Dutaland – Waiting to unlock the value of its assets

equitydiary

Publish date: Thu, 17 Dec 2015, 03:34 PM

Link to official blog: www.equitydiary.blogspot.com

DUTALAND BHD

Waiting to unlock the value of its assets

Price: RM0.43

Market cap: RM363.8m (shares outstanding: 846.12m)

Book value: RM932.5m / RM1.10 per share

Enterprise value: RM347.7m (cash RM17.9m, borrowings RM1.8m)

Summary:

-

With most of its debts cleared off, Dutaland could now be in a better position to resume its property projects, namely the Kenny Heights development and Duta Grand Hotel.

-

Over the past few months, Dutaland has submitted revised/new plans for those projects.

-

Its three main assets could be worth RM1.392bn or RM1.65 per share: (i) Kenny Heights development. Remaining development land of 69.7 acres could be worth RM1.214bn at RM400psf. Dutaland’s 58% stake is then worth RM704m. (ii) Duta Grand Hotel project. Dutaland’s 76% interest in the project could be worth RM335m. (iii) Oil palm plantation. Book value of RM352m after recent revaluation. Dutaland currently trading at an EV/ha of about RM29k.

The current subdued property market and weak CPO prices are obviously not a boon to Dutaland.

Nevertheless, it could still be an interesting asset/RNAV play to watch, now that its balance sheet has turned around.

Dutaland’s total borrowings vs. cash & cash equivalents

It has been in a net cash position for the past two quarters. Over the years, the bulk of its debts had been pared down mainly from:

-

6-year restructuring scheme which was completed in 2013. Implemented in Apr 2007 to address indebtedness which totaled RM769.1m initially.

-

Major asset disposals in recent years including: Olympia Plaza Sdn Bhd (netted cash proceeds of RM35m) and 5-acre land in Kota Kinabalu (compulsory acquisition by Sabah State Government, RM49.5m).

-

RM85m settlement sum received in Feb 2015 (from long standing legal suit brought by its 92%-owned subsidiary, UNP Plywood Sdn Bhd against Sabah Forest Industries Sdn Bhd since 1997).

With an improved liquidity position, could Dutaland be planning to recommence its property projects soon?

Over the past few months, it has submitted revised/new plans for its projects, namely the Kenny Heights development and Duta Grand Hotel.

Ideally, it would be best if Dutaland manages to find a buyer (at the right price) for its oil palm plantation and use the proceeds to fund its projects.

Potentially, it could secure alliances with strategic investors or JV partners to help fund those projects. Perhaps property developers from China would be interested?

The recent plans to revive the Plaza Rakyat project involved a property developer from China. We also saw Agile Property Holdings Ltd partnering with PJ Development Holdings Bhd to develop a residential project on a 10.16-acre land in Mont Kiara. The land of this project (which is close to Dutaland's Kenny Heights land) was sold by PJD to Agile for RM186m or RM420psf.

It will be interesting to see what Dutaland’s next move will be.

Let’s take a look at Dutaland’s three main assets.

1. DUTA GRAND HOTEL (DGH) PROJECT

Current physical state of DGH project

Artist’s impression of DGH project (not dated, intended for visualization purposes only)

Source: http://www.dcmstudios.com.hk/work/main/hotels_and_hospitality/duta_grand_hotel/en/

DGH project details:

-

Consists of 5-star hotel, offices and service apartments on a 2.8 acre site at intersection of Jalan Ampang and Jalan Sultan Ismail (Google Maps: https://goo.gl/maps/BmeJYWkPDkv).

-

Started in 1994 but was suspended in 1998 due to Asian economic crisis.

-

Structural work for 33 storeys out of the 52-storey building was completed before suspension.

-

Undertaken by Dutaland’s 76% owned subsidiary, Duta Grand Hotels Sdn Bhd.

-

Total development cost RM790m, cost to completion RM460m (estimation as of 2009).

-

Previous indicative GDV of RM1.15m (a news report stated in 2006)

-

Est. GFA around 1.8 mil sq ft.

-

Book value RM332.8m.

Previous development plans

Source: Dutaland circular dated 8 Sep 2009

Current development plans?

The DGH project could now be a 64-storey high building, with about 700 service apartments.

Based on a planning permission application submitted a few months back (see figure below), the revised plans are:

-

Retail podium (Basement 2 – Level 3)

-

Recreational facilities (Level 4)

-

Offices (Level 5 – Level 19)

-

M&E floor (Level 20)

-

350 units of service apartments (Level 21 – Level 34)

-

325 units of 5-star hotel rooms (Level 35 – Level 47)

-

351 units of service apartments (Level 48 – Level 62)

DGH project planning permission application, submitted 28 Sep 2015

Link: http://www.epbt.gov.my/osc/Proj1_Info.cfm?Name=605645&S=S

Previous applications show that DGH involved land Lot 10, 30, 33, 34, 35 and 36. But interestingly the latest application included Lot 64, 65 and 66 (see endnotes at bottom).

