Eddie Ng Related Party Transactions

revenueng

Publish date: Sun, 05 Feb 2023, 06:51 PM

https://revenueinsider.wordpress.com/2023/02/04/eddie-ng-related-party-transactions/

Please be patient to read until finish as this is slightly longer as we will be including the evidence, chronological of event and also naming the other directors of the company who is abetting Eddie Ng.

In this sharing, we’re going to expose the related party transactions of Eddie Ng, and how the rest of the entire board of directors of Revenue Group Berhad are also controlled by him and aiding him.

Background

It first started back in 2020 when Eddie told the whole world the company is embarking on a journey to develop an e-wallet called WannaPay.

It was then met by huge resistance by majority of the company working level, stating that there is already way too many e-wallets in the already crowded the market and certainly it doesn’t need another one.

But no, Eddie refused to listen and insisted to push on despite most departments are not supportive of it and claims that there isn’t enough resources and it should be optimized and focus to grow the existing credit card machine business which is picking up rapidly.

So, Eddie since claimed that the company has not enough resources internally, then they will outsource some work to 3rd party companies as this is a normal practice in the company as there are indeed external contractors that does a lot of IT work for Revenue Group according to the employees who shared the evidence with us.

But however, what is glaringly alarming is that the people on the receiving side is Eddie Ng himself, Connie Yong his wife and also the current HR Director of Revenue Group, his daughter Felicia Ng, his son Cliff Ng, and also another board member Lai Wei Keat all through proxy companies.

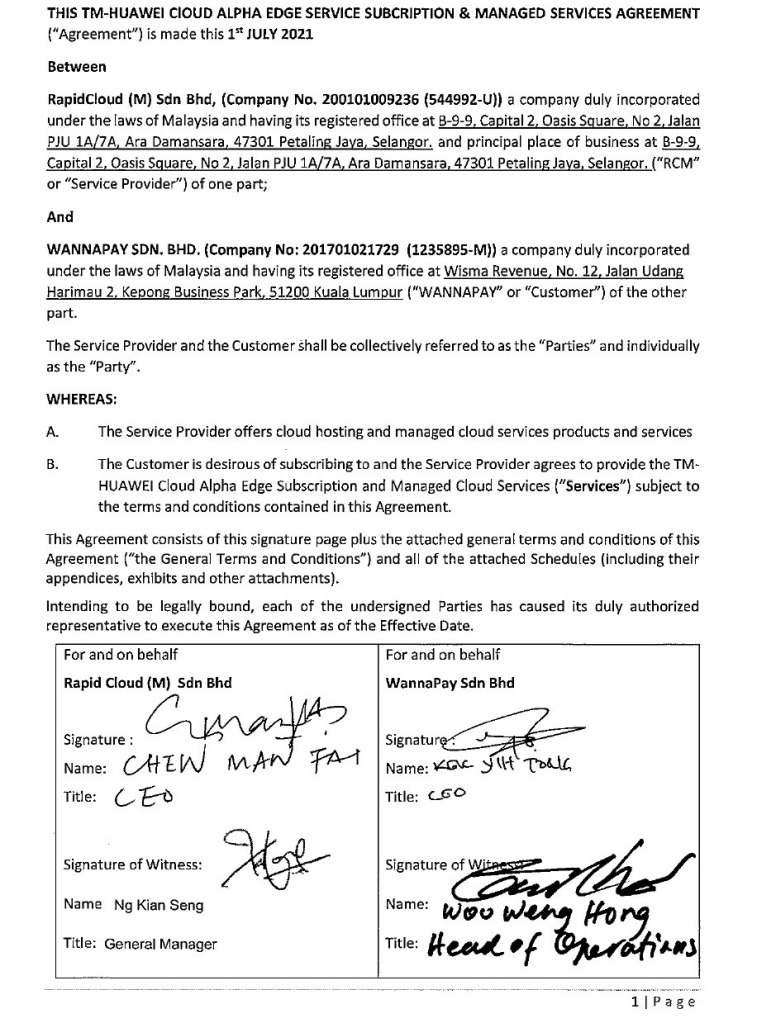

Best of all, one of the signatories between WannaPay Sdn Bhd which is a fully owned subsidiary of Revenue Group, is signed by Kevin Woo Wen Hong who is currently the brother-in-law of Eddie Ng.

Talk about all in the family.

