1 Trillion Debts? Some Points to Ponder.

tksw

Publish date: Thu, 24 May 2018, 09:14 PM

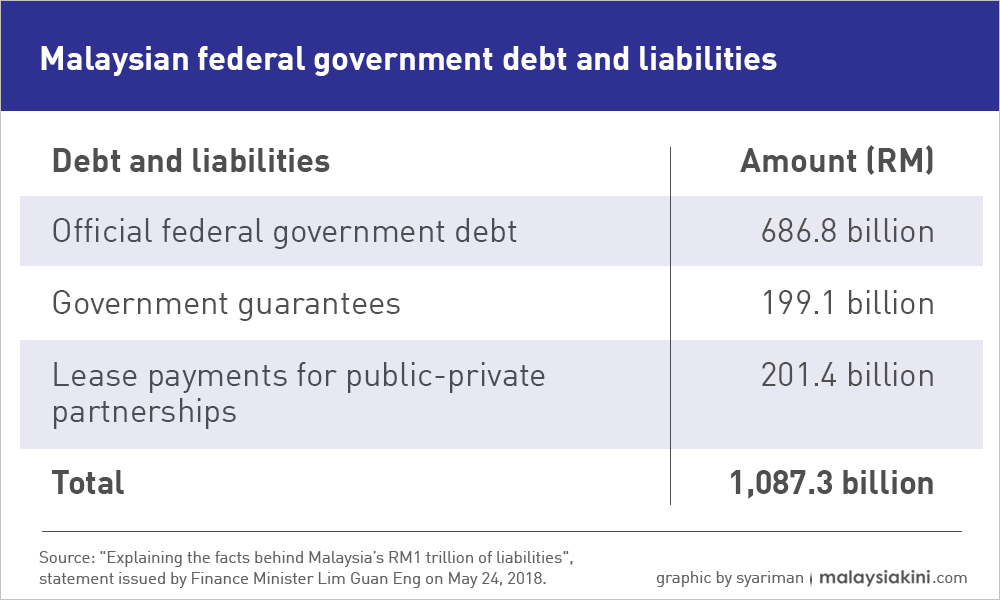

Our Finance Minister has given the brreak down of the 1 trillion debts.

It comprises:

The debt increased is actually off balance sheet items as explain by the FM.

1. Government Guarantees

These Guarantees, are actually potential liabilities which may or may not be crystalised. It only crystalised if the subject guaranteed could not service its debts, like 1MDB. So it is a bit unfair to call it a debt before it crystalised. Hopefully not all guarantees are given to entities like that of 1MDB, and hopefully with the new government, those entities can be controlle well and able to service their debts.

2 Lease Payments.

It appears that these are future instalment payments, which has no immediate threats, If the tenure is long, the Government should be able to handle. Furthermore, we nedd to find out whether such instalment payments has already included in the annual brudget, ie, treated as expenses in the budget, since it is off balance sheet (like rental payments). If so, it is not so scary.

3. Is There a Posibilities of Double Counting of the Two Items above?

You see, the Governument may Guaranteedthe Lease Payments of entitiy set up to handle the pubrliv-private partnership. If that is the case, some figures are double counted. For example, A government's enutity has entered a lease of 360 million in total for 30 years, and Government guoranteed to pay if that entity is not able to service the debts. Assuming the lease has yet to commence, so the debt figure will be 360 mil +360 mil in the above case.

So, what you say?

Discussions

and like i said winter bear, LGE is not being a hero, he is an accountant, and an accountant is blunt as always... they only know how to crunch numbers and spew the truth about these numbers.. Probably he needs to brush up on his PR.... He is not tactful when it comes to public presentation. The previous govt, on the other hand, is a smooth operator! They have top notch PR-men doing all the smooching, just look at the amount of advisers our ex-PM has. No wonder every minister was on cloud nine lah before this...they were fooled by their own PR team also lol.

2018-05-25 00:28

Yes Lk036, exactly like you said...its better to spew the truth... vomit out the dirty truth first, then spent time to fix it....

If LGE still talks about 1 trillion debt 1 year later, then i think we should consider spanking him already for sensationalizing politics and not doing his work.

2018-05-25 00:30

VenFx sifu, me no attacking LGE lar, me is ok with the disclosure, but just suddenly throw out 1 Trillion Debt like that,people got scared lar. tok one more

time, Guaranteed is a possible exposure oni, it is good to know the exposure, but there are many details need to look at before making conclusion. When people dun get full picture, will freak out la...

