Rakuten Trade Research Reports

Technical View - Teo Seng Capital Bhd

rakutentrade

Publish date: Tue, 06 Feb 2024, 09:57 AM

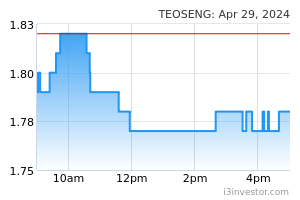

Teo Seng Capital Bhd

- TEOSENG is poised for a potential bullish breakout from its one-month rectangular pattern, targeting to surpass the immediate resistance at RM1.93. In view of the stock hitting a new 52-week high yesterday, coupled with the supportive technical reading in RSI and improving EMAs, we opine that the stock has a decent chance to stage an upper breakout in the near term.

- In the event it breaks above the RM1.93 neckline, this will improve market sentiment and should lift the stock towards the subsequent level of RM2.00 (R1), followed by RM2.20 (R2).

- On the downside, stop-loss is set at RM1.65.

- Fundamentally, we like TEOSENG for its robust earning visibility bolstered by higher egg production volumes, government subsidies for eggs, and promising growth prospects in animal health products. The company's strategic expansion plan, aiming to increase egg production capacity to 4.5m eggs per day by mid-FY24, coupled with diversification into downstream products such as boiled eggs and the processing of old hens, is poised to broaden Teo Seng’s revenue streams.

Source: Rakuten Research - 6 Feb 2024

To sign up for an account : http://bit.ly/40BNqKI

[Youtube Tutorial] Account Opening & Enable Foreign Equity:http://bit.ly/3I5Jzxo

Related Stocks

More articles on Rakuten Trade Research Reports

Discussions

Be the first to like this. Showing 0 of 0 comments