DGH potential value

If we assume:

- GDV of RM1.3bn

- Cost to completion of RM600m

- Whole development (including hotel and retail) is sold

Then the profit from the project is RM700m. After tax of 24%, this leads to a net profit of RM532m. If we spread the net profit over a three year development period and discount back at a 10% rate, we get RM441m. Dutaland’s 76% interest could then be worth RM335.2m.

2. KENNY HEIGHTS DEVELOPMENT (KHD)

KHD details:

-

73.44 acres of prime land in Mont Kiara/Sri Hartamas area (Google Maps: https://goo.gl/maps/mEzkRW7rbv22).

-

Development period of 10-15 years, est. GDV of about RM20bn. Expected GFA est. 23mil sq ft.

-

Phase 1, Kenny Heights Estate, launched Nov 2008, GDV of RM216m. Completed and handed over in Apr 2011. Comprised of 49 town villas on 3.7 acres of land.

-

Phase 2, Kenny Heights Sanctuary, previous GDV est. RM1.5bn, GDC est. RM900m. Previous plans were for 4 blocks of condominiums (709 total units) on 9 acres of land. Construction delayed and original development plans have been revised.

-

JV development with sister company Olympia Industries Bhd.

-

Dutaland’s wholly-owned subsidiary KH Land Sdn Bhd will take on the role of developer, while OIB will be a passive investor.

-

Under the restructuring scheme, Dutaland acquired 41.14 acres for RM261m (by issuance of new shares) or about RM146psf. OIB acquired 32.3 acres for RM189m (by issuance of new shares) or about RM134psf.

-

Under their consortium agreement, Dutaland and OIB to derive all profits from the development in the ratio of 58:42

KHD potential value

Total land area 73.44 acres. The remaining land area (removing 3.7 acres of Phase 1) is about 69.74 acres.

With a 58% interest in the JV consortium, Dutaland’s stake of the remaining land area is about 40.4 acres, which could be worth RM704.8m if valued at RM400psf.

Note: The KHD land is not listed among Dutaland’s “properties held by the group” in the annual report, but nonetheless it’s still carried in the books. The land was recorded under “property development costs” (refer to annual report 2007), then a bulk of it was transferred to “land held for property development” in 2013.

Some planning permission applications for KHD have been submitted recently (see endnotes at bottom).

3. OIL PALM PLANTATION

Plantation details:

-

About 29,600 acres (12,000 ha) in Sandakan, Sabah.

-

Planted mature area of 24,790 acres (10,032 ha) or 95.2% of total planted area of 26,034 acres (10,536 ha).

-

FFB production of 101,587 MT in FY15, about 10% yield per mature hectare.

-

In 2011, IOI Corp offered RM830m cash or about RM69k/ha for Dutaland’s plantation estates. However the deal fell through.

-

Biological assets revalued in Sep 2015, giving rise to a surplus of about RM33m and increased BV to RM352.42m (RM29,421/ha).

Plantation potential value

I will use the book value of RM352m or about RM29k/ha.

Dutaland’s FFB yields are relatively low vs. the industry average. As a small plantation player, I think Dutaland is not be able to reap the full potential of its oil palm estates due to having less resources for labour, fertilizer, etc., and expertise. If a larger plantation player decides to acquire Dutaland’s estates, a much higher FFB yield would be achieved from the plantation.

With an enterprise value of RM348m, Dutaland is trading at an EV/ha of RM31,083 and EV/planted ha of RM34,655.

SUM OF PARTS

Dutaland's book value of RM1.10 per share doesn't reflect its true value. Taking the values of its three main assets and deducting total liabilities gives rise to a value of RM1.55 per share.

RNAV based on three main assets (excluding other assets, but including all liabilities)