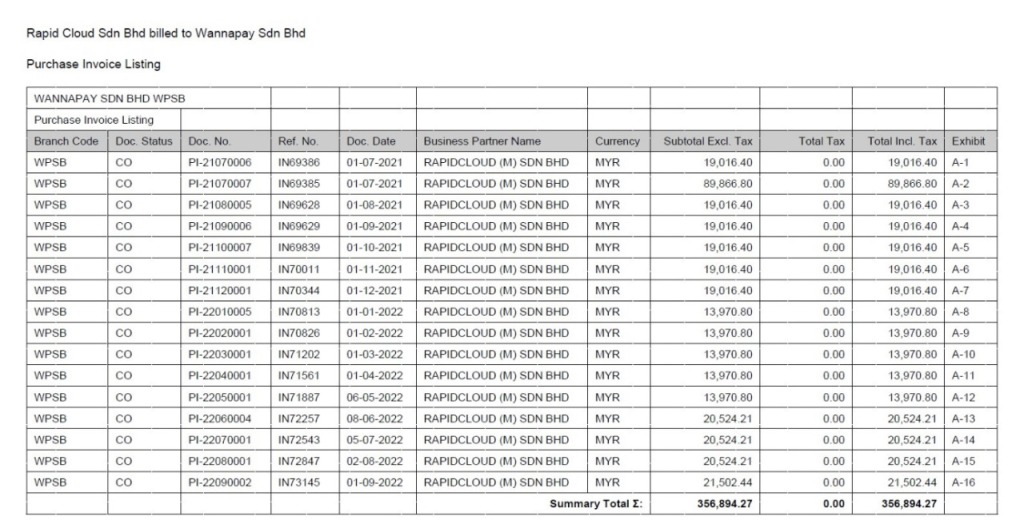

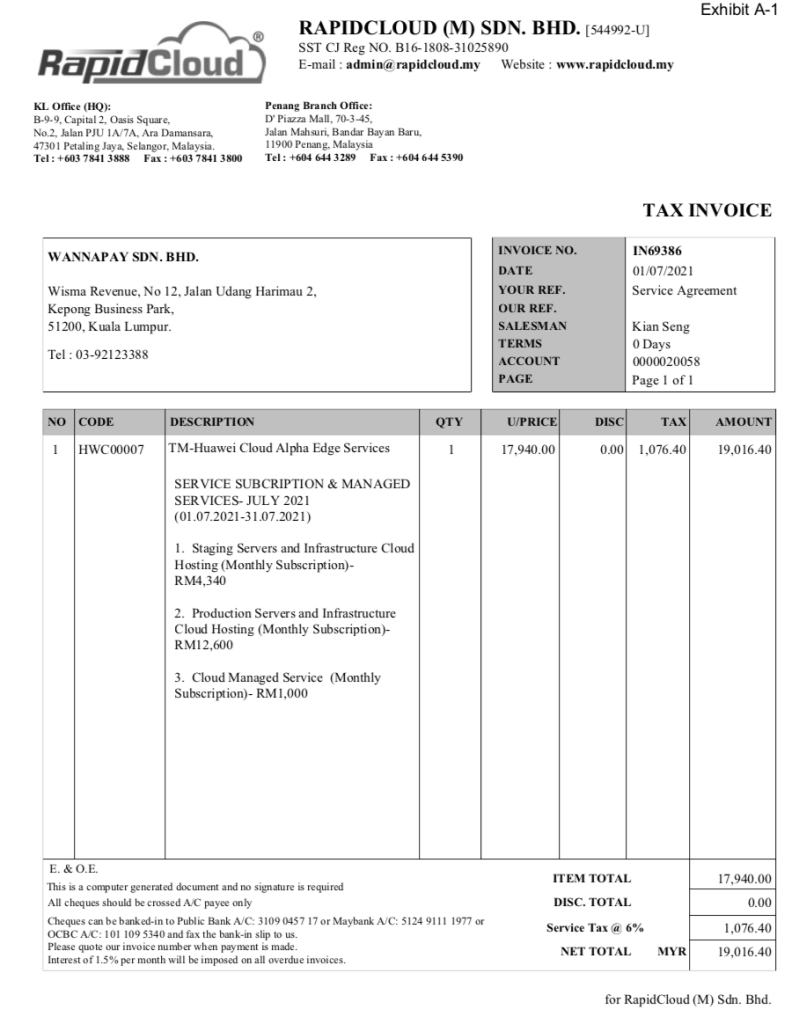

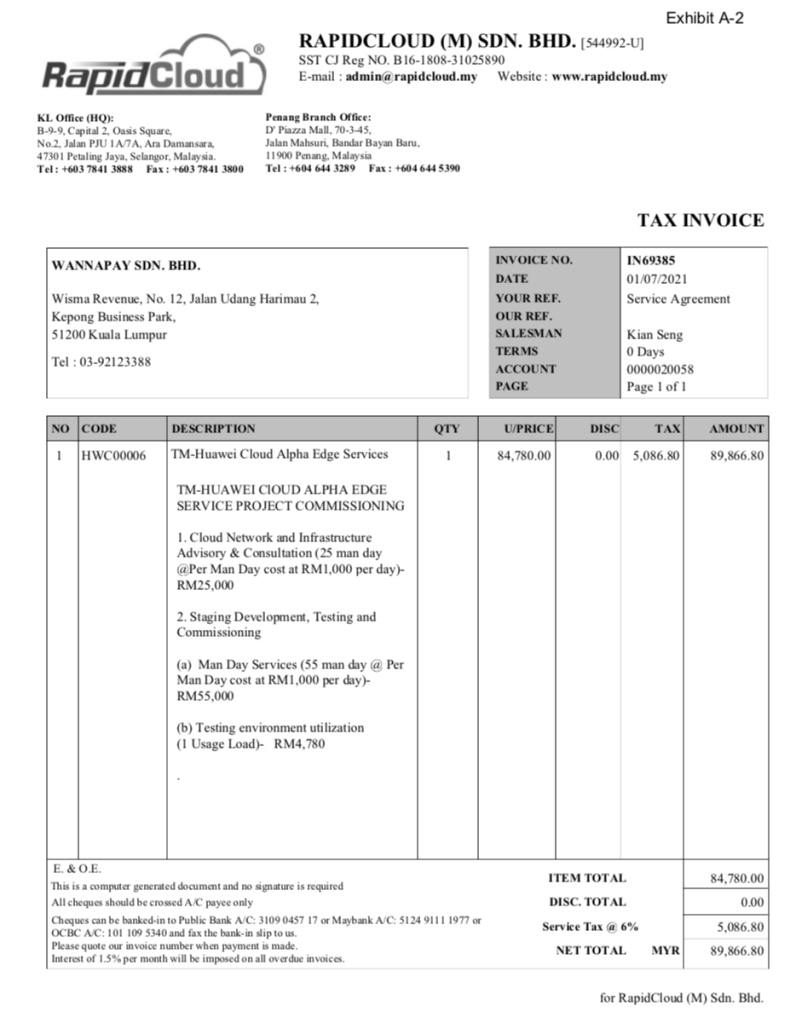

