[转贴] The Big Short中的8个投资智慧 - 杨佳文

Tan KW

Publish date: Fri, 11 Mar 2016, 05:36 PM

《大卖空》(The Big Short)是知名作家Michael Lewis的著作,内容讲述几名投资者看准美国的次贷危机(subprime mortgage crisis)将会发生,于是以信用违约掉期(credit default swap)卖空由次级贷款构成的债券,同时卖空投资银行的股票,最终在2008年全球金融危机爆发时大赚了一笔。

The Big Short的电影预告

这本书已被改编成电影,并将于本月21日在新加坡上映。本文从《大卖空》这本书中归纳出了8个投资智慧:

一、不要害怕特立独行

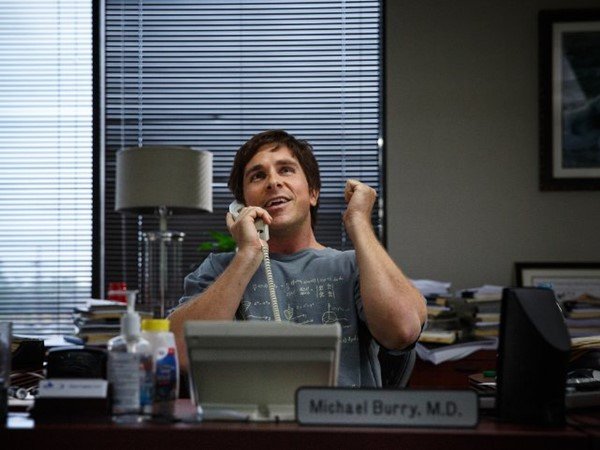

书中的其中一名主角Michael Burry是一名对冲基金经理。由于他一直以来所取得的投资回报相当不错,许多投资者都愿意把钱交给他投资。但当投资者发现他把资金用来买入信用违约掉期以卖空次贷债券,而且其基金的表现不及大市表现时,他们却不断投诉,要他解释投资表现下滑的原因,甚至要求取回资金。

最终,事实证明Michael Burry的观点是正确的。他没有在众人施压之下改变决定,不害怕特立独行,结果他设立的基金取得了巨额回报。投资要获利,有时候就是要敢于“跟别人不一样”。

二、耐性

书中的几名主角都看准次贷危机将会发生,因此仔细地进行部署,然后耐心地等待他们认为“最好的情况”发生(对市场而言却是最坏的情况)。

当你做足了功课,预计某件事将发生并带来投资良机时,你需要做的是及时进场并耐心等待收成,而不需要太过在意间中出现的“杂讯”,结果太早离场。

三、掌握市场资讯

投资总是一买一卖,为什么别人要卖东西给你,或者跟你买东西?对方是不是知道一些你可能不知道的事情?

要跟整个市场“作对”,书中的几名主角其实一直都战战兢兢,害怕自己误判形势,所以他们都一直在思考,卖信用违约掉期给他们的机构是不是知道一些他们不知道的事情。他们密切地关注市场动向,与投资银行、评级机构的主管会面,从而了解业内人士(market participants)知道和不知道什么事情。

四、不要过度自信

2008年的金融危机之所以会发生,主因之一是投资银行过度自信,认为房地产市场和次贷活动不会出问题,它们设计的金融产品能够有效地分散风险,带来丰厚回报。

当你认为“这次不一样(this time is different)”时,就是你该多加警惕的时候了。

五、清楚自己承担着多大的风险

在金融危机爆发之前,各家投资银行的总裁和许多基金经理其实都不了解他们因为次贷债券和信用违约掉期而承担了多大的风险、可能蒙受多少损失。结果,当问题发生时,他们才发现那些高风险交易所造成的亏损远超预期。

六、不要承担太多债务

当年为什么许多美国民众会失去房子?因为他们没有好好衡量自己的偿债能力,只知道贷款前几年的利率较低(所谓的“teaser rate”),却忘了当利息变成以浮动利率(floating interest rate)计算时,他们可能无法支付每月所需偿还的款项。

七、不要盲目相信“权威”

Michael Lewis在书中提到,信用评级机构(credit rating agency)当年也只是“拿钱做事”的机构,它们的工作就是给债券和各种金融产品评级,而且调高还是降低评级的大权都由上层职员掌控。另外,它们利用的估值模型也未必能准确地反映市场状况。

另外,投资银行理论上应该相当了解市场状况,比较能够判断市场的走向,但它们当年也无法确知自己面对着多大的风险。

所以,不要盲目相信所谓的“权威”。权威也会犯错。

八、学会看出趋势,了解经济和信贷周期

事后孔明很容易,要有先见之明就不简单。事后看来,书中的几名主角能够准确预测到次贷危机发生,看似很容易(他们做的不过就是简单的推理:很多人会还不了房贷),但这一切靠的都是他们丰富的知识、经验和判断能力。

所以,投资者要尽量累积知识,比如了解经济和信贷周期的变化,掌握正确的资讯,大胆假设,小心求证。

http://cj.sharesinv.com/20160106/14629

More articles on Good Articles to Share

Created by Tan KW | Jan 03, 2025

Created by Tan KW | Jan 03, 2025

Discussions

Bursa saham performance depends on few uncertainty ahead. 1)The nxt BN Gobenor succesor ( hopefully, not from someone sent by / closed with jib ) 2.)Crude price is another double sword,the stronger it is Us dollar will have the opposite direction. 3) Domestically consumers spending .

