CONSTRUCTION - Tale of the Foundation Builders

AmInvest

Publish date: Thu, 04 Jul 2024, 09:27 AM

Investment Highlights

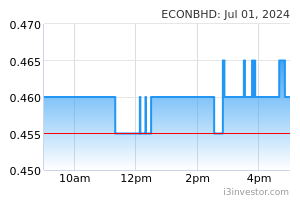

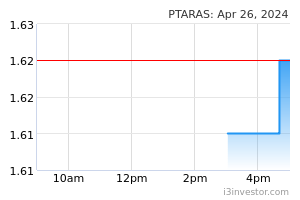

- We spoke to the management of Econpile (ECON MK, HOLD, TP:RM0.42), and also did some work on Pintaras Jaya (PTARAS MK, Not Rated). Both are respectable players in foundation laying and piling works (EXHIBIT 1).

- We gathered respective management’s input on the state of the industry as well as outlook and challenges. The key takeaways are the following:

1) The bulk of the jobs right now are in high-rise buildings for both residential and commercial purposes. There is one big shopping complex project (Pavilion Damasara) that requires sophisticated foundation laying.

2) New job contracts are higher yielding than the ones signed during the pandemic, alluding that they are profitable and value-enhancing. However, they are still below the profit margins achieved before the pandemic.

3) There is a growing trend for above ground parking lots in high rise buildings for newbuilds. This is negative for foundation layers because deep foundation with integrated basement parking is a very lucrative job.

4) Data centres (DC) are a mixed bag as big scale DC requires deep foundations and could be an interesting source of revenue. The small scale DCs, however, only requires basic foundation structures which just anyone in the industry can do.

5) Utilisation rates remain sub-par; Econpile states theirs is at 50% for both manpower and machineries. Pintaras stated “below historical average” in Malaysia, but “OK” in Singapore.

6) The low utilisation rate is a function of available jobs in the construction industry at the moment. The moment they get a job win, they will be able to mobilise their resources immediately (literally tomorrow) and ramp-up their utilisation rates quickly.

7) Everyone is waiting for the government to announce and roll out mega infrastructure projects, such as the MRT3, LRT and highway expansions. These are the high-value jobs with better margins due to their complexity and the greater level of expertise required. Until this happens, the industry will likely remain oversupplied, and job wins will require very competitive bids.

OUR VIEW

- The calm before the storm

We describe the local construction sector as waiting for the floodgates of mega infrastructure jobs to open. Everybody is ready and waiting; but until it happens, just grab what they can for the time being.

Therefore, we find it difficult for the industry to reach the >10% GP margins achieved before the pandemic. It will likely hover in the 6-9% range, in our view.

- But will the government projects come?

The markets have long factored in that big government projects are underway. But the reality has been otherwise; the negotiations are still ongoing, and the management of various construction companies are alluding to the fact that the approval is just around the corner. We have been hearing this since last year and continue to wait.

Our house view is that the government will likely only make announcements after Budget 2025 announcement in late October 2024. This will enable the government to implement its planned petrol subsidy rationalisation and have a much better financial positioning.

- Take note on cost inflation!

EXHIBIT 2 shows the cost situation updated till April 2024. However, things have changed dramatically in the past two months. Cement prices have spiked upon the diesel subsidy rationalisation. Technically, this should not be the case as the construction sector was never a recipient of diesel subsidies. But we can surmise that some in the industry have benefitted from the policy and now trying to pass on the cost escalation.

Econpile stated they were slapped with a 5% cement price increase last week, and they believe more is underway.

Thankfully, other cost components such as steel and rebar are coming off the peak as supply increases and there are substantial lower-priced imports from China.

RECOMENDATION

- Stay NEUTRAL

We note that the risk-reward tradeoff appears balanced for Econpile, which is trading at 17x FY26F PE - 13% above its pre-pandemic era average of 15x. It appears the market has already priced in a recovery. Therefore, the risk is if there are further delays to mega project rollouts and cost escalation of raw materials. Hence, there is no reason to accumulate Econpile now.

We do not have a rating for Pintaras but acknowledge that it looks much better in comparison to Econpile given its net cash balance sheet. However, it is trading at 22x FY26F PE based on consensus, and this is well above its pre-pandemic era average of 18x. Again, valuation is not compelling to accumulate.

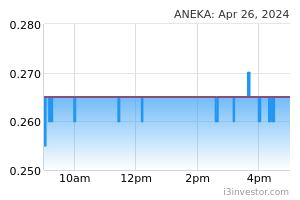

There is no consensus for Aneka Jaringan. Unlike the other two bigger foundation makers, it is profitable in 9MFY24 with a GP margin of 9.6%. Aneka is trading at an annualised PE of 31.7x with ROE of 4.0%.

In our view, there are no bargains for foundation builders, much like the construction sector in general.

Source: AmInvest Research - 4 Jul 2024