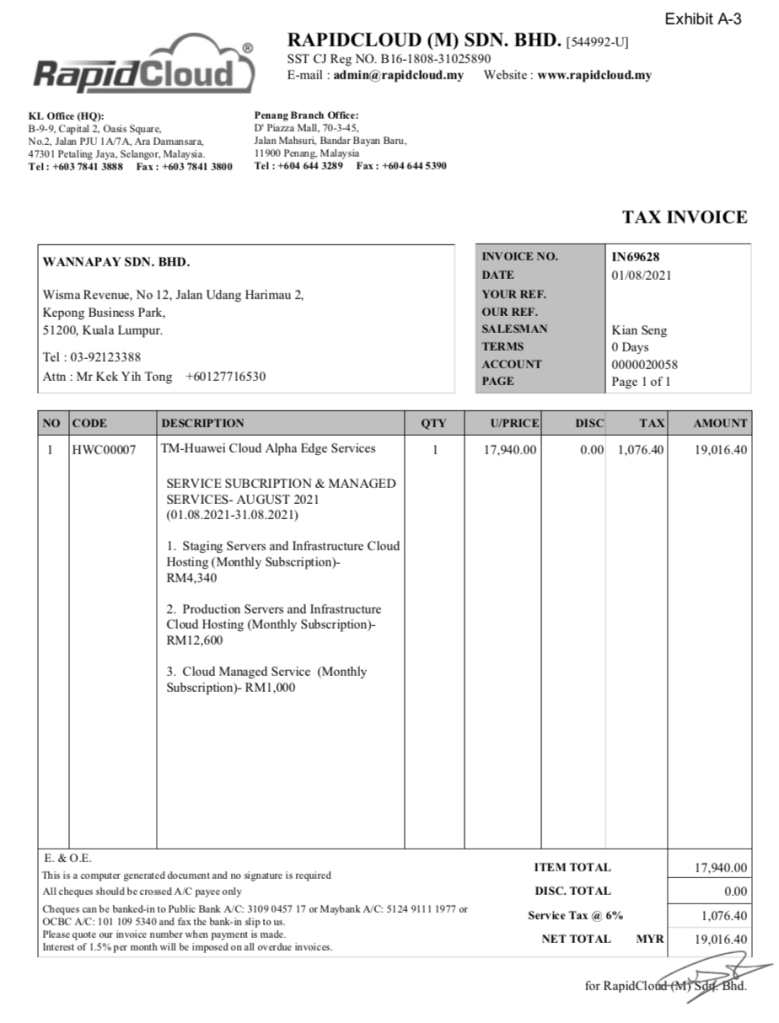

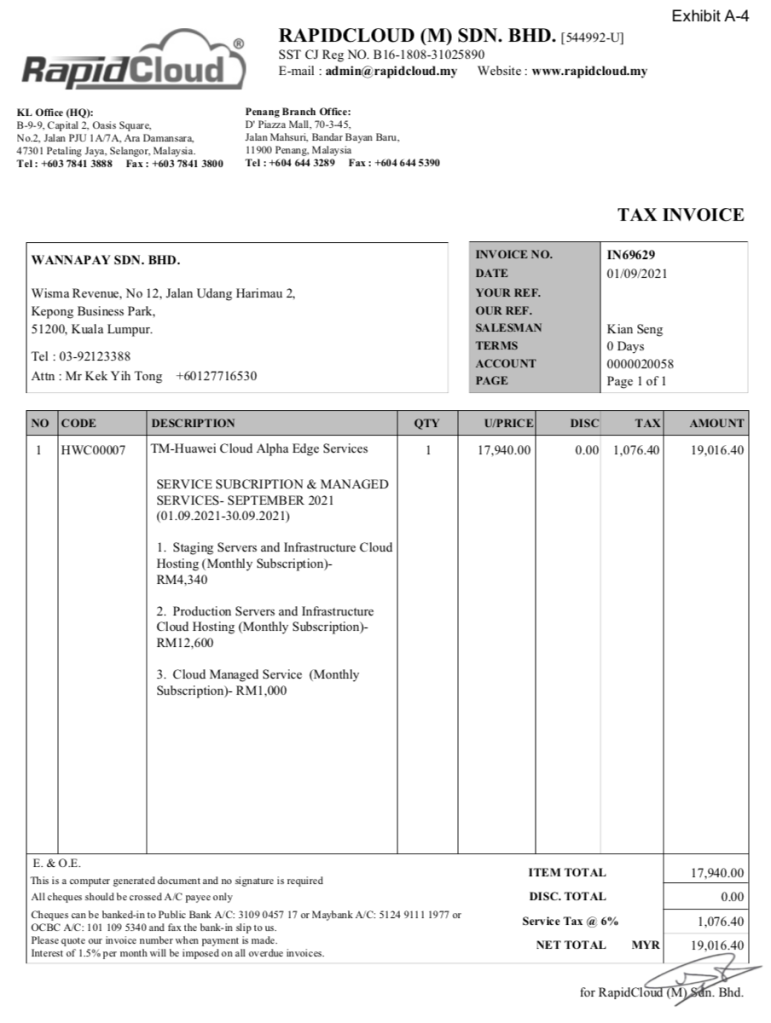

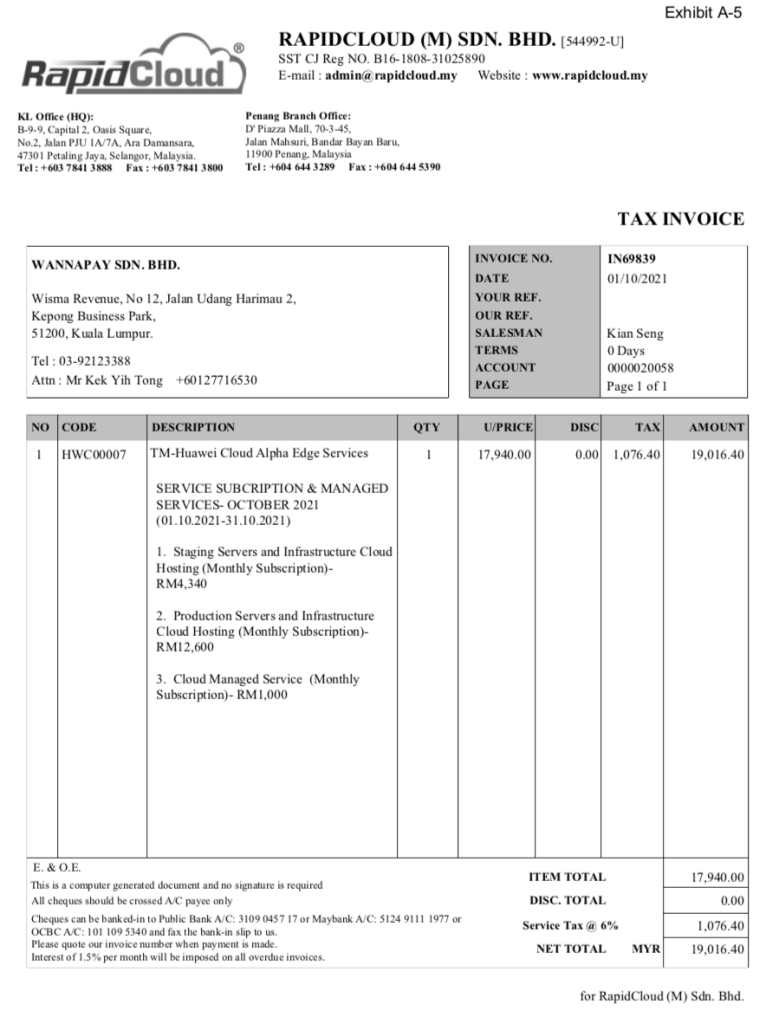

