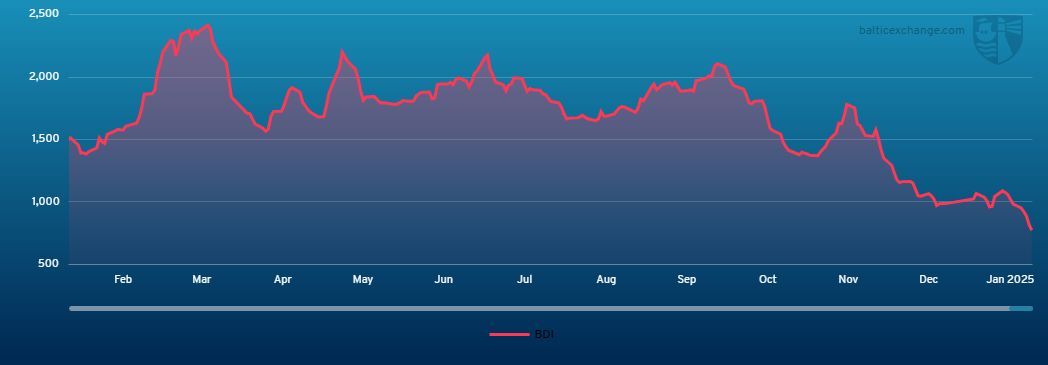

Baltic Exchange Shipping Updates: Jan 24, 2025

edgeinvest

Publish date: Tue, 28 Jan 2025, 11:15 AM

A weekly round-up of tanker and dry bulk market (Jan 24, 2025)

This report is produced by the Baltic Exchange.

The Baltic Exchange, a wholly-owned subsidiary of Singapore Exchange, is the world's only independent source of maritime market information for the trading and settlement of physical and derivative contracts.

Its international community of over 650 members encompasses the majority of world shipping interests and commits to a code of business conduct overseen by the Baltic.

For daily freight market reports and assessments, please visit www.balticexchange.com.

Capesize

The Capesize market endured a challenging week, with a steadily declining trend across the board. The BCI 5TC shed US$2,852 over the week, closing at US$8,156. In the Pacific, miner activity remained sparse, with only one miner consistently present. Fixtures from West Australia to China hovered in the low US$6 range early in the week but slid to US$5.85 by the end of the week. While cargo volumes appeared stable, limited demand and increasing tonnage weighed heavily on sentiment. The South Atlantic showed initial promise midweek, driven by fresh inquiry from South Brazil and West Africa to China, momentarily lifting the C3 index. However, mounting tonnage in ballast and weaker trans-Atlantic activity caused a sharp decline, with the C3 and C8 indices dropping significantly by weeks end.

Panamax

Rates continued to slide all week with hopes of the market finding a bottom, but some very low trades were still witnessed. The Pacific began the week active, but as Asian holidays approached, the market slowed significantly towards the weekend. The Atlantic was bereft of sufficient demand to counterbalance against the sheer volume of ballaster tonnage that has harshly impacted rates on most trade routes. From South America to Far East trades, a big spread between the voyage and time charter rates, US$30 concluded a couple of times for second half February arrivals equating low against the timecharter equivalent rates compared to spot pricing. In Asia, previously seen robust rates ex NoPac unwound this week, rates in the US$7,000’s not uncommon whereas far ranging rates for the Australian round trips, between US$4,000 and low US$5,000’s. As is historically seen this time of year a reasonable amount of period activity, 82,000dwt’s achieving between US$13,750 and US$12,000 for short period up to one year.

Ultramax/Supramax

Another poor week for the sector as the continued uncertainty and lack of fresh cargo led to rates sliding across the board. The Atlantic remained very subdued, from the US Gulf very little enquiry was seen, a 61,000dwt fixed delivery US Gulf with petcoke to China at US$16,000 mid-week. Elsewhere another 61,000dwt was heard fixed delivery West Africa trip to China at US$12,000. From Asia, with a build-up of prompt tonnage it remained bleak from an owner’s point of view. A 56,000dwt fixing a trip from Indonesia to China US$3,000. Further north, limited options remained, a 61,000dwt fixing a NoPac round basis delivery Busan at US$8,000. Similarly backhaul options remained limited, a 57,000dwt was heard fixed from China to West Africa in the mid-US$7,000s. The Indian Ocean also lacked inspiration, a 59,000dwt fixing delivery South Africa for a trip to China at US$10,000 + US$100,000 ballast bonus. With the upcoming Chinese holiday, it seems difficult for this trend to see any great change.

