Over RM12.96 billion worth of Gross Development Value and a huge support from institutionals side with Guocoland securing 27% stake in this IPO. These heading creates a massive WOW! among crowds and truly marketing itself with all the hyped up headlines brewing interest and maintaining it as this is one of Malaysia’s biggest and most anticipated IPO.

Eco World International (EWI) would become a proxy for Malaysian investors to gain exposure in overseas housing markets. The RM12.9 billion worth of GDV accounts for 3 projects in the United Kingdom and one in Australia.

We are not interested in the project location as we believe that it likely to be out of investor’s control even if they plan to sell it off half way through. But we took a glimpse on the locations involved and rated average for it the reason being nothing much can go wrong with it. You can save your time to look up those locations unless you are buying a property there.

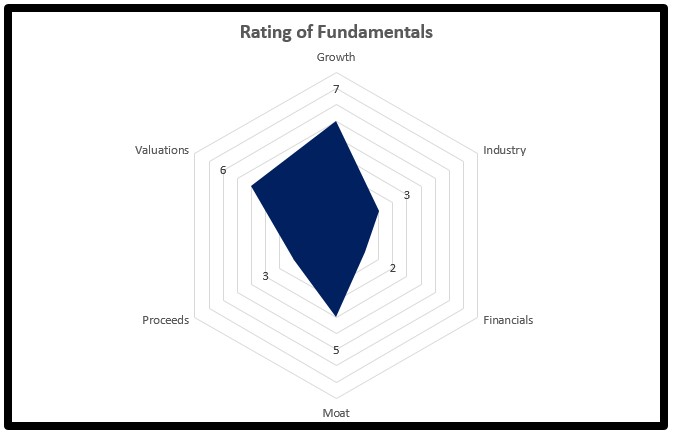

Let’s analyze the ratings given:

Growth (7) – We think that growth potential is huge with project value as high as RM12.9 billion. I guess that’s a very big order book or 5 times the expected market cap of RM2.58 billion post listing that would be raked in by this IPO at RM1.20 per share. The average Malaysian property developers has a GDV to market cap sits around 2.5 to 3.5 times.

Valuations (6) – We couldn’t derive the PE that we are expecting but a rough estimation from GDV of RM12 billion can be spread out in the next 5 years adding in a margin of 11% (referring to local minus 5% since EWI would likely have problems on foreign land). We come up with our projection with the PE of 9.23 at the listing price of RM1.20. But according to the timeline of the project development, we could only see these numbers later in FY2018.

Note that we haven’t include dilution from warrants that would be given out after a bonus issue. The valuations would definitely be more expensive with the exercising of warrants in the future.

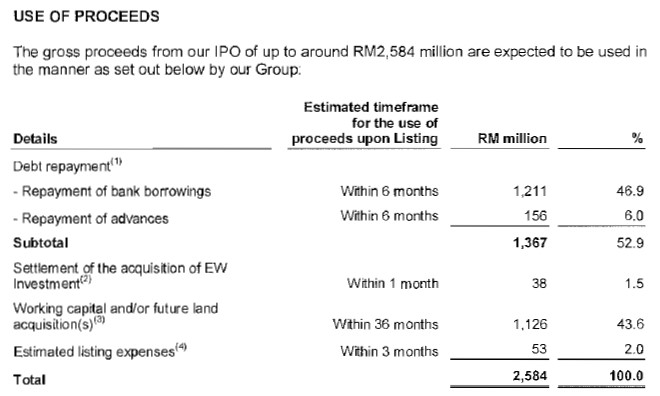

Proceeds (3) – This is the part that’s bothering us every single time an IPO goes on air. We really dislike to invest in something that uses our money to pay debt. 52.9% of the IPO proceeds would be used to pay debt which makes it felt as if we are being used as bailout plan when a company gets loaded with a little too much debt. Obviously you can take a contradictory view where investors who want a piece of their landbank overseas would have to literally ‘share the cost’ of the landbank acquired earlier through debt.

Moat (5) – Neutral on EWI’s moat since everything looks average in our books. The moat isn’t that deep since it’s a developer but already owning the land for development in those location makes it look better on paper.

Financials (2) – Still a loss making company with accumulated losses of RM200 million in the balance sheet. Around RM900 million worth of borrowings are classified under current liabilities which meant that these liabilities need to be settled within a year or to refinance those borrowings with a longer tenure. This pretty much explains why so much of its IPO proceeds goes into debt repayment.

Industry (3) – Properties around the world might see slower than expected growth rates when increasing interest rates begin to loom. Perhaps the United Kingdom properties might fare better with historical low British Pounds that would likely attract foreign buyers into that market. Nevertheless, we still rate the industry a low 3 seeing that there’s a limited room to grow coupling with intense competition moving forward.

Conclusion

We recommend you to subscribe only to flip it over on the first day of trading expecting to register a huge gain in price with all the hype created. If you plan to hold the stock long term, I guess it would be more suitable to enter when the market is expecting good earnings for quarters ahead. That’s likely FY2018 or so since much of the completion comes in after 2019!

We felt that with an issue price of RM1.20 per share, we might see a 10-15% gain on the first day of trading which is a great opportunity for you to unload. The fact that this counter seems to be treated like a ‘superstar’ IPO and the high percentage of institution and director holdings lowers the downside risk on first day trading for this stock.

See Our Extract from the IPO Prospectus

Like our page to get more these https://www.facebook.com/omightycap/

Make the next post easily visible from your Facebook!

You can visit us at http://omightycap.wordpress.com