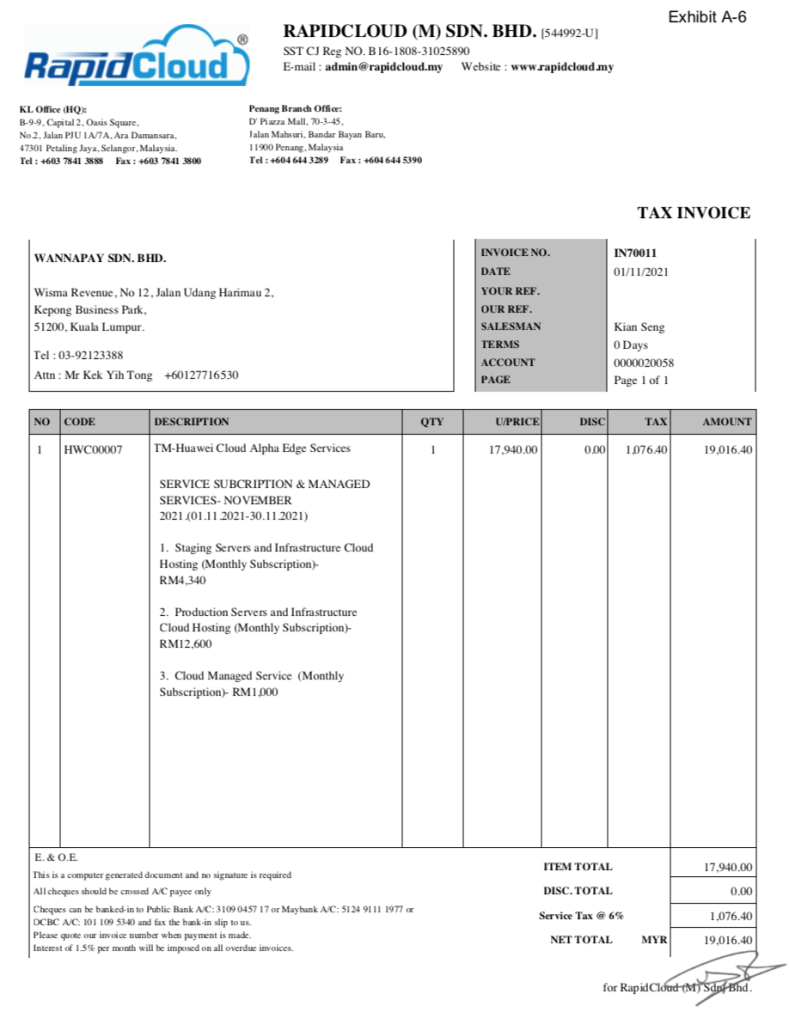

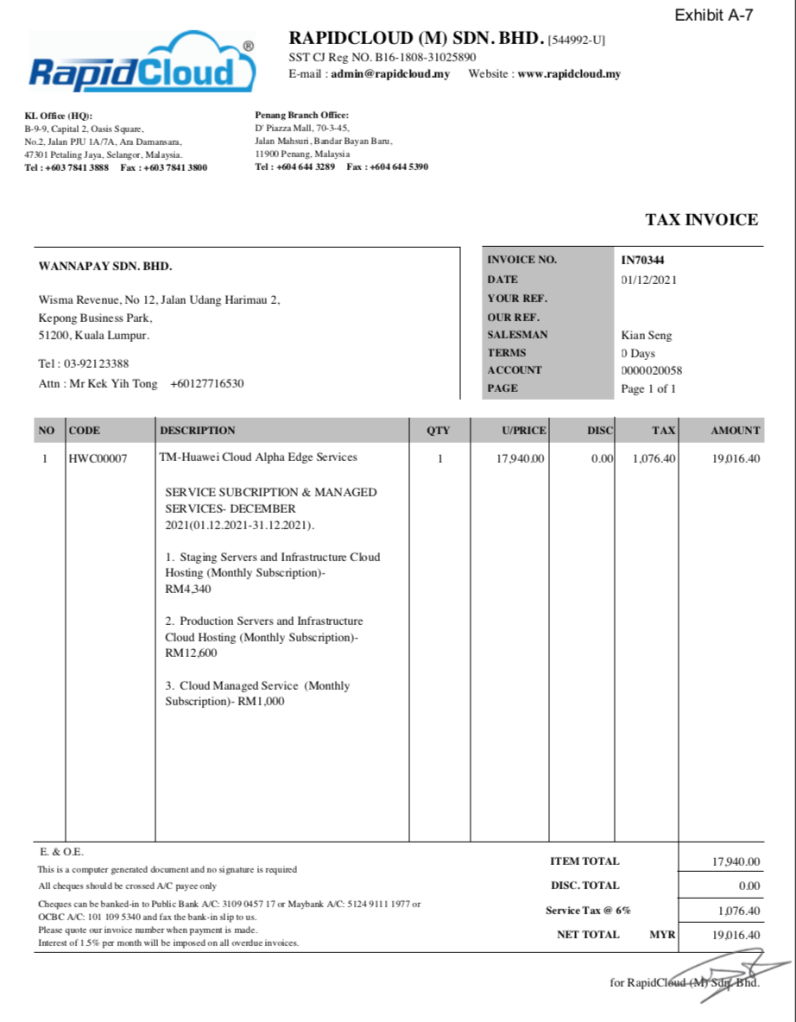

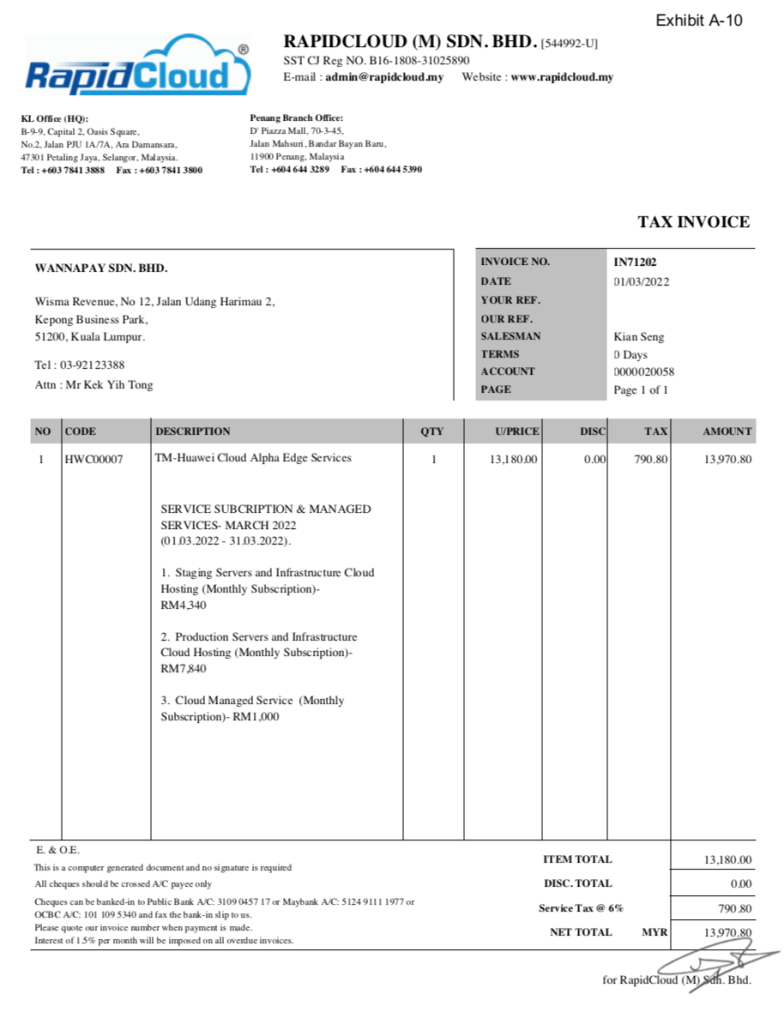