2016-03-12 01:30

PureBULL . > Mar 12, 2016 03:00 AM | Report Abuse

X

John Paulson graduated among the very top in his MBA finance program from world # 1 Harvard Uni. He was 1 of a star MD with half bankrupt Bear Sterns IB. It was his hedge fund client at Bear Sterns that inspired him to go into hedge fund biz after seeing the client making tonnes of money without fail in hedging M&A deals.

John Paulson is the 1st to have the idea that subprime mortgage derivatives will crash. He knew so much about sub prime financing biz. He started shorting subprime in mid 2006 n loss like crazy. He tried many other ways to convince more followers n still no result at all.

Running out of choice, in his last attempt he suddenly thought why not ask for the contact # of that old man and gives him a call.

The old man granted a meeting with him in late 2007 to early 2008. Within 1 hr of his presentation, the old man bought John Paulson's big short story.

Immediately they both went shorting subprime like crazy in early 2008 ...

n the whole investing community followed suit leading to 2007-09 DOW financial crash.

At the end of the story, John Paulson become so famous for making the biggest money per deal in hedge fund history.

Paulson is the record holder making a personal record profit of usd$3.2 billion in 1 single deal.

The old man was 2nd record at usd$2.9 billion. No name was mentioned. So Humble he is.

Do u know who is that 80+ old man? Yes, your G Soros.

Bottom line, follow the smart mkt movers early to aim RIGHT at RIGHT TIMING.

& be sensitive to all things RIGHT to score in this endless 'stock mkt exam' every cycle ...

This is the invincible model :

G SOROS - "Economic history is a never-ending series of

episodes based on falsehood and lies, not truths.

It represents the path to big money.

The object is to recognize the TREND whose premise is false,

ride that trend, and step off before it is discredited"

Jim Rogers - "Figure out the money and you’ll figure out what’s going on."

2016-03-12 03:31

base on these few days act , kl index is nearly to go down , just technically one

2016-03-14 01:25

I bet oil price can go down to 23 usd per barrel by coming month, right now is much danger place to get in.

2016-03-14 11:56

Regnig:不会, 美国如果还不起房贷,把钥匙寄回给银行就没事了,房贷一笔勾销,所以烂账多,容易垮。马来西亚就比较小心。比起周围国家,政策,经济走势,大马还有十年的牛市要走,现在只是停下来休息。

2016-03-15 21:32

Angielim9955: the question is, what is opec hidden intention to push down the oil price, to the point on collaborating with russia to do so. Coming month is the critical point when US banks reserve based loan redetermination period start, if they want to win this war quick, they have to push down price even further. This will not only restraint but also pull out those dodgy companies lifeline. They have been doing so much and would not eaily give up this time.

2016-03-15 22:54

So Ahbeng base on your view, oil price will continue up or going down ?

just your view of points ?

2016-03-16 01:23

Strategically, $20 per barrel is still possible. There is no hard evidences to support my view, esp if you look at supply and demand side. But neither those hard evidences able to explain what will happen next, those who relying on those evidences were wrong badly for the past 2 years. My take is, $23-26 will be the new balance for coming few months, oil producers need to be this low to psychologically deter high cost producers. The war will not end if not one were hurt.

Anyway, I will not go short, sit on the fence and waiting for the worst to come. I hope im right but i might be wrong, time will tell.

2016-03-17 15:04

Ahbeng Beng,today oil and kl index double up, you still believe oil will down again, just your view of points? just discuss la , haha

any commence ah ?

2016-03-18 01:17

Then when is the meaning. Mid of April. Because I need to wait oil prices dropped in order for me to collect oil counters. As you say i cannot buy now wait after April then only buy. Because I already sapu alot dayang at 1.3 now abit takut. Advice me please

2016-03-18 19:32

For me, im on safe side, not chasing the bull as my view completely different with the market. I also hate missing bull if months later found out that my assumption are all wrong. So im unwilling to advice you anything as you may blame me cause you to miss this bull run. Maybe you can tell me more about dayang, at what oil price level, dayang can start performing again. Personally, from oil inventiry point of view, oil price will linger at low point for a month or two before it can break to next resistance level...unless drastic changes happen to the supply market.

Why relying on me to give you advice? I dont know the answer, thing that im telling you is simply a question that im asking myself. If the whole war is a conspiracy, what is my target? what will i do next? You can ask yourself and come out with diff idea. I will just stick to my instincts.

2016-03-19 04:58

Ahbeng Beng : thanks Ahbeng Beng . I wait fist , because I still strongly feel oil will drop , haha

thanks a lot , thanks

thanks

2016-03-22 20:51

regnig

大马会有很多人还不了房贷的危机吗?

2016-03-12 00:47