Kronologi Asia Bhd: A recovery play

Kronologi Asia Bhd

Market Cap (26/9/16): RM63.9mil (RM0.27/share)

PER:20.93 (TTM)

Div. Yield: Nil

Net Gearing: Net Cash

We initiate coverage on Kronologi Asia Bhd as we believe the company will undergo a strong recovery in FY16 and the market has not yet seen or priced in this recovery.

Company Background

Kronologi Asia Bhd is a provider of Enterprise Data Management (EDM) solutions. They sell on-site data storage equipment and also provide off-site cloud services to their target customers of mid to large size corporations. Krono has a presence in 5 countries across South East Asia namely Malaysia, Singapore, Thailand, Indonesia, Philipines and it just announced an acquisition that would expand its market presence to India. Its main markets are Singapore (64% of revenue), Philipines (8%) and Malaysia (7%). Among its major customers are Starhub in Singapore, Public Bank in Malaysia and Pertamina in Indonesia.

Source: www.channeltimes.com, Quantum

The story so far

Kronologi Asia Bhd listed on the ACE market at the end of 2014. They have been in the business of selling on-site data storage equipment since 2002 but had little experience in cloud services. However, identifying that the world was moving towards both on and offsite storage services, they decided to expand and start selling cloud services. They got listed by selling the story of expanding their recurring revenue through selling their subscription based cloud services as well as further expansion into new ASEAN markets such as Myanmar and Vietnam.

However, this story failed to materialise as immediately in the first 2 quarters of 2015, the company went into losses. The losses were mainly due to companies cutting heavily on CAPEX because 2015 saw a major slowdown in some of their main markets and this had a major effect on high value IT CAPEX spending. As a result, while revenue still grew 12%, profits plunge by 50% due to compressed GP margin due to poorer sales mix caused by selling lower value replacement-type products.

Major shareholder and then CEO of the company, Mr Piti Pramotedham resigned from the board after that. Exact details of what happened are lacking but an EGM was called in August of 2015 by Mr Piti to replace the existing board of directors. This move did not materialise and Mr Piti eventually resigned citing health reasons with then CTO, Mr. Phillip Teo Chong Meng (pioneer employee of Krono) replacing him. The board has roughly remained the same with the exception of the appointment of Mr Geoffrey Ng (currently Director at Fortress Capital Asset Management and former CEO of Hong Leong Asset Management).

Mr Piti still owns the majority of shares in the company at 53% but his stake will eventually be diluted to 43% upon the completion of the India acquisition (which will be discussed below).

In 2HFY15, after 2 straight quarters of losses, earnings recovered and Krono has posted a positive bottomline for the past 4 quarters. Q1FY16 results were encouraging with profits of RM1.4mil vs Q1FY15 losses of RM1.1mil. In addition, Krono has announced expansion plans going forward with their acquisition of their India associate company.

Competitive advantages

Kronologi has the exclusive rights to sell the 'Quantum' brand of on-site data storage equipment. Quantum is a manufacturer of data storage equipment listed on the NYSE. These equipment include large sold state disc drives and flash arrays that are used to back up data on a huge scale. In addition, Krono also offers off-site data managed services which is equivalent to cloud services.

The on-site data storage equipment business has a decent barrier to entry due to the fact that the business is a global oligopoly with a few major players.

Only few major players in the world have spent millions in R&D in order to build the technology and the strong brand name. These are names such as IBM, EMC, Oracle, HP and Quantum. Its very difficult for any new player to build new technology as the R&D costs will run into millions if not billions. Its also very difficult for any new player to build a brand the likes of IBM and EMC have done. However, checks on IDC's recent market share releases has shown that Quantum is not among the Top 5 players around the globe. The Top 5 spots are dominated by EMC, IBM, Dell and HP.