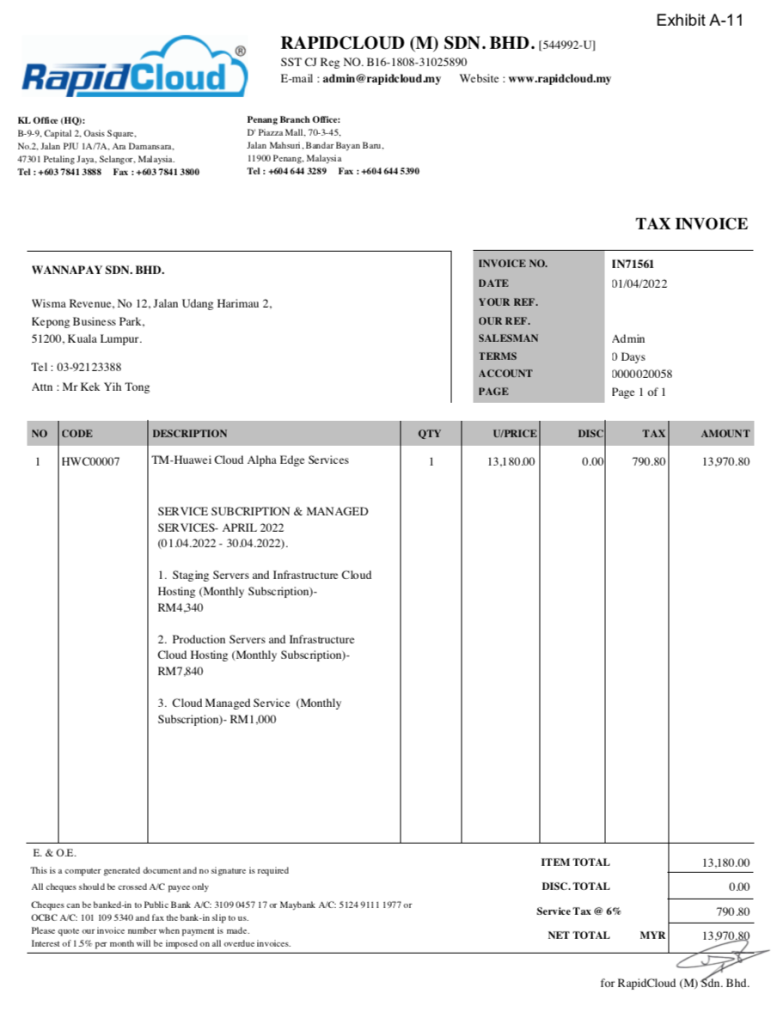

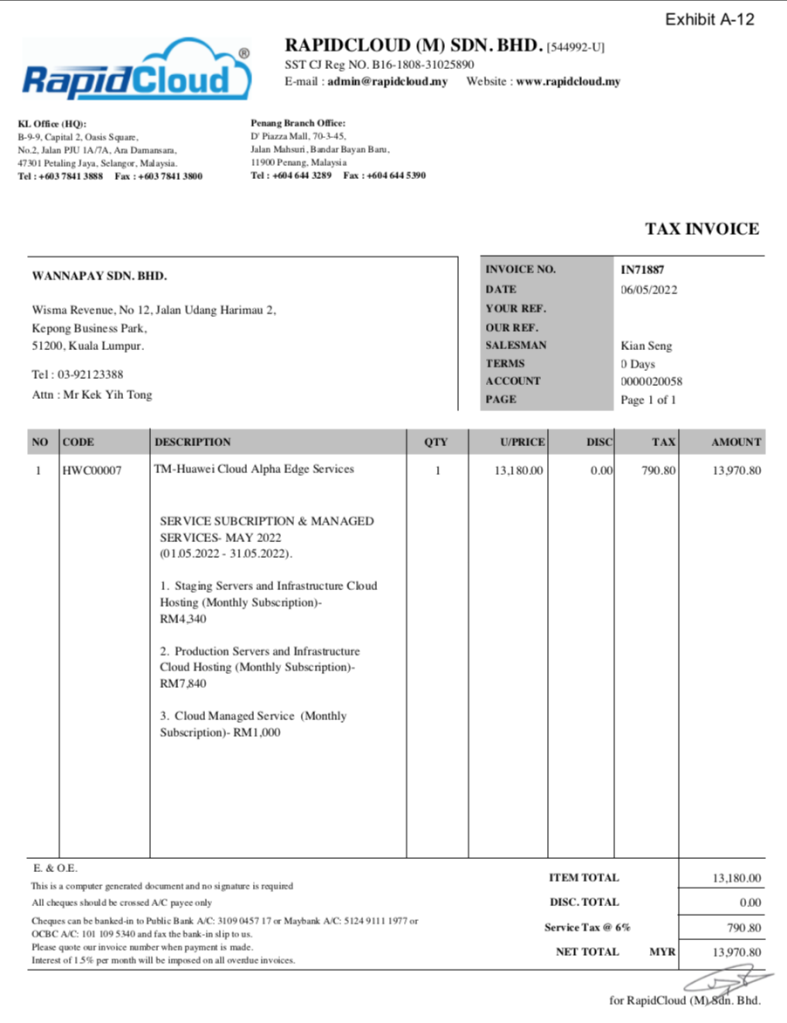

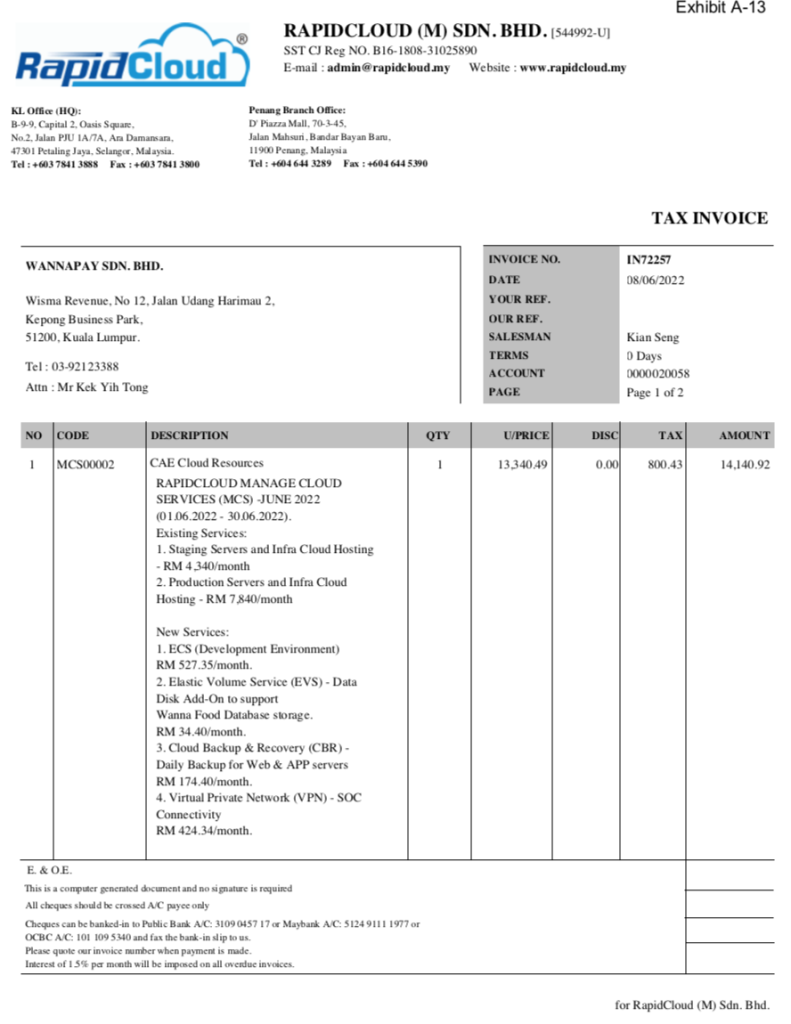

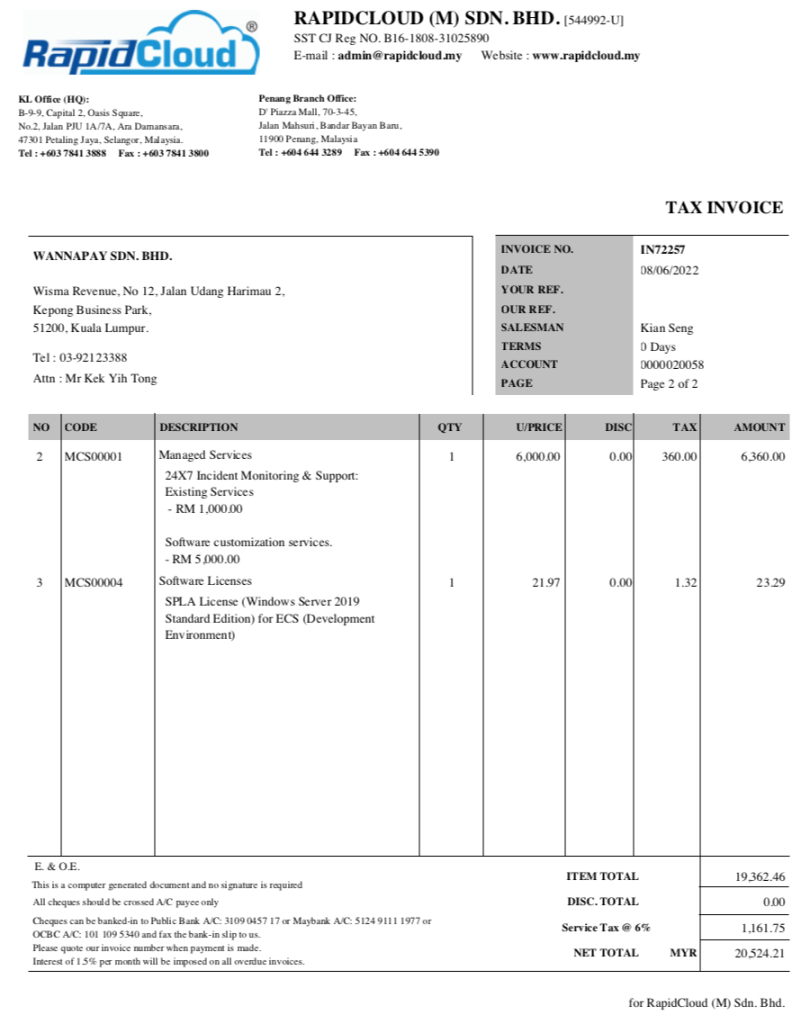

