Back in November / December last year, MRCB raised additional funds at 1 for 1 rights at 79 sen per share. My question is why?

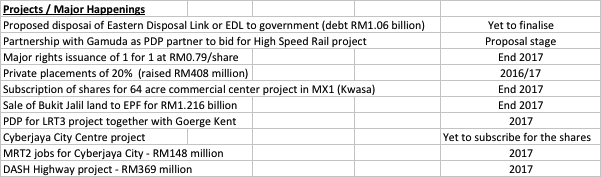

Although felt like not much, MRCB had a major fund raising exercise over a period of 18 months - as mentioned above first a 20% private placement, then rights issue which raised RM2.26 billion, followed by sale of land to EPF for RM1.144 billion and probably another big one in the sale of EDL i.e. Eastern Dispersal Link for another RM1 billion or more. Confused?

I am. But this potentially signifies something really big may come on stream.

I am not one of those who think speculatively, but with a total add-ons of funds of potentially more than RM4 billion, it definitely does makes me turn around and look further.

|

| Cash add-ons of RM3.9 billion (excluding EDL deal with the government) |

- private placements of 20% raising RM408 million - which includes the MD's additional subscription, Bank Rakyat, Tabung Haji.

- sale of 80% of the land which MRCB gotten for refurbishing the Bukit Jalil stadium to EPF. This amounts to RM1.144 billion. Yet to compete, but potentially will be done in near future.

- the biggest one which is rights issue raising RM2.257 billion at 1 for 1. Obviously the MD and EPF took up the shares.

- Sale of Setapak land for RM100 million to Tabung Haji.

- negotiation with government to settle the EDL project in which case the toll collection has been stopped since 1 Jan 2018. One has to note that this is one of the toll highway which is loss making, hence the sale could be a goo thing for MRCB.

- MRT2 projects at Cyberjaya City valued at RM148 million

- Cyberjaya City project which it will invest RM229 million for a controlling stake. See the link with the MRT2 project.

- Big one - Kwasa Damansara which it will subscribe for probably the most premium land (commercial center) there for 70% stake - project called MX1 - costing RM737.88 million.

- project delivery partner for LRT3 with George Kent - the project is a RM9 billion project.

- partnership with Gamuda to bid for High Speed Rail project - which I think the partnership has a fairly good chance of winning considering that Gamuda has experience in the MRT1 and MRT2 while as mentioned MRCB is working on the LRT3 with another partner.

- Get the large scale projects like PDP for HSR, LRT3, MRT3, DASH Highway;

- push for development into larger mixed development like Kwasa and Cyberjaya;

- sale of less strategic land while still be able to keep the construction work. The sale of land at Bukit Jalil and Setapak does not mean they are out of the projects but yet they are construction partner for these projects. I think this is sweet.

Mohd Fahmi Bin Jaes

No big

2018-01-20 16:42