2018-05-25 00:43

tksw,

i trust LGE has the details with him.

Qhy not just wait qith little patient ?

I loke LGE to expose the debt level ... no belok kiri kanan .

This is truely what we need.

I rather hear facts even it is bitter over sweet talks but venom.

Economic and strategic maybe already start scratching their head for a better mechanisms to solve the issue.

2018-05-25 00:49

Malaysian are fully with UBAH semangat.

Dont underestimate it, temporarily bitter is nothing.

2018-05-25 00:51

I'M REPOSTING HERE :

Posted by VenFx > May 25, 2018 12:30 AM | Report Abuse X

Winter bear,

I get your point on the govt. Account yteatment...

I rather LGE focus on what fiscal after such tremendously debt issue.

I belive LGE aware and prepare whats coming next.

.....................................................

Posted by Winter Bear > May 25, 2018 12:50 AM | Report Abuse

Tksw! That's what i was trying to say all this while! But i guess some don't get it! It's good that i3 still have few with good head on their shoulder!

2018-05-25 00:54

The issue doesnt come from LGE's debt press conference or the Govt. Account treatment. We cant control what the outsiders who is font to Najib to rate our economy .

An United Malaysia is the only force can stand up and prevail from this great impact due to Najib's scam.

2018-05-25 00:56

In short, no matter how rating agency lime fitch will bash down Malaysia lar... u shud know why i say fitch rating agent...

It is bias to Najib.

2018-05-25 00:57

actually hor, the MoF can send LHDN audit team to audit those cronies, if the team sent is good, sure will turn to tax investigation, and may even lead to corruption charges. I am not suggesting a harassment like what they did to Lee Kim Yew or Koon Yew Yin, do a professional one, see those people can explain how they got so much money which cannot explain by their income reported. sure kena one. unless they launder the money wisely. else if they are careless, than money Laundering Act can come in to play. Income tax, MACC, Money Laundering Act, sure got one can make them vomit back the money.

2018-05-25 00:59

If I am dirty like those people, I cannot sleep already ler, cos the law enforcement now don't scare them so much already, Just make sure the MACC watching the LHDN officer do work....those people last time may be too cocky, now the law enforcement body got new government back up, and this is to save the country, they can do a proper and professional job liao. but not a political harassment arr....

2018-05-25 01:07

VenFx sifu, people will use the 1 Trillion figure as your MoF said so, then they will assume the MoF did not make any mistake like double counting, or make adjustment base on their own assumption on the lease payments. They just take the official figure since you said so. They dun check your figure ler...

2018-05-25 01:15

One more thing, the wording use in describing the Guaranteed used is a bit ambiguous, make people think that those guarantees listed are those that already crystalised, meaning those companies already cannot repay their debts. If they are so, than serious lor....

2018-05-25 01:20

Something may be going on.

I guess only.

Deep down LGE know what he is dealing is best for the nation.

非常时期 嘛

2018-05-25 01:34

This announcement is unacceptable and show LGE confident start to shaky.

LGE cant even answer how to cover the 20 billions shortfall by abolish GST.

Now pop up to announce government debts increase to 80.3% and without any solution again.

This just make a valid reason for international credit agency to downgrade Malaysia credit rating.

This indirectly will cause companies get financing from oversea to pay higher interest.

The 1 Trillion debt, who is the lenders? I bet, mostly is local banks and this put local banks in very uncomfortable situation.

High volume drop in top 4 banks already shown foreign investors start losing confident.

LGE word sounds like there is time bomb in our banking. I prefer he to keep quiet before any solution, not need to make headline everyday.

2018-05-25 01:38

Foreign investors would not care the debt hole is created by which government and retails investors is very excited with new government and buys up to 1 billions++ in last 7 trading days.

This is worrying sign.

Will retails start to panic, if foreign continue to sell???

2018-05-25 01:57

Why so worry on things that is going to happen ?

As i said before Expose or not the debt issue, i dare not saying ficth wont discredit Malaysia economy...

Can u see fitch is bias to whom?

2018-05-25 02:03

Guys, only fact talk ya. Penang become surplus from debt and huge increase in FDI in Penang too. So let time do the work, no harm right than guessing around lolz.