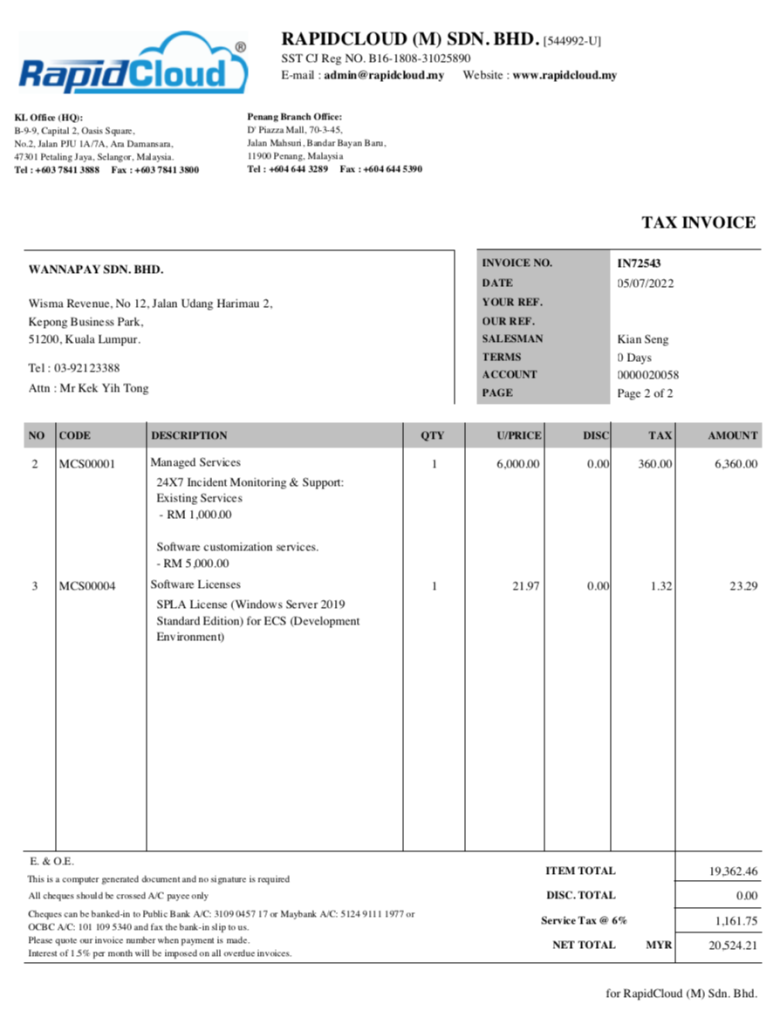

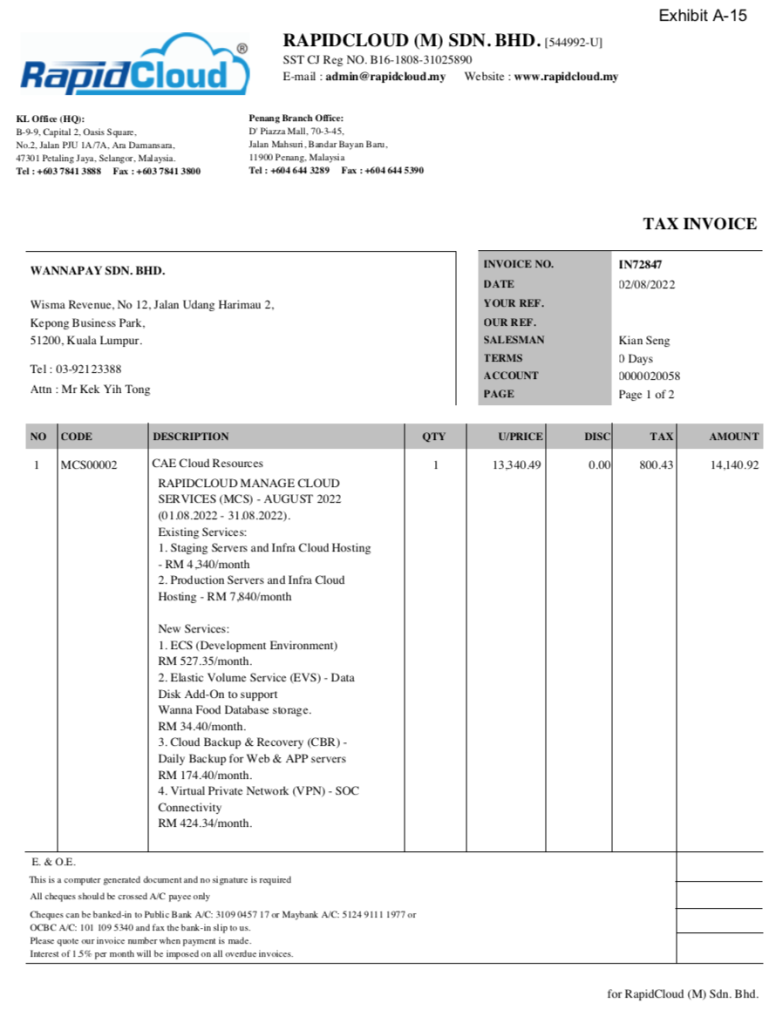

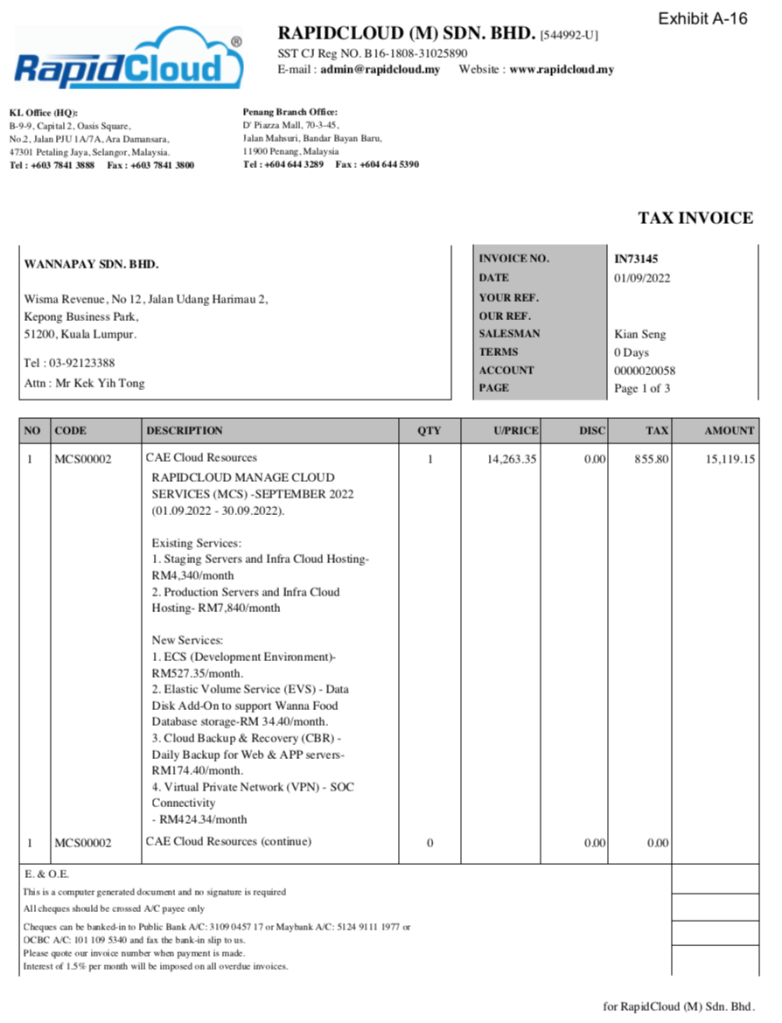