For their on-site data storage equipment, while Quantum is not in the Top 5 companies that sell data storage equipment worldwide, we believe they have pricing and quality that is competitive due to the fact that the likes of Starhub and Public Bank are their customers. They sell through a network of distributors that include the likes of Ingram Micro and ECS Computers in Singapore (Ingram Micro is the world's largest distributor of ICT equipment. These two players are top 2 in Malaysia and we think they are top few in Singapore as well.) However, Krono maintains immediate contact with major end customers. This is to ensure they provide reliable after-sales technical service and the direct access will enhance their chances of recurring orders for replacements/upgrades of old equipment and new purchases when the customer expands.

For their off-site cloud services, their competitive edge lies in the fact that they already provide on-site data storage equipment to existing customers. This would allow them to cross sell their cloud services to these existing customers. Their customers would prefer dealing with just one party instead of dealing with two different parties to save the hassle.

Market outlook

Their immediate growth prospects lie in their recovery and stabilisation of earnings as well as the recently announced acquisition of their associate company in India.

Krono's recovery looks to be on track with recent 1HFY16 revenue growing 39% y-o-y while profits returned to the black at RM3.1mil from RM2mil in losses last year.

In relation to the acquisition, on 22nd July 2016, Krono announced an acquisition of their 20% owned India associate company - Quantum Storage India (QSI). The associate company is also involved in the business and selling 'Quantum' data storage equipment to the Indian market. They intend to pay RM 26mil which values the company at 6.5x PE based on a profit guarantee of USD1mil for FY16 (RM4mil based on 1USD:4MYR). The profit guarantee will be for 2 years for FY16 and FY17. We think the valuation is fairly cheap as it is a discount to the 12x PE valuation Krono got when it was listed.

The RM26mil will be paid with RM 15.2mil in cash and RM10.8mil in shares. This will require an issue of 55.6mil new shares (23.4% of existing share base). Nevertheless, the acquisition is earnings accretive (EPS will increase after share dilution due to profit guarantee). Assuming no core operations profit growth in FY16 from FY15, an addition of RM 4mil (1mil USD profit warranty) would boost EPS from FY15 1.29c to FY16 2.42c. The EGM was held on the 26/9/2016 and the acquisition was approved by the shareholders.

The other significant thing of note is that upon acquisition, the current owner of QSI, a certain Mr Tay Nam Hiong would own 20% of Krono with the majority shareholder, Mr Piti's stake being diluted down to 43%.

In terms of Krono's medium term growth prospects, it continues to lie in their ability to expand in the off-site cloud services segment and building/expanding in other ASEAN countries who will require more and more data storage services in the future.

Key Risks

Declining prospects of on-site data storage market

The worldwide on-site data storage market is declining in favour of off-site cloud services. However, Krono's target market of mid to large corporations still need to have multiple data backup systems for added security and protection.They would not shun the traditional on-site data backup equipment in favour of cloud services like the ordinary retail customer has done. Instead, they would utilise a mixture of both these services in order to enhance data security and protection.

Lack of support from major shareholder

There is the risk that the major shareholder might not support future decisions by the company due to the circumstances of his resignation. However, in the recent EGM, the company received 100% support from shareholders owning 60.5% of the total shares, with no shareholders voting against the acquisition. Given that the major shareholder owns 53% of the company, the major shareholder must have voted in favour of the acquisition. We view this move positively as it shows that the major shareholder will not stand in the way of any positive developments for the company.

In addition, the approved acquisition will see the major shareholder's stake diluted from 53% to 43%.

Loss of principal

There might be a termination of relationship between Quantum and Kronologi. However, this is unlikely as Krono has been their seller for >10 years. In addition, Quantum is currently facing problems on its own as it is making losses and is in the midst of executing a turnaround plan to bring it back to profitability.

Prolonged or sudden economic downturn

A sudden economic crash will result in a repeat of last year where companies cut CAPEX and Krono went into losses. A prolonged economic downturn will have the same result.

