Hevea Under Attack - Bursa Dummy

Tan KW

Publish date: Wed, 13 Jan 2016, 10:37 AM

Wednesday, 13 January 2016

http://bursadummy.blogspot.my/2016/01/hevea-under-attack.html

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Good Articles to Share

Created by Tan KW | Jan 14, 2025

Created by Tan KW | Jan 14, 2025

Created by Tan KW | Jan 14, 2025

Created by Tan KW | Jan 14, 2025

Discussions

is my answer. Why counters like Xinquan, China stocks and other counters under attack nobody create so many blogs to highlight it like Hevea?

2016-01-13 10:55

Like China stocks Hevea also has high EPS. Problems is why dividend so little only 2.5 sen? Yet people chase it so high.

2016-01-13 11:04

we have heard from both side now...its up to investors, traders,market to react/decide...

2016-01-13 11:22

Hevea used most of the cash to repay its debt first. Once debt is cleared, they will increase dividend slowly. I think they mentioned before.

2016-01-13 11:24

Who care your high debts? Dividend is what shareholders should care. You ask China counters investors or other high debts counters.

2016-01-13 11:29

Because their debt is US denominated. Hence, it will be wiser to repay the debt first before USD further strengthen.

2016-01-13 11:31

As an investor, I actually hoped that management don't give dividend at all but use all their free cash to settle their debt first.

2016-01-13 11:35

Actually strong USD is neutral to Hevea due to their debt. However, they manage to increase their profit. Imaging once their debt is cleared, how would their next QR will be. Eps and dividend!!

2016-01-13 11:38

as there are another 3 interest hike in 2016 this year, the USD will expect to strengthen further, settle debt earlier is the more effective use of Cash, imagine Bank going to increase 3 time the interest soon, will you not wish to settle your housing ( or pay more than the regular installment)so as the outstanding loan will be reduced and hence reduce the bearing interest also .

2016-01-13 13:52

It is a good stock to invest in as local economy is very weak due to the GST and the weak Ringgit. So concentrate in company that export. Ringgit will continue to weaken or stay where it is.

2016-01-13 16:46

To begin with... Hevea should make a public announcement... And not selectively talking to cimb only... The selective disclosure doesnt seem right to me.

2016-01-13 17:21

I do not see anything wrong with that as basically there is no hidden information from the public. Firstly, the court case has been set aside in favour of the defendant. Moreover, it is a court case involving the shareholder and not the company so there is no material impact on the company. Company does not need to disclose court cases against another shareholder.

And, the person who alleged the 700 containers claim has since went into hiding. It is a misinformation and laughable story. The intention is obvious i. e to bring down the price and buy up.

Any public company can use their bankers to iron out this issue and make the announcement. They have not infringed the Bursa rulings in anyway. Well, caveat emptor, so make the decision if one would like to invest in the stock.

2016-01-13 17:51

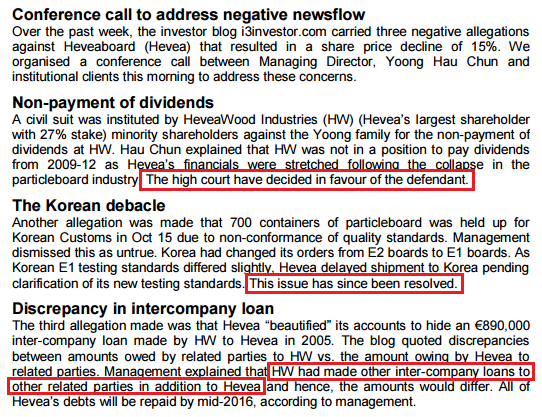

Official Statement by HeveaBoard Berhad

This announcement is made in relation to the article published in TheEdge Financial Daily on 13 January

2016) titled “HeveaBoard rebounds as allegations against it dismissed” in relation to certain articles

posted by certain parties on an online stock investor portal known as I3investor recently:

(a) “HEVEA, Internal Cracks Emerging” dated 6 January 2016;

(b) “HEVEA: 700 Containers Stranded in Korean Port” dated 7 January 2016; and

(c) “HEVEA” Ingenuity Accounting (Bomb No.1) dated 10 January 2016.

