DPHARMA: Reaping the Rewards of a Strong Ringgit

KingKKK

Publish date: Thu, 26 Sep 2024, 12:27 PM

Overall Technical Verdict:

The stock shows a strong technical setup with bullish signals, supported by rising volume and positive indicators. However, the stock is now at overbought level.

Stock Background:

Duopharma Berhad is a leading pharmaceutical company in Malaysia, specializing in the development, manufacturing, and distribution of medicines, health supplements and healthcare tools.

Theme for the stock:

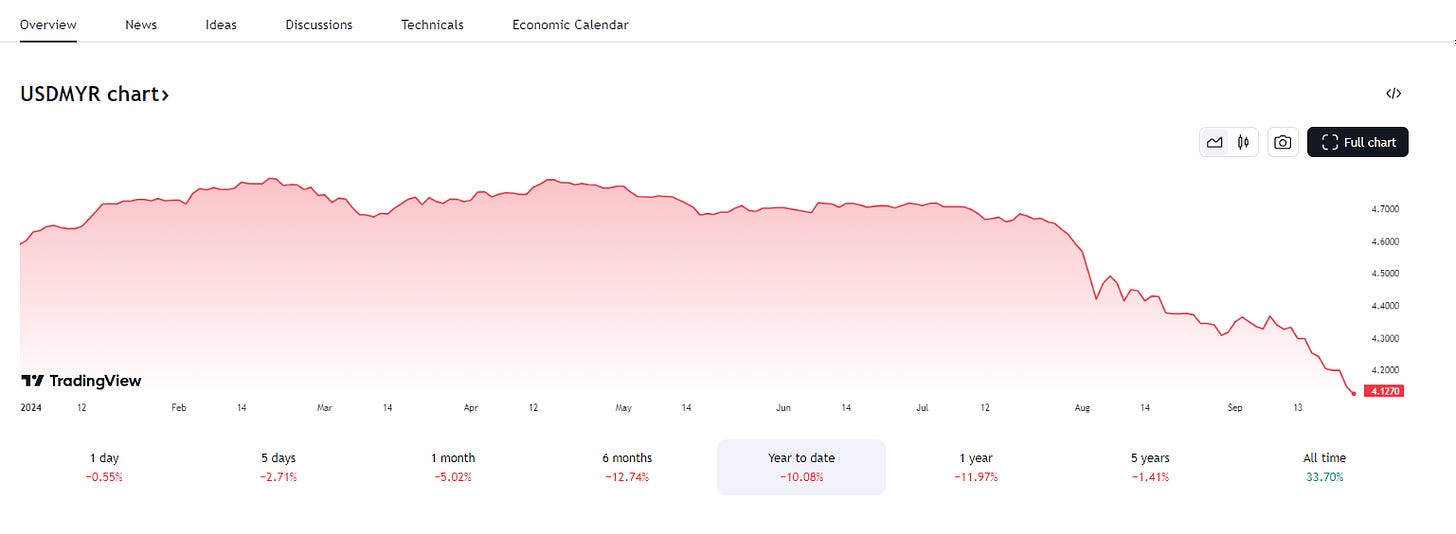

Beneficiary of Strong Ringgit. Almost all sales are in Ringgit. Most of the company’s cost is denominated in USD. In short, margin will improve. As shown in the chart below from TradingView, Ringgit has appreciated 10% YTD and 13% in the past year.

Strong Market Position: As a leading player in the Malaysian pharmaceutical sector, Duopharma has a solid market presence, which can drive steady revenue growth.

Diverse Product Portfolio: With a wide range of generic and proprietary medicines, the company can cater to various therapeutic areas, reducing reliance on any single product line.

Details of Technical Analysis

Moving Averages: The stock has crossed above the key moving averages (50, 150, and 200-day MAs), showing a strong bullish signal.

Bollinger Bands: The stock has broken above the upper Bollinger Band, indicating strong upward momentum. However, this could also suggest a short-term overbought condition.

MACD: The MACD shows a bullish crossover, indicating a possible continuation of upward momentum.

Volume: There's a noticeable volume spike during the breakout, which reinforces the strength of the current movement.

My other posts:

Unveiling Market Gems: Your Guide to Beating the Market (substack.com)

MRCB: Bouncing Back - Can It Sustain The Recent Momentum? (substack.com)

Econpile: Double Bottom or Bullish Engulfing? (substack.com)

MALAKOF: Uptrend Continuation With Potential MACD Crossover? (substack.com)

MAGNI-Tech on the rise, is a Major Breakout Brewing? (substack.com)

IHH Healthcare: An Uptrend Defensive Stock (substack.com)

IGBREIT: An Uptrend REIT To Weather The Storm (substack.com)

FFB: Positioned for a New High? - KingKKK’s Substack

KLCC - A Deep Dive Into the Chart's Next Move (substack.com)

ABMB: Ready to Soar or Due for a Pullback? (substack.com)

PBBANK: Short-Term Pullback or Long-Term Gain? (substack.com)

KPJ: Breakout Stock with Crossover and Uptrend Pattern (substack.com)

US Fed Slashes Rate: Here's How It Will Reshape Malaysia Stock Market (substack.com)

YTLPOWER: Reversal Ahead? Hammer + MACD Crossover Pattern Emerging... (substack.com)

SIMEPROP: Momentum Building For A Surge? (substack.com)

APOLLO: Strong Fundamentals Amidst a Neutral Technical Setup - Is It A Time To Buy? (substack.com)

China's Moves and Their Ripple Effect on Malaysia’s Stocks (substack.com)

HPP Holdings: Ready for a Strong Rally? (substack.com)

DPHARMA: Reaping the Rewards of a Strong Ringgit (substack.com)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Stock Market Enthusiast

Created by KingKKK | Feb 01, 2025

Created by KingKKK | Jan 31, 2025

Created by KingKKK | Jan 23, 2025

Created by KingKKK | Jan 22, 2025