Valuation

Kronologi 1HFY16 net profit was RM 3.07mil, going forward if the company can maintain that performance, annualised FY16 profits will be RM6.14mil. Including profit guarantee of RM4mil (based on 1USD:4MYR), FY16 profits will equal RM10.14mil (up 232% from FY15 profits of RM3.05mil). Assuming full dilution from issue of shares, share base will expand to 292.629mil shares. Fully diluted FY16 EPS will be RM0.035c/share.

Based on this EPS, some possible valuations are:

Current Price (26/9/2016): RM0.27

8x PE (Annualised PE pre-announcement of acquisition): RM0.28 (13% upside)

10x PE: RM0.35 (41% upside)

12x PE (IPO valuation): RM0.42 (69% upside)

Conclusion

We believe in Krono because we thought the market had significantly undervalued it if one considered the earnings growth it would experience compared to FY15. We continue to believe in the shorter term recovery play even more so now because of the India acquisition.

大数据趋势已来到发展中国家,KRONO如何从中受惠?

这是一个大数据的时代,人人都在电子空间中留下了自己的痕迹。早上起来,打开手机,手机不断与基站联系,机主大概在什么地方,经过了些什么地方,就留下了痕迹;在路上,打开手机浏览器又再次留下cookie数据,浏览了些什么网页,很可能被别有用心者收集;或者交通卡,从哪里进哪里出,也被服务器记录;中午,吃了什么,信用卡可以查询到消费的场所,而饭店的记录,甚至能精确到吃了什么菜,几个人;在上班的时候,使用聊天工具,可能留下痕迹,很多单位,也有记录员工操作的软件;下班了,打车软件、聊天软件都可以上传GPS数据;晚上,在哪里开了房,不但有消费数据,也有摄像头精确记录。这些数据综合起来,不但可以清晰的描述一个人的生活轨迹、行为、甚至连爱好,乃至不愿意被人发现的隐私,在别有用心的收集之下,都是清清楚楚的。

但是,不难预见的是,在大数据时代,公民的个人隐私与自由,会被越来越多的大数据阴影所包围。

不妨假设一下,2019年,苹果8发布,这时,手机已经不叫手机,而叫个人信息终端,人们可以在这上面完成一切;2025年,打车软件的大数据系统已经不需要个人发出打车需求,你出门的时候,就已经有车停在门口,并且知道你要去哪里;2032年,一个无远弗届的信息收集机制被建立起来,同年,国家统计局改名为国家大数据中心,一切已经不需要统计,一切发生的时候就已经被统计;2050年,市场取消,在大数据与智能制造的配合下,一切个性化的需求都可以被满足;2084年,时间回到100年前。

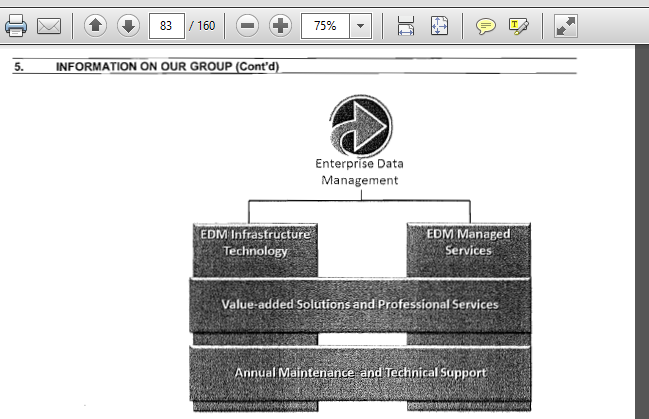

KRONO主要业务分为EDM Infrastructure Technology 和EDM MANAGED SERVICES

EDM Infrastructure Technology

krono原本核心业务是EDM infrastructure technology,而这个生意模式的对象只是服务大型企业而已因为技术的费用比较高而大企业才有能力负担,

EDM MANAGED SERVICES

现在krono计划在2015年会推出新的生意模式叫做EDM MANAGED SERVICES,这个生意模式主要是针对中型企业,而营运的方法是顾客不需要给upfront payment然后收取的费用是以utility base 和monthly base,EDM managed services合约通常是以2年或3年的期限进行。这方法使得EDM技术不再是大型企业拥有的技术而中型企业也能享有了。