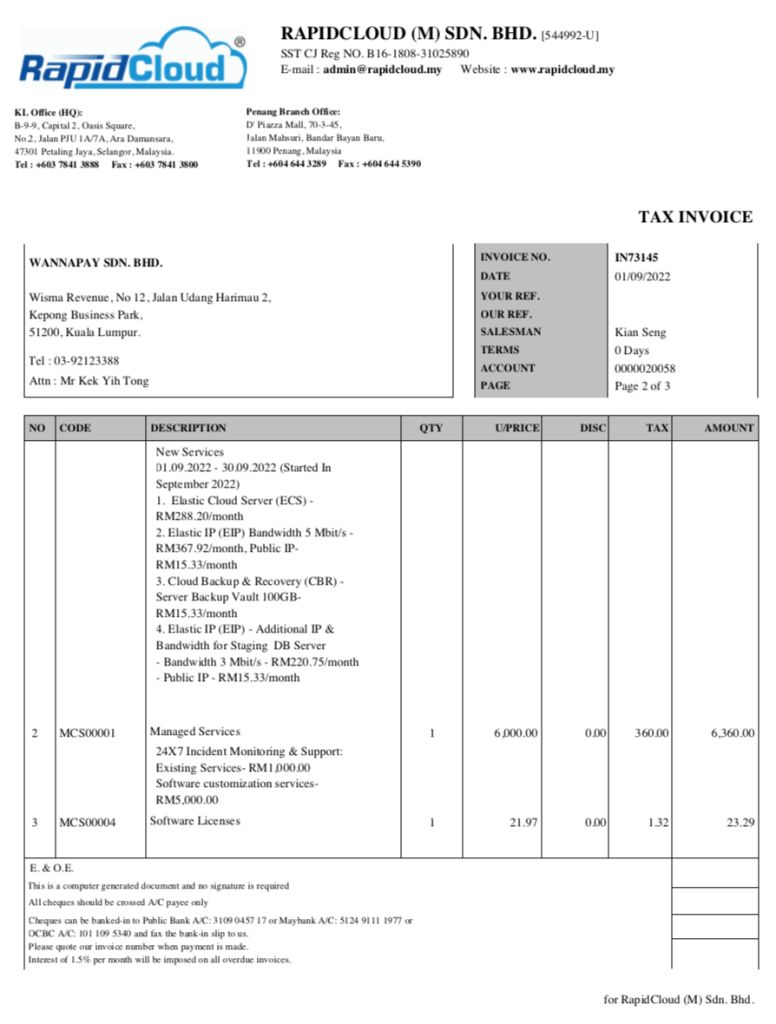

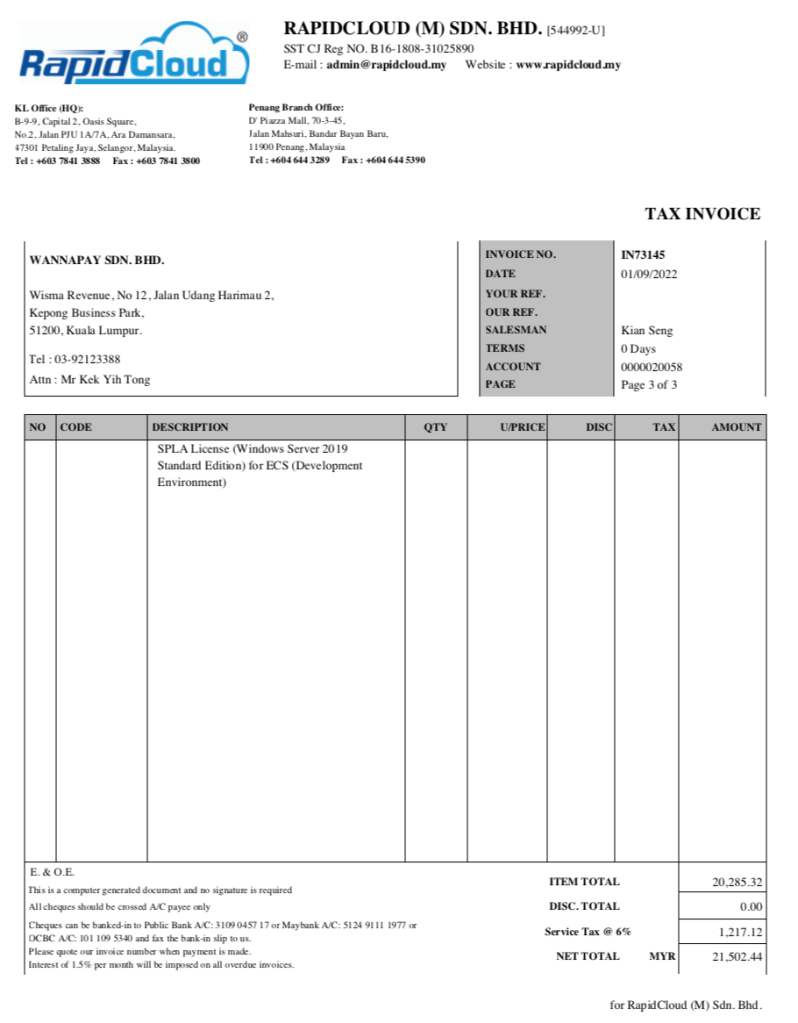

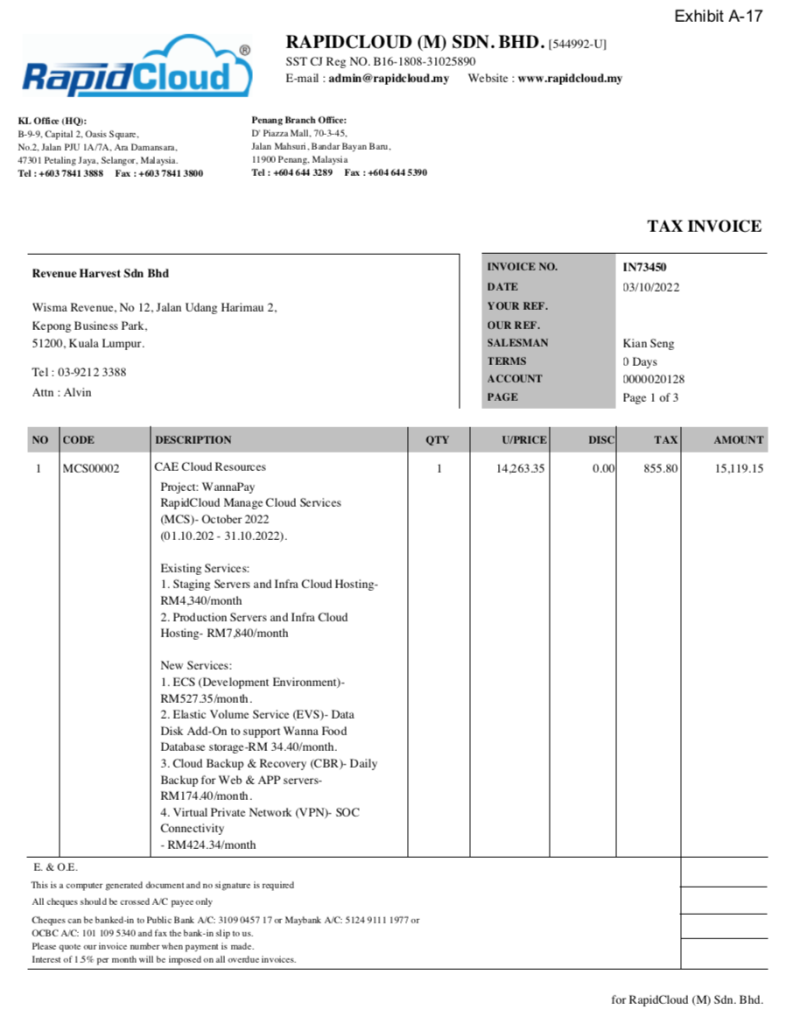