2018-05-25 03:21

"In addition, the Government is already committed to pay for government guarantees for various entities which are unable to service their debts

Read more at https://www.thestar.com.my/business/business-news/2018/05/24/debt-to-gdp-ratio-above-80pct-says-lim/#Uj7SyHHj56WXp2Gk.99

2018-05-25 06:30

Of course 1mdb can't service their own debt, because their assets have been transferred into mof!!! And mof paid the creditors using 1mdb assets transferred earlier.1mdb cannot pay not because they lost everything but because their 50bils worth of assets already transfered to mof for management purposes.remember trx, bandar Malaysia all these previously under 1mdb but now transfered to mof.pls check both sides, assets and liabilities + debts then only you will see the whole picture.

2018-05-25 06:50

trulyinvest sifu, that's why I said some paper use ambiguous language. Once you give guarantee, it is a commitment already. the above sentence you quote, will make people think that the various enutities already unable to service their debts. Actually, normal disclosure for guarantee is just said Government give RMxxx guarantees. or if they want to use such long sentence, they can use "should they" instead of "which are" if the guarantee has not crystalised

ie, "Government is already committed to pay for government guarantees for various entities should they unable to service their debts "

2018-05-25 09:25

bagan sifu, 1mdb not transfer their assets to MoF without value gua? May be MOF already pay absurd price for those assets transfer, and according to 1MDB scandals, these money all gone to somebody's pockets, that's why ppl said cryptocracy

2018-05-25 09:55

Venfx sifu, just found this, worth listening https://klse.i3investor.com/blogs/bfm_podcast/157580.jsp

2018-05-25 10:08

I am glad to know my thinking is on the right line, reduce the wastage and fix the corruption problem, malaysia will be fine

2018-05-25 10:09

Think of it in layman terms.

It is a necessary pain to factor in all these just like write off a bad investment to prepare for worse case and to have a clean start. Yes, we all will be hit hard.

BUT while it reborn, the growth will be immense. Finance market always seeks for opportunities whether bad or good.

Great pain also brings great reward for those who appreciate and adapt!

2018-05-25 10:20

come to think of it, if LGE really work on reducing the so call 1 Trillion, he must work harder than if he take the official figures.

2018-05-25 10:40

哗众取宠! Confirm first only announce lol. Today 70%, tmr 80%. What is the point?

2018-05-25 16:56

LGE needs to do more research and come up with solution before declaring actual debts. Malaysian confirm kena credit downgrade.

2018-05-25 22:13

I opine the declaration of the total debt may be necessary and is in the interest of the ruling party since they just take over to avoid future misconception of the debts incurred. The matter is, PH have to come out with a well and detailed plan of rescue to as to calm the financial market.

2018-05-26 06:36

As a new finance minister, LGE of course would like to report the worst figure. He can then work on it to reduce the national debt. Some years later, he can tell public the new government has managed to reduce the debt from ~RM1 trillion to much lesser amount. In this way, he can show his and the new PH government efforts and contribution. The amount of debt reduced will be as much as possible, thus the starting point must report the worst debt figure loh. Logic and common sense lar.

In manufacturing industry, new CEO also would do the same thing. They would carry out all the possible write-off, impairments, report the worst figure, and then start to work from the bottom.

2018-05-26 11:37

Don't worry about Malaysia Rm1 trillion debt

See Japan got Rm55 Trillions Debt

The Japanese public debt exceeded one quadrillion yen or about US$10.46 trillion in 2013, more than twice the country's annual gross domestic product.[1][2] By 2015, the figure rose to US$11.06 trillion. As the country adopted key economic initiatives, this figure start to dip so that by the end of December 2017, the debt stood at US$9.94 trillion.[3]

And US Debt even bigger

See

Debt Rm1 Trillion with Population of 30 millions in Malaysia

USA has Rm84 Trillion Debt with population of 300 millions

So US population is only 10 times more than Malaysia with Debt 88 Times Higher.

See US Debt Clock http://www.usdebtclock.org/

If US ok why not Malaysia?

What is the Overall Net Net Wealth of Malaysia?

2018-05-26 11:38

What LGE may not keep in mind or take it lightly is his statement would distort the stock market in negative way and affect people like us.

2018-05-26 11:38

If i think in positive way, this phenomenon would be short term, and it gives opportunity for us to buy more depressed stocks (if one still has cash reserves).

2018-05-26 11:40

If I were new finance minister, I may do what LGE did. But as a normal investor and already has a handful of stocks presently, we of course not welcome this news.

2018-05-26 11:41

We as Rakyat must always be alert that issuing Government Guarantee must stop immediately. See below statement from CEO of IDEAS (Ali Salman by FMT)

"But what is worrying is the revelation that institutions like 1MDB, Danainfra Nasional Bhd, Prasarana Malaysia Bhd, Malaysia Rail-Link Sdn Bhd and Govco Holdings Bhd need to be rescued by the finance ministry.