The contents made in those articles are untrue, defamatory and malicious in nature.

The Company states the following:

1. It is business as usual at the Company and its subsidiaries (collectively, the “Group”).

2. Business operations of the Group have not been interrupted as a result of the allegations

contained in the abovementioned articles.

3. The civil suit (“Suit”) filed in the High Court of Malaya in Seremban (“Seremban High Court”)

in September 2014 is a suit brought under Section 181 of the Companies Act 1965 by the

minority shareholders of HeveaWood Industries Sdn Bhd (“HeveaWood”) against the majority

shareholders of HeveaWood (i.e. Yong Kian Seng @ Yoong Tein Seng, Yoong Hau Chun, Tenson

Holdings Sdn Bhd, Firama Holdings Sdn Bhd and HeveaWood Industries Sdn Bhd). The minority

shareholders alleged that they have been oppressed by the majority shareholders, and non

payment of dividends by HeveaWood was one of the allegations made. On a separate note, the

Company had not paid any dividends during the financial years ended 2009 to 2012 due to its

financial position during that period of time.

HeveaWood should not be confused with the Company. HeveaWood is a substantial

shareholder of the Company and is a private limited company.

This Suit had been decided by the Seremban High Court in favour of the majority shareholders.

The minority shareholders have subsequently filed an appeal against the decision of the

Seremban High Court.

As the Suit does not involve the Company and is at the shareholders’ level, it is a private matter

and there is no legal requirement for the Company to make any announcements to Bursa

Malaysia Securities Berhad on the same. The Suit has no bearing on the governance of the Company.

4. As for the allegation of 700 containers of the Company being stranded in a port in South Korea

in October 2015 due to non-conformance of quality standards, the Company reiterates that this

is untrue. The South Korean authority had changed its standard of panel products from E2

boards to E1. As South Korean E1 testing standards differed slightly, the Company had decided

to delay its shipment to South Korea pending clarification on new testing standards applicable

to its products. As of to-date, this matter has been resolved.

5. In respect of the allegation of ingenuity accounting in that there were discrepancies between

the amounts owed by related parties to HeveaWood and the amounts owed by the Company

to related parties, the Company understands that in addition to the amount owing by the

Company to HeveaWood, there are other amounts due from other related parties to

HeveaWood. Hence, the alleged discrepancies. The amount owing to HeveaWood by the

Company is intended to be repaid in 2016.

The Company reserves all rights to take legal steps

2016-01-13 18:58

Yes. it is from bursa dummy (http://bursadummy.blogspot.my/2016/01/hevea-under-attack.html)

2016-01-14 09:39

Sometimes, I really don't understand the level of mentality of Malaysian investors. The accussation was posted in the internet, without revealing the real author... whoever this robert chai is... no real and full name... no IC or whatever identification... and you people believe it. No wonder so many scam can be successful in Malaysia.

If you believe what he wrote, then don't buy the counter. Simple as that. But when the counter start to move up, don't kau beh kau bu loh. Nobody pointing a gun at your head to buy. And please, don't try to act so noble as if you don't know the game of the share market. Most of the counters are being goreng before. So what? That is the game of the market.

2016-01-15 07:15

Pakcik... I am not saying anything negative about TanKW. Please re-read what I have posted again. All I am saying is those people who are too damn emotional and like to over re-act, as mentioned by you. Reading through all the respond here and other topic related to Hevea, I find it amusing that people will seriously take that robert fella said. If what he said is true, he can always make a police report or report to the proper authority or even go to the press. Heck, he don't even have the balls to use his full name and identification. Now... if there is something to hide, it will be him hiding. Hahaha!!!

2016-01-15 08:01

Yes ... today the stock will be moving to upside ... i believe you will not be able to see the stock at yesterday price as it held quite nicely despite the global/local market meltdown.

2016-01-15 08:07

Ahbeng11

Well said !!

2016-01-13 10:44