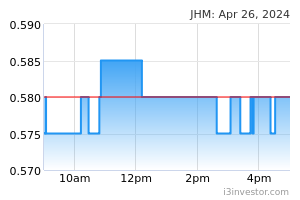

JHM Consolidation - In the Red

kiasutrader

Publish date: Tue, 28 May 2024, 11:06 AM

JHM’s 1QFY24 results disappointed. It dipped into the red on a 46% plunge in turnover, worsening the problem of its under-utilised floor space. It guided for a challenging outlook, weighed down by under- utilised new assets. We cut our FY24-25F net profit forecasts by 28% and 21%, respectively, reduce our TP by 13% to RM0.61 (from RM0.70) but maintain our MARKET PERFORM call.

JHM disappointed with a 1QFY24 core net loss of RM5.1m (vs RM1.9m profit in 1QFY23). The variance against our forecast came largely from a sharp plunge in sales, leading to low plant utilisation and hence loss of operating scale.

YoY, JHM’s 1QFY24 top line fell by 46.1% due to weakness in: (i) its industrial segment (-6.7%), and (ii) its core automotive segment (-63.5%) amidst the end-of-life cycle of certain automotive LED projects and the postponement of new LED projects. It dipped into a loss at the net level, weighed down by unabsorbed overheads from under-utilised floor space. More specifically, its industrial segment reported its fifth consecutive quarterly loss since 1QFY23.

QoQ, its 1QFY24 revenue inched up by 7.7% but it reported a core net loss of RM5.1m (compared to a RM3.9m profit in 4QFY23), weighed down by overheads from expanded capacity (for new automotive LED projects of which production ramp-up did not materialise on requests for postponement by customers).

Outlook. It guided for challenging outlook ahead, particularly for its industrial segment due to the weak demand for sheet metal fabrication and CNC machining. Not helping ether, is the inconsistent order flow at its core automotive segment, resulting in poor cost absorption due to under-utilised expanded capacity. This includes: (i) the hermetic glass seal business, (ii) the collaboration with Jiangsu Dekai Auto Parts Company Ltd for headlamp assembly, and (iii) the joint venture with Mass Precision Inc for front-end equipment fabrication

Forecasts. We cut our FY24-25F earnings forecasts by 28% and 21%, respectively.

Valuations. Consequently, we reduce our TP by 13% to RM0.61 (from RM0.70) based on an unchanged PER of 15x, pegged to a rolled-forward earnings base of FY25F. Our valuation represents a c.15% discount to the average forward of its peers such as NATGATE (OP; TP: RM1.58), PIE (OP; TP: RM6.75) and CNERGEN (Not Rated) to reflect its longer lead time to ramp up new projects. There is no adjustment to our TP based on ESG given a 3-star rating as appraised by us (see Page 4).

Investment case. We like JHM for: (i) its presence in the growing automotive LED market, (ii) being a proxy to the rising demand for 5G test equipment, and (iii) the lucrative margins from its venture into hermetic glass seals. However, its prospects remain unexciting in the immediate term owing to under-utilisation of its new assets. Maintain MARKET PERFORM.

Risks to our call include: (i) further deterioration of the global economic outlook, hurting demand for components from the semiconductor and automotive sectors, (ii) rising production cost, and (iii) new products fail to hit mass production sooner.

Source: Kenanga Research - 28 May 2024

Related Stocks

Market Buzz

No result.

More articles on Kenanga Research & Investment

Created by kiasutrader | Jan 10, 2025

Created by kiasutrader | Jan 10, 2025

Created by kiasutrader | Jan 10, 2025

Created by kiasutrader | Jan 10, 2025

Created by kiasutrader | Jan 10, 2025