for LAD - Ekocheras and highwe interest expense as mentioned earlier.

|

|

Figure 3 |

How I see Ekovest

As in many of my investments, I see Ekovest as a good long term investment with solid assets. It is moving into a territory where it will be less dependent on new projects while focusing on what they have built in the last one decade.

Seems to me, after this few years, it hopefully can become a good dividend stock if the controlling shareholder is fair.

KLCI King

Good analysis. The analysis helps readers to make decision.

For me, it helps me to decide not to go in for Ekovest for the next 3 years.

2018-09-12 11:29