Swift Haulage - FY23 Results In-line

kltrader

Publish date: Mon, 26 Feb 2024, 11:12 AM

Results in-line; maintain HOLD

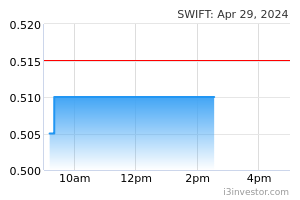

Swift’s FY23 core net profit (CNP) of MYR31.7m came within ours but below consensus estimates, at 94%/82% respectively. We raise FY24E earnings by 5% due to housekeeping, maintain FY25E and introduce FY26E. Our TP is trimmed to MYR0.51 from MYR0.52 based on 7.0x FY24E EV/EBITDA (unchanged), in line with its peers' 5Y mean.

FY23 CNP -30% YoY, dragged by higher overheads

FY23 CNP (ex- MYR32.5m positive one-offs, including MYR25.5m gain on GVL acquisition) fell 30% YoY to MYR31.7m, despite 4% higher revenue. The CNP decline was attributed to lower operating profit margin (higher overheads, including depreciation), ESOS costs, consultation fees, and finance costs. Revenue growth was contributed by the LT (+14% YoY) and W&CD (+21% YoY) segments due to new capacity additions, partially offset by weaker contribution from CH (-3% YoY) and FF (-15% YoY).

4Q23 CNP surged in absence of one-off overheads

QoQ, 3Q23 CNP surged by almost 5x, largely due to the absence of non- recurring costs such as ESOS cost and consultation fees, while revenue grew +3% QoQ. All segments experienced growth in operating profits due to margin expansion except for W&CD (EBIT: -5% QoQ). CH recorded higher rev/TEU thanks to the year-end peak season, while higher LT and FF revenue were primarily due to higher trips or jobs completed.

Cautious outlook but largely reflected in share price

We remain cautious on the group’s outlook. While we anticipate growth in its W&CD segment due to recent capacity expansion, uptake rates may be slow. The group faces pressure from macroeconomic headwinds, posing downward risks to rates and volume handled. However, we believe its depressed share price largely reflects these headwinds.

Source: Maybank Research - 26 Feb 2024

Related Stocks

More articles on KL Trader Investment Research Articles

Created by kltrader | Dec 17, 2024