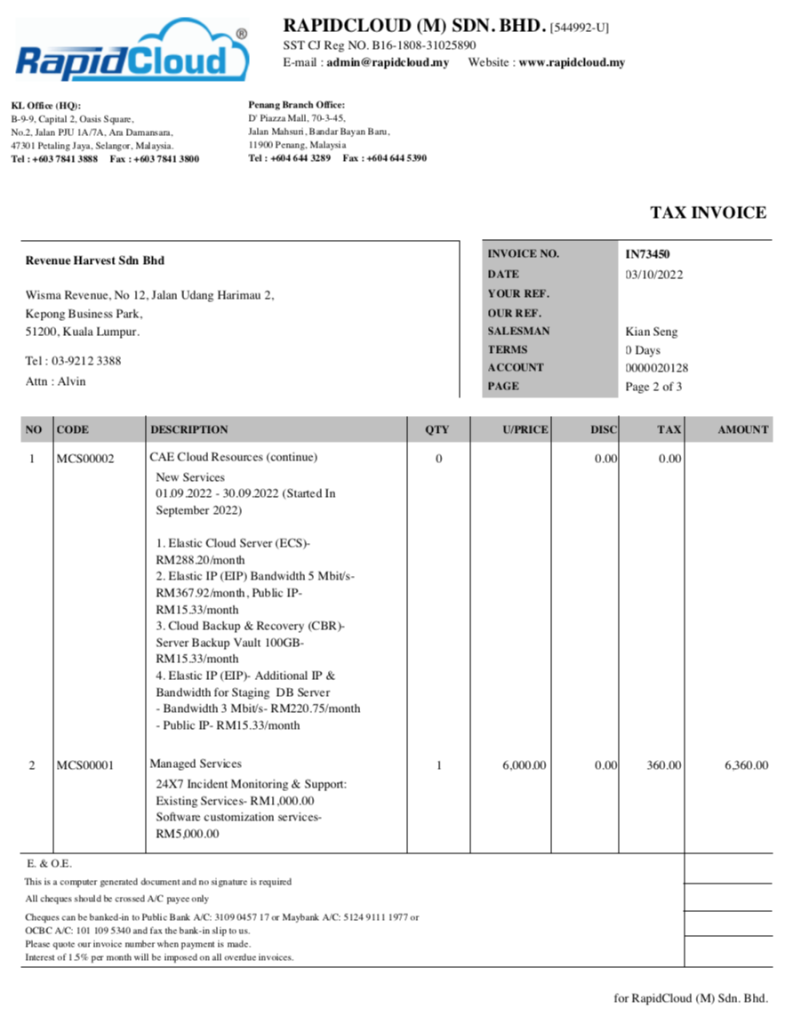

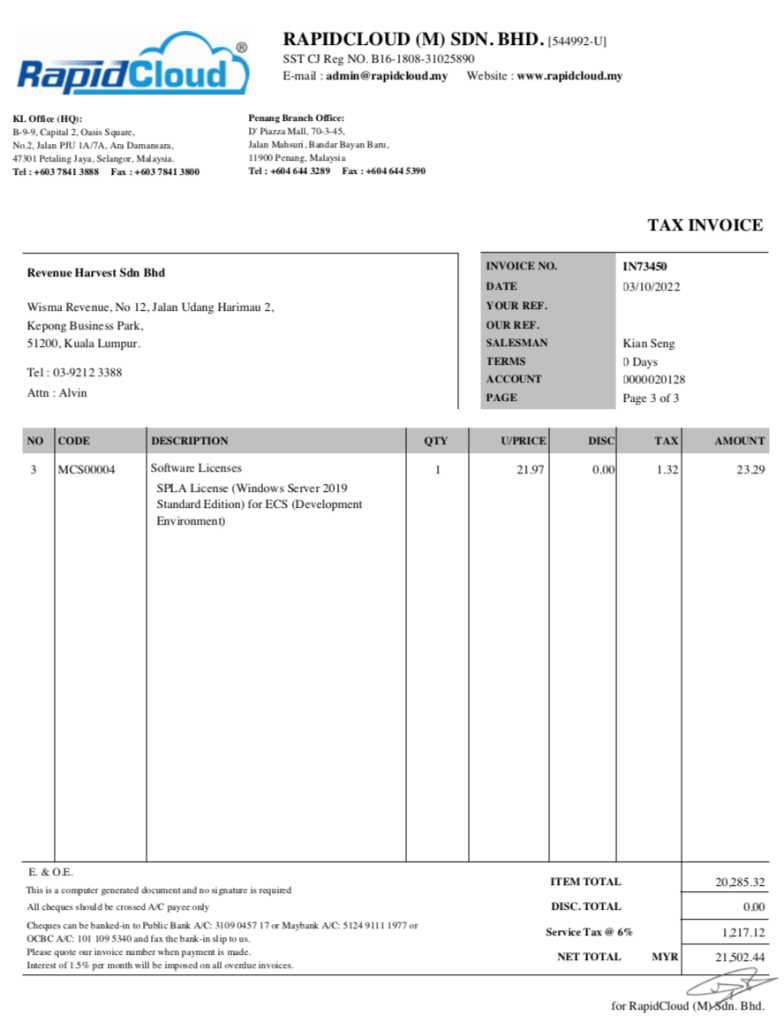

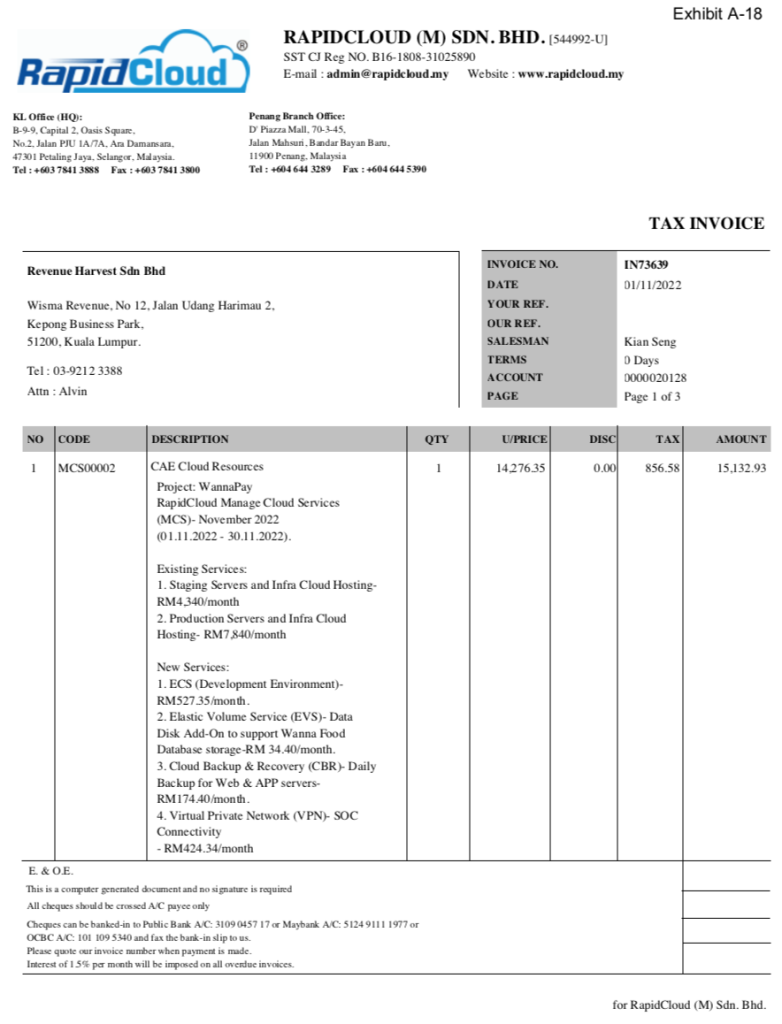