Handysize

The market this week saw minimal visible activity across both basins. The rates kept going down across the Continent and the Mediterranean with sentiment appearing generally soft. A 30,000dwt open spot Castellon/Spain fixed trip delivery Safi to redelivery Dakar-Abidjan with gypsum US$5,000. In the South Atlantic and US Gulf, sentiment remained subdued, with tonnage count seeming to maintain its length and putting further pressure on rates. A 38,000dwt fixed delivery Recalada to redelivery Peru US$15,000. In Asia, the tonnage count has been increasing throughout the week, leading downward pressure on rates and some brokers anticipating further market softening. A 37,000dwt fixed delivery Paradip Jan 27 coastal trip redelivery Kandla at US$6,000.

Clean

LR2

MEG LR2’s plateaued and began to fall back down this week. TC1 75kt MEG/Japan was assessed 31.39 points less to WS140 and heading West on TC20 90kt MEG/UK-Continent went from US$4.36 million to US$3.94 million.

West of Suez, Mediterranean/East LR2’s of TC15 managed to tick up US$100,000 to US$3.27 million.

LR1

The TC5 55kt MEG/Japan also came down significantly this week, dropping 33.43 points to take the index to WS139.98. A run to the UK-Continent on TC8 65kt MEG/UK-Continent also came off nearly 25% to US$2.84 million.

On the UK- Continent, the TC16 60kt ARA/West Africa index climbed to WS123.89 (+9.17) off the back of some early week activity.

MR

MR’s in the MEG saw a dramatic recorrect down this week. The TC17 35kt MEG/East Africa index shed 40.72 points to WS185.71 but has held here for the last two days at time of writing. UK-Continent MR’s topped out this week. This was around the WS180 mark for the TC2 index 37kt ARA/US-Atlantic coast which since its peak mid-week has returned back to WS167.19 taking the Baltic TCE for the run back below US$20,000 /day round trip to US$18,175/day. TC19 37kt ARA/West Africa also peaked at a hair over WS200 but is now back to WS189.06.

Freight for MR’s in the USG came off in steps this week. TC14 38kt US-Gulf/UK-Continent was marked 12.15 points lower than last Friday at WS115.71 with the Baltic TCE showing US$9,526 /day for the trip. TC18 the 38kt US Gulf/Brazil index dropped from WS185 to WS165.71 and a Caribbean run on TC21, 38kt US-Gulf/Caribbean came down 21% to US$495,000. The MR Atlantic Triangulation Basket TCE went from US$28,100 to US$25,020.

Handymax

Both BCTI Handymax routes improved again this week. In the Mediterranean, TC6 index shot up 47.23 points to WS221.67 and up on the UK-Continent the TC23 30kt Cross UK-Continent went from WS190 to WS193.89.

VLCC

The market crashed back close to the levels seen two weeks ago. The 270,000mt Middle East Gulf to China trip (TD3C) fell 23 points to WS54.15 giving a daily round-trip TCE of US$31,568 basis the Baltic Exchange’s vessel description. In the Atlantic market, the rate for 260,000mt West Africa/China (TD15) tumbled 18 points to WS59.33 (corresponding to a round voyage TCE of US$37,517 per day), while the rate for 270,000mt US Gulf/China (TD22) lost US$1,285,000 to US$8,750,000 (which shows a daily round trip TCE of US$44,635).

Suezmax

The Suezmaxes have weakened as well although as this asset size had not reached the heady highs seen on VLCCs, the reduction is less dramatic. The 130,000mt Nigeria/UK Continent voyage (TD20) fell nine points to WS76.67, meaning a daily round-trip TCE of US$27,132 while the TD27 route (Guyana to UK Continent basis 130,000mt) fell 5.5 points to WS73.67 which translates into a daily round trip TCE of US$24,904 basis discharge in Rotterdam. For the TD6 route of 135,000mt CPC/Med, the rate lost almost 2 points to WS88.25 (showing a daily TCE of US$27,097 round-trip). In the Middle East, the rate for the TD23 route of 140,000mt Middle East Gulf to the Mediterranean (via the Suez Canal) eased a point to around the WS98.5 level.

Aframax

In the North Sea, the rate for the 80,000mt Cross-UK Continent route (TD7) hovered around the WS110 level again giving a daily round-trip TCE of about US$19,691 basis Hound Point to Wilhelmshaven.