管理层观点

krono的老板认为,在越来越多企业运用到IT来营运生意的时代,这些企业都是他们的服务对象,因为经统计计算企业的数据有41%的概率是人为丢失以及54%的概率是软件和网络问题而丢失。他认为在一个庞大数据的时代而数据流失这是一个时间上的问题而已。另外老板也认为中型企业面对数据流失的问题只有3项选择,第一do nothing,第二自己管理可惜的是很多中型企业没有这样的能力,第三交给krono 专业的数据管理商。

东南亚经济具有大批中等规模的公司,他们正寻求更高成本效率和解决方案,这些市场具有许多机会,所以krono就在2015年推出EDM MANAGED SERVICES主要是服务中型企业。

全世界EDM市场周期调查

Krono的业务遍布大马、新加坡、菲律宾、泰国、印尼和印度等。这些都是出于初始阶段的市场,未来还有很大的增长空间对比已发展国家如美国和英国等。

KRONO科技去年總營業額有約60%來自新加坡、15%來自大馬、6%來自泰國、其餘的來至其他國家。公司深受大众银行(PBBANK,1295,主板金融股)、新加坡StarHub、泰国PTT勘探生产和Production 公共公司、菲律宾的长程电讯公司及印尼的Pertamina企业等信赖。另外管理层透露,当时机成熟时才会考虑转主板。

KRONO最新消息跟进

原文来自:http://www.thestar.com.my/business/business-news/2016/08/08/kronologi-reboots-to-capture-big-data-growth/

Philip Teo Chong Meng (pic),a key member of the founding management team and now acting CEO, explains that Kronologi is running ahead on full steam after going through that difficult period.

Kronologi, however, suffered a decline in its bottom line in its financial year ended 2015, which Teo puts down to a difficult year. Its profits halved to RM3mil from RM6mil previously although revenue rose to RM61.3mil from RM54.6mil the year before.

In the company’s 2015 annual report, the lower performance was attributed to a change in sales mix, with a higher proportion of lower margin projects implemented during the year.

But things could be looking up. For its first quarter ended March 31, 2016, the company posted a net profit of RM1.4mil versus a loss of RM1.1mil in the previous corresponding period.

KRONO管理层提到KRONO已经成功从困难时期走过来并且乐观看待未来前景,我们也能从KRONO的季度业绩中看到净利也开始复苏甚至超越IPO刚上市的水平。

当然KRONO的股价也成功造低,股价开始从底部回升开始挑战之前的下跌缺口,目前股价距离前期高点RM 0.415还有客观的潜在增长空间。

其余重点归纳:

KRONO将会受惠于大数据的增长趋势。

其中一个例子是,CCTV在商场上的需求处在增长趋势是因为透过QUANTUM设备,CCTV只要存上很长时间的记录就能分析出购物者的行为模式而达到精准行销的商业价值。

在7月22日,KRONO宣布用RM26mil买下印度子公司其余80%的股份,透过RM 15.2 mil现金和RM 10.8 mil 新股发行。

为何收购?印度的电影市场正在转移像素至4K Ultra HD,这项转型将要求的存储数据是原本HD存储数据的5倍之多。另外卫星覆盖市场也是需要大数据的储存系统。

这项收购将受惠于“Digital India” and “Smart Cities”的趋势。

这项收购也有盈利保证高达RM4 mil each year of financial years 2016 and 2017。

-

KRONO在2014年12月的上市价格为RM 0.29,目前股价低于IPO价格加上近期的季度业绩中净利也开始复苏甚至超越IPO刚上市的水平,目前股价距离前期高点RM 0.415还有客观的潜在上升空间。

-

KRONO受惠于大数据趋势,也间接受惠于智慧城市和物联网等概念

-

目前它的PE只有 7,明年将有新收购业务的盈利注入将会进一步拉底PE估值。

Bruce88

Chances to go higher .

2016-11-23 07:33