Source: Based on my own assumptions and estimates

* * * * * * * * *

ENDNOTES

1) DGH project

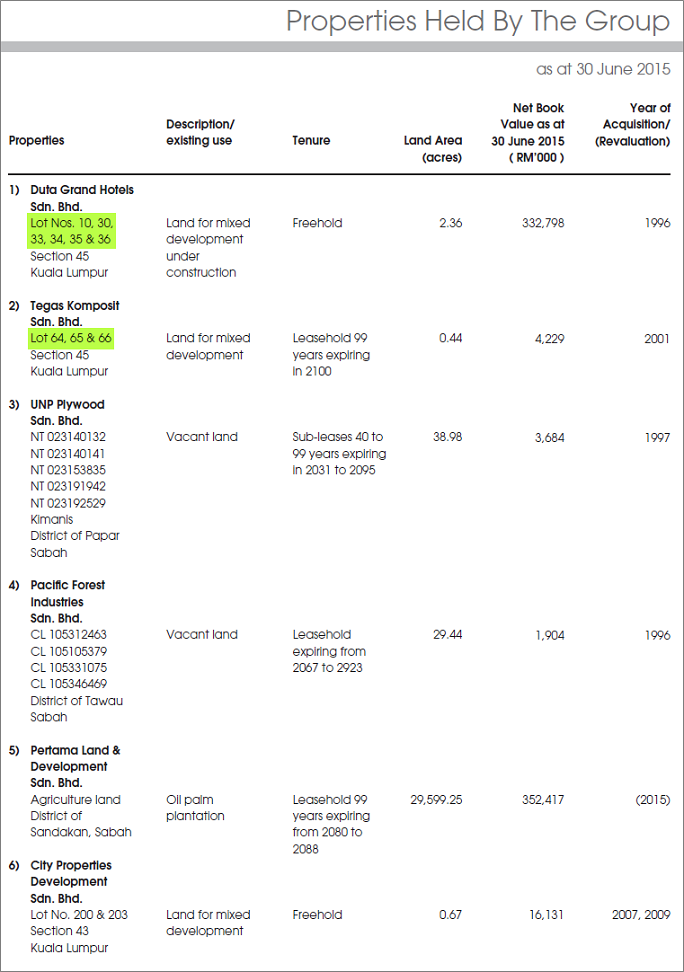

Lands involving DGH project highlighted green

Source: Dutaland annual report 2015

Potential GDV, rough estimation:

Floor space assumption: 2009 circular stated 290,00 sq ft of office space over 15 floors (Level 5–19), assume each floor has net floor area of 19,333 sq ft.

I. Offices

- Floor area: 290,000 sq ft

- Value = 290,000 sq ft × RM1,100 psf = RM319m

II. Service apartments

- 701 units over 29 floors.

- Floor area: 19,333 sq ft × 29 floors = 560,657 sq ft.

- Value = 560,657 sq ft × RM1,100 psf = RM617m

III. Shopping mall

- 6 floors of retail

- Assume gross floor area (GFA) per floor is 1.7x office’s floor area

- GFA = 6 floors × 1.7 × 19,333 sq ft = 197,197 sq ft

- Assume 70% of that is net leasable area. NLA = 70% × 197,197 sq ft = 138,038 sq ft.

- Value = 138,038 sq ft × RM1,100psf = RM152m

IV. 5-star hotel

- 325 rooms

- RM700k per room

- Value: RM700k × 325 rooms = RM228m

KL hotels benchmarks: IGB Corp Bhd's 910-room Renaissance Hotel, right opposite of the DGH project, has a book value of RM652m, translating to a BV of RM716k per room. KLCC Holdings Bhd’s The Mandarin Oriental with 632 rooms (571 rooms, 21 suites and 40 executive apartments), has a BV of RM538.9m or RM850k per room. The Westin KL was sold for approximately RM1m per room, back in 2007. 540-room DoubleTree by Hilton hotel was sold for RM388m, translating to RM718k per room.

I + II + III + IV = RM1.32bn

or

GFA should be about 2 mil sq ft now with the additional floors. Say net floor area is 60% of GFA or 1.2 mil sq ft. At RM1,100psf, GDV is RM1.32bn.

or

GDC should be about 60% of GDV. Previous GDC estimated at RM790mil, which is around 60% of RM1.3bn

2) KHD lands

Layout plan of KHD lands (could have since changed)

Source: Dutaland circular dated 8 Sep 2009

Planning permission applications involving KHD (not exhaustive):

Parcel 4?

Lot 21767 and 21768

Submitted: 11 Nov 2015

Status: Conditional approval

Link: http://www.epbt.gov.my/osc/Borang_info.cfm?ID=369604&NoForm=Form2

Based on the application, the proposed development plan consists:

- Offices (2 tower blocks, 38 floors) above mall

- Shopping mall (3 storey)

- Service apartments, 3 blocks, 584 total units

Parcel 1 (Kenny Heights Sanctuary)

Lot 25167, 25168 & 25169

Submitted: 21 Oct 2015

Status: Approved

Link: http://www.epbt.gov.my/osc/Borang_info.cfm?ID=368762&NoForm=Form2

Plans involve:

- Apartments, 4 blocks, 1,017 total units.

Applications submitted earlier this year:

Parcel 6, 7 & 9?

Lot 21762, 21763, 21764, 21765 & 57487

Submitted: 16 Jan 2015

Status: Conditional approval

Link: http://www.epbt.gov.my/osc/Borang_info.cfm?ID=357820&NoForm=Form2

Plans involve:

- Shopping complex, 8-storey

- Service apartments, 6 blocks, 31 floors, 432 total units

- Offices, 3 blocks, 31 floors

Parcel 3?

Lot 25177, 25178 & part of 21762

Submitted: 23 Jan 2015

Status: Delayed?

Link: http://www.epbt.gov.my/osc/Borang_info.cfm?ID=358255&NoForm=Form2

Plans involve:

- Service apartments; 3 blocks (18, 23 & 28 floors), 230 total units

- Retail podium, 6 floors

- Service apartments, 3 blocks, 450 total units, 39 floors

- Hotel, 39 floors, 300 + 150 rooms

* * * * * * * * *

“In the meantime, the Company will continue to explore other means of unlocking the value of its sizeable landbank such as joint development and/or sale of land.”

- Dutaland annual report 2015

Link to official blog: www.equitydiary.blogspot.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on equitydiary.blogspot.com

Discussions

Simple tikam one of the glove...u will laughing all the way to bank except if u accidently bought ruberex

2015-12-17 17:12

i4investor

property stock now cannot perform, even u've very good write-up

go buy plastic stock, more amazing move is waiting...

2015-12-17 15:43