In the Mediterranean market the rate for 80,000mt Cross-Mediterranean (TD19) rose seven points to WS131.78 (basis Ceyhan to Lavera, that shows a daily round trip TCE of US$34,055).

Across the Atlantic, the market slackened further. The 70,000mt East Coast Mexico/US Gulf route (TD26) and the 70,000mt Covenas/US Gulf route (TD9) saw rates lose around 14 points to both end up at the WS117 level, which shows a daily round-trip TCE of around US$19,000 and US$17,300 respectively. The rate for the trans-Atlantic route of 70,000mt US Gulf/UK Continent (TD25) fell back 15 points to WS115.28 (giving a round trip TCE basis Houston/Rotterdam of US$22,130 per day) which will not encourage ballasters from Europe for the time being.

LNG

The LNG shipping market has seen a further decline in sentiment. Driven by excess tonnage, a lack of cargoes and delays at Freeport, the market experienced another downturn, with the most recent fixture involving a two-stroke deal being made at sub-US$10,000 and less than 100% round-trip earnings.

The BLNG1 Australia-Japan route for both 160k cbm TFDE and 174k cbm two-Stroke vessels saw declines, with rates dropping by US$1,600 and US$1,800 respectively. The TFDE index closed at US$8,600, while the 2-Stroke index ended at US$15,400. Despite these declines, The Pacific market performed better than the Atlantic, where both the BLNG2 and BLNG3 routes saw even sharper drops.

For BLNG2 Houston–Continent, the 174k cbm 2-Stroke index fell by US$8,100, closing at US$9,500, while the 160k cbm TFDE equivalent dropped by US$5,400 to US$4,400. This represents some of the lowest rates recorded in LNG market history. The BLNG3 Houston-Japan route recorded the largest decline of the week, with the 174k cbm two-Stroke index falling by US$8,900 to US$14,200, and the 160k cbm TFDE index dropping by US$7,800 to close at US$7,100.

The term market also saw very little change. Short-term rates increased slightly by US$450, settling at US$25,200 for six-month charters. One-year rates decreased by US$600, closing at US$30,725, while three-year rates saw a modest increase of US$1,700 to US$48,250. These minimal fluctuations reflect the lack of interest in longer-term charters. With the growing supply of vessels, period rates are not expected to recover soon.

LPG

This week, the LPG market experienced a noticeable bearish shift, with declines observed across key routes. BLPG1 Ras Tanura to Chiba saw a sharp drop, with rates falling by US$12, closing at US$47.33. This decrease also impacted daily TCE earnings, which fell by US$12,573, settling at US$27,075. The drop in rates highlights a weaker demand for vessels in this route, further adding to the overall negative sentiment.

In the Atlantic, both BLPG2 and BLPG3 faced downward pressure as a softer bearish sentiment took hold. BLPG2 Houston-Flushing saw a decrease of US$2.63, closing at US$53.25. Daily TCE earnings also saw a decline, falling by US$3,488 to close at US$49,002. This reflects the broader trend of diminishing activity in the Atlantic basin. Meanwhile, BLPG3 Houston-Chiba experienced a US$1.92 drop, largely attributed to vessels being listed with no inquiries, pointing to a further weakening in demand for this route. The Baltic final published rate for BLPG3 settled at US$97.58, with TCE earnings of US$33,160. The overall outlook for the market remains cautious, as these declines suggest a period of reduced activity and potential further pressure on rates in the near term.

Disclaimer:

While reasonable care has been taken by the Baltic Exchange Information Services Limited (BEISL) and The Baltic Exchange (Asia) Pte. Ltd. (BEA, and together with BEISL being Baltic) in providing this information, all such information is for general use, provided without warranty or representation, is not designed to be used for or relied upon for any specific purpose, and does not infringe upon the legitimate rights and interests of any third party including intellectual property. The Baltic will not accept any liability for any loss incurred in any way whatsoever by any person who seeks to rely on the information contained herein.

All intellectual property and related rights in this information are owned by the Baltic. Any form of copying, distribution, extraction or re-utilisation of this information by any means, whether electronic or otherwise, is expressly prohibited. Persons wishing to do so must first obtain a licence to do so from the Baltic.

Source: TheEdge - 28 Jan 2025

More articles on CEO Morning Brief

Created by edgeinvest | Jan 28, 2025

Created by edgeinvest | Jan 28, 2025

Created by edgeinvest | Jan 28, 2025

Created by edgeinvest | Jan 28, 2025

Created by edgeinvest | Jan 28, 2025