Bumi Armada - Flare Gas Recovery System EPCIM

kiasutrader

Publish date: Mon, 04 Nov 2024, 05:28 PM

ARMADA has secured an engineering, procurement, construction, installation & modification (EPCIM) job for a flare gas recovery system from EnQuest in UK North Sea. We believe the win is positive with ESG benefits as it helps its client to reduce emissions but the expected PAT contribution to the group per annum is marginal. We maintain our forecast with TP held at RM0.60. OUTPERFORM call maintained.

Secured flare gas recovery system job in UK. ARMADA announced on Bursa Malaysia that it entered into an EPCIM agreement with EnQuest Heather Limited on 29 October 2024 to provide a Flare Gas Recovery System on the Magnus platform in the UK North Sea (blocks 211/12a and 211/7a). The contract, valued at approximately GBP50m, is expected to span four years.

Aligns with ESG initiative. This project aligns well with ESG objectives, as the system will capture and repurpose gas that would otherwise be flared, thus reducing emissions while creating sellable resources for EnQuest. That aside, we believe that ARMADA possesses some track record with jobs of this type, as it has gone through the conversion stage for its previous FPSOs which required similar technical expertise. With an estimated 10% net margin, the contract could contribute around RM7.1m in PAT annually to ARMADA, adding approximately 1% to FY25F PAT.

Outlook. In July 2024, FPSO Sterling 5 secured final acceptance from its clients and will begin to generate full lease revenue from 3QFY24 onwards. Additionally, the group's short-term gearing risk has been largely resolved after securing USD400m in new loans, consisting of an Islamic syndicated commodity murabahah facility and a conventional syndicated term loan with a 6-year tenor. This will enable ARMADA to refinance its expiring sukuk murabahah, worth a total of RM1.5b. The restructuring of its balance sheet paves the way for the group to invest in new upcoming projects, such as the Blue Streak CO2 JV developments and Akia PSC, though capex for these projects may only commence in 2026.

Forecasts. Maintained as the earnings accretion from this job is expected to be marginal.

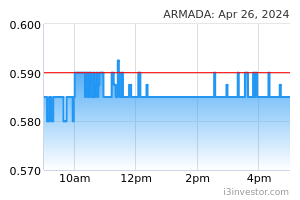

Valuations. We maintain our SoP-based TP by 3% at RM0.60 after a 5% discount to reflect a 2-star ESG rating as appraised by us (see Page 5).

Investment case. We like ARMADA due to: (i) better net gearing position (0.4x in 2QFY24 compared to 1.2x in 2QFY22, (ii) long-term earnings visibility from sizeable order book above RM23b (including potential extensions), and (iii) still reasonable PER of 4.4x in FY25F compared to its 5-year mean of 4.7x despite the projected earnings drop from FPSO Kraken. Maintain OUTPERFORM.

Source: Kenanga Research - 4 Nov 2024

Related Stocks

More articles on Kenanga Research & Investment

Created by kiasutrader | Jan 10, 2025

Created by kiasutrader | Jan 10, 2025

Created by kiasutrader | Jan 10, 2025

Created by kiasutrader | Jan 10, 2025

Created by kiasutrader | Jan 10, 2025