Hiap Teck is cheapest Steel Producer - Koon Yew Yin

Koon Yew Yin

Publish date: Wed, 06 Oct 2021, 04:26 PM

Steel price is rising:

The steel price chart below shows that steel price has gone up from 3,750 to 5,835, 50% increase in the last 12 months due to various reasons. One of the reasons is that China has been the world largest steel exporter before and it has stopped exporting because it wants to reduce the use of coal to produce steel to improve its air quality and environment.

Covid 19 shut down

Hiap Teck reported revenue Rm 164.8 million and EPS 4.26sen for the quarter ending July. Its previous quarter ending April, revenue Rm 329.6 million and EPS 4.79sen. Its revenue has dropped about 50% but its EPS has dropped only about 12% despite of its factory in Kelang was shut down for 2 months and its associate Eastern Steel plant in Treggannu was shut down for 1 month.

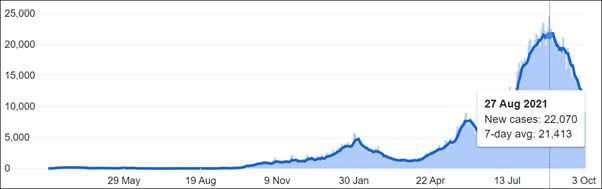

Covid 19 cases is reducing:

The number of new Covid 19 cases is reducing so rapidly, largely due to the rapid vaccination rate. As shown on the charts below, on 26 Aug the number of new Covid 19 cases was 24,599 and on 4 Oct the number of new Covid 19 cases was only 8,075.

Vaccination

Currently 44.6 million doses of vaccine were injected to 20.7 million people which is 64% of our population.

Last month alone, 5 million people were vaccinated. If this month another 5 million people were to be vaccinated, the total number of people vaccinated would be 25.7 million, equal to about 80% of our population.

From next month, there will no more MCO lock down and people will be free to move about. Based on the above facts, Hiap Teck should be able to report much better profit in the next few quarters.

Based on current prices, Hiap Teck is the cheapest stock among all the steel producers in Malaysia as shown on the comparison below.

|

Name |

price |

Latest EPS |

EPS divided by price |

|

Hiaptek |

56sen |

4.26sen |

7.6 |

|

Melewar |

41.8sen |

2.64sen |

6.4 |

|

AnnJoo |

Rm2.65 |

15.48sen |

5.8 |

|

CSC Steel |

Rm1.31 |

4.18sen |

3.2 |

I wish to point out Mr Ooi Teck Bee’s latest weekly recommendation especially the chart formation of Hiap Teck.

Hiaptek - Cup And Handle Chart Formation

- The present chart pattern will form a Cup And Handle Chart.

- Please note that Parabolic SAR buy signal (Green ball) has appeared.

- The pivot line of this Cup And Handle Chart is at 0.615.

- Once the 0.615 major resistance line is overcome, the Cup And Handle Chart is formed.

- The slogan for a Cup And Handle Chart is "the sky is the limit".

Investors should take this great opportunity to buy Hiap Teck. Mr Ooi Teck Bee has named Hiap Teck Miss Universe.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Dec 13, 2024

Indonesia remains committed to start implementing a 40% mandatory biodiesel mix with palm oil-based fuel, or B40, on Jan 1 next year, its chief economic minister said. Indonesia, the world's largest..

Created by Koon Yew Yin | Dec 12, 2024

Indonesia is the world's largest producer of palm oil, producing an estimated 46 million metric tons in the 2022/23 marketing year. Indonesia also exports over 58% of its production, making it the w..

Created by Koon Yew Yin | Dec 03, 2024

Indonesia is the largest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Discussions

I feel sorry for the people who believe so much in hiaptek just because the company happened to have some good FA and steel prices might be rising. I have respect for OTB but I feel his judgement here has been clouded. He has over analysed it to paralysis. Hiaptek nosh will be a ball and chain on the share price. If you own hiaptek shares, just get out now. So many other good non steel stocks flying now.

By December this year, the price will still be no higher than 60, I guarantee.

2021-10-06 17:58

Geezer is a failure today. He used to boast and thump his chest. Now I wonder where are all his followers. Nothing coming from Geezer will be taken seriously by anyone. In fact, if he chooses to buy the share you owned, then its time to sell out. The share will go down instead. He is shunned like the plague. This is his KARMA.

2021-10-07 00:06

Without OTB, Grandpa Koon is nobody! He has gone back to his old faulty ways! Yeah, always picking losing horses!

2021-10-07 00:12

“It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.” - Warren Buffet

2021-10-07 00:22

"Posted by gohkimhock > Oct 7, 2021 12:22 AM | Report Abuse

“It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.” - Warren Buffet"

=====================================

So true, like how 51% is demanded.

2021-10-07 00:30

Dear Mr Koon Yew Yin,

As you know, I've been advising to take a position in Genting (3182). You must understand, steel stocks may or may not rise, however what is proven is that the sector is highly cyclical and subject to one-offs

What is not is Gaming. After all, gambling is human nature and is as old as Man himself. In fact, with all the other travel and tourism stocks closing due to the pandemic, Genting's attractions in Genting Highlands, US & Bahamas, UK & Egypt will be that much more attractive - as the aphorism goes, 'what doesn't kill you, makes you stronger'. As such, we hope that you are able to take a position in Genting before you miss the boat on the greatest run in Genting's history

1971 Genting Highlands Opens

2021 50 Years of History and Growth

2009 Global Financial Crisis

2020 Covid-19 Pandemic

2009 Year of the Ox

2021 Year of the Ox

2010 Resorts World Sentosa (SG) opens

2021 Resorts World Las Vegas (US) opens

2009 Mar RM3.08 (low) to 2011 Nov RM 11.98 (all time high)

2020 Nov RM2.95 (low) to 2022 Xxx RM ????

History always repeats itself

Sincerely,

emsvsi

2021-10-07 09:15

Bosan, asyik ulangi benda yang sama saja. Kyy suruh Bilis up up up untuk dia jual?

Omg

2021-10-07 12:08

Bosan, asyik ulangi benda yang sama saja. Kyy suruh Bilis up up up untuk dia jual?

Omg

2021-10-07 12:09

Tak ulangi, macam mana nak bagi naik dan gaut balik berpuluh juta yg hilang? Belum lagi kira kerugian sahabat-sahabat yg ikut bersama. Rasa serba bersalah. Sebab tu, baik bilis mati dari sahabat maki....paham??

2021-10-07 15:41

Whenever this old dick promote stocks, the stocks will fall 18th floor.

2021-10-07 16:56

same modus operandi, luring ikan bilis so he can offload. then after he offloaded then will sing bad that counter. in short, KYY recommend buy, you should consider take profit already.

2021-10-08 09:36

patrico8

There are more than 900 companies in KLSE, 30% are quite profitable, maybe >10% are strong , well managed companies. Hiap Teck has a big NOSH with a poor price history. If I am uncle with his huge financial can easily look for some nuggets to play with. This Hiap Teck thing is getting boring.

2021-10-06 16:57