If one can remember in 2012/2013, DRB-Hicom made a huge purchase of Proton. The Proton deal does not do good for the group as it created huge losses over the last few years. However, if one can remember, at almost the same time, it also acquired a controlling stake (then was around 30+%) in POS Malaysia.

Over time, it has managed to hold a more than 50% of POS Malaysia through several exercises - among them acquisition of Konsortium Logistik Berhad, restructuring through injection of KLAS and several other smaller companies.

Why is it doing this? It sees opportunities.

Along this period as well, there have been so many strategic partnerships or business investments involving the logistic companies. I only need to point a few here (besides the DRB's move) and one will be able to see it - Yamato's entry into GDEX, Tasco's acquisition of Gold Cold chain, Korea's CJ acquisition into Century Logistic and several more. Why out of a sudden?

The government over the last few years have been talking about expansion in this area of business. Logistics involve plenty - from ports, highways, airports, business infrastructure, people talent and the business enablement. Imagine, we are continuously talking about building new ports or at the very least expanding the existing ones.

I strongly believe that the continuous investment into this area of business will successfully enhance Malaysia as a strong logistic hub. I believe that in several areas, such as banking, plantations, upstream oil and gas and even construction - we can only do so much in Malaysia. But in logistics, because of our geographical location - we can have more than our country's capacity can provide. It definitely involves services strength and Freight Management is largely about that.

What about Freight Management that interests me

Not a household name, but in any case there are rarely household names in freight businesses.

As a listed company, it is one of the least noticeable. (The lesser the people notices, the better.) It is in a growing space and it has great management which I will explain below. Also, importantly, it is not expensive (RM245 million market cap, PE around 10x-12x) and yet to really move much in terms of stock price as compared to many other companies recently. Dividend is also consistent and yield is good.

Not everything requires the ownership of the entire foodchain - integrated offerings no doubt - but one does not need to own all. Freight Management is about that. I had an article which I would like to bring back. In fact, there has not been much changes of its business since that article. Additionally, one can understand the business more here and here. In terms of business, I like it for its asset light-er strategy as compared to many other competitors.

When a company has a strategy of less asset, it has to have a strong services and integration arm.

The statement by the CEO sums it:

|

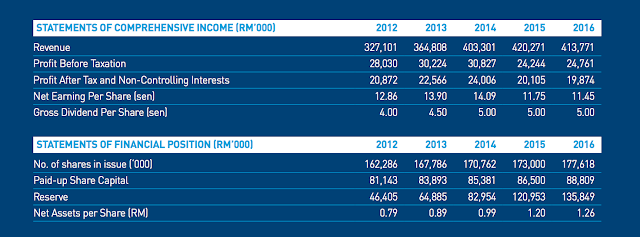

| Diagram 1: Last 5 years numbers |

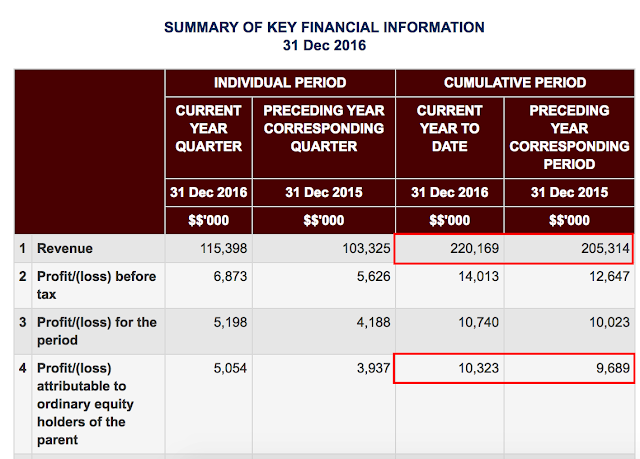

For the last two years, its revenue has stagnated a bit but this has picked up for its FY2017 as highlight below. The main thing is that though, its revenue growth is pretty consistent (as well as Profits) over the last 10 years which signifies the strength of the management. The CEO has mentioned of 15% growth target annually.

During 2015 and 2016, there was a period where business volume has gotten tougher partly due to challenges in reduced consumption due to GST and the challenging international trade scenario, as probably volume in/out China has been affected. This is also, as mentioned in the article, where the company invested into a new warehouse for pharmaceuticals and healthcare. Hence, its depreciation has increased.

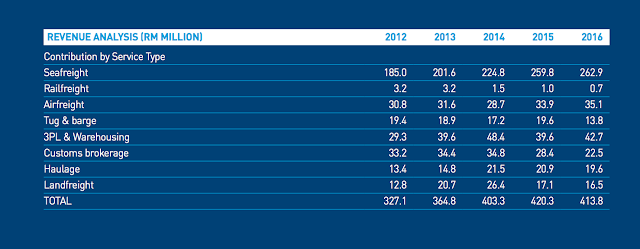

Freight's strength is in seafreight business (quite common) while 3PL & warehousing and airfreight comes in a distant second and third.

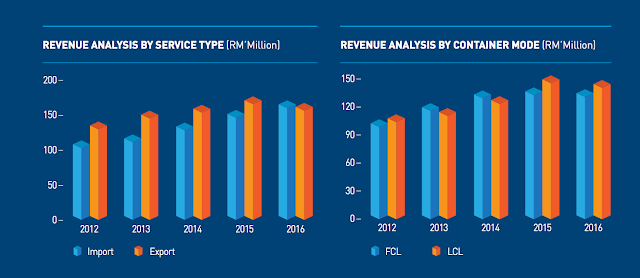

In terms of the type of services and container mode, its import and export is quite balance - potentially signifies that, Freight mainly does operations for its export clients which will be importing and value add and later exports those products AND/OR, its customer type is just well-balanced.

On e-commerce, it has embarked on that space by having a 65% stake in FM Hubwire Sdn Bhd. This is still preliminary and it is not profitable. It just to show that it is looking at this space as an opportunity.

Dividends

As provided in Diagram 1 above, its dividend numbers have been pretty consistent - upped from 4% in FY2012 to 5% in FY2016. This is despite its profit coming down for 2015 and 2016. Normally, for a company to be able to do that - it has 2 things in mind - the reduced profitability is only short term in nature (hence it has comfort to provide a consistent dividend) and cashflow is strong enough for it to do that. At 5% dividend, that translates to about 3.78% dividend yield. (I know that at this moment, it is not that important when stocks are appreciating, but when the tides run low - you know what the rest of the sentence will say).

I have decided to purchase 7000 units at RM1.32.

Note: Not all freight and logistic companies do well, but Freight Management seems to be the one that does well.

wooddragon

Decreasing profit margin, so many competition and increasing debt. This company is like fighting very hard to survive leh... ...

2017-03-23 23:23