With the exception of 1MDB, these companies are involved in transport and infrastructure projects. There are indications that loans taken for these entities are unproductive, that they can’t recoup enough money to settle the loans.

This could lead to an increase in prices to meet the loan repayments. It could also lead to the use tax revenues for the repayments, which was what the previous administration was doing."

2018-05-26 11:43

Think realitily. Will up or not in future nobody know. I agree. Many ppl are very naive. Everybody very clear what BN did. That is the reason we UBAh. Now in order to gain popularity, Mr Lim action make the condition become worst. So it is not for the rakyat, it is for ownself.

2018-05-26 12:31

Guess who's going to get this...https://www.thestar.com.my/business/business-news/2018/05/26/listing-of-petronas-among-options-to-increase-revenue/

2018-05-26 13:27

The crooks of the 90s are back.Congratulations Malaysia you have just won a jackpot...hahaha hahaha hahaha

2018-05-26 13:41

I thot pkr who were fighting to bring down Mahathir ended up making Mahathir the 7th premier was the biggest joke, but this one is even bigger, I really can't stop laughing...hahaha hahaha hahaha

2018-05-26 13:44

Whenever a new government or a new CEO takes over, it is normal to do 'kitchen sinking' - announce a worst-case scenario at one go... http://www.bbc.com/news/magazine-32412594

With regard to your three points:

1) Government Guarantees

Without a detailed breakdown/nature of the RM199bln of government guarantee, we cannot identify clearly how much may actually be liable by the Federal government. The RM199bln excludes guarantees provided to viable entities like Khazanah and Tenaga. A big chunk of it are for Prasarana (RM26.6bn), DanaInfra (RM42.2bn), PTPTN, Msia Rail-Link (RM14.5bn), Pembinaan PFI and 'infamous' 1MDB (estimated RM38bn). @tksw, you are right, Govt will not be liable until the respective entity 'defaults'. Even if a number of them cannot service their debt obligations timely, what is the government 'net exposure' (i.e. liabilities less assets)?

2) Lease Payments

The key point to note on RM201bn lease payments...is the amount stated in total nominal amount or discounted amount? A lease payment of RM100mln due in 20 years from now is actually worth much less in present value (time value of money). Did the new government simply add up all the payments payable over a long period of time to get a total of RM201bn or did they apply a discount rate to the amount payable?

3) Is There a Possibilities of Double Counting of the Two Items above?

I doubt so. It is unlikely to be double counted as the amount outstanding are likely to be for specific projects or entities. If even there is, the amount will not be big.

We have to view the announcement of RM1trn debt headline objectively...it makes a 'glaring' headline. However, the new government may want to paint a more holistic picture of the fiscal position and indebtedness of the government. We as rakyat have to take in stride...the debt level is still manageable by the new government as long as fiscal prudence is enforced.

The following news can partly 'address' some of author's points to ponder:

https://www.malaymail.com/s/1635147/dr-m-says-found-ways-to-reduce-liabilities-debt-by-rm200b

2018-05-26 14:41

Baguslah! Haha!

Dr M says found ways to reduce liabilities, debt by RM200b | Malaysia | Malay Mail

https://www.malaymail.com/s/1635147/dr-m-says-found-ways-to-reduce-liabilities-debt-by-rm200b

2018-05-26 16:35

Look forward to gomen sell land/properties and maybe abolish rpgt. That will shake up Msian property market abit. Dah lama tidur....Zzzzzzzz

2018-05-26 16:44

.

Moron

Those so called.. off balance sheet agencies.. were intentionally set up to go around and circumvent the national debt level

The BN had become so good at this.. if they had remained in power... and had set up another 1MegaMDB.. and incurred a debt of 500 billion which it cannot pay... and guaranteed by the government

Moron

Will still say.... national debt is only 686.8 billion... not 1.5 billion

.

2018-05-26 17:14

DUN so angry. Whatever debt, only tax payer yang bayar. Those who goreng stock, tax free. Only 7% of our population bayar cukai. Or 15% yang bekerja! Hoho...

85% of Malaysia's Work Force Don't Make Enough to Pay Taxes, and GST Won't Increase Next Year, says Deputy Minister - The Coverage

https://thecoverage.my/news/85-malaysias-work-force-dont-make-enough-pay-taxes-gst-wont-increase-next-year-says-deputy-minister/

2018-05-26 17:27

tksw

Fixed the corruption and wastage problem, Malaysia will be fine.

2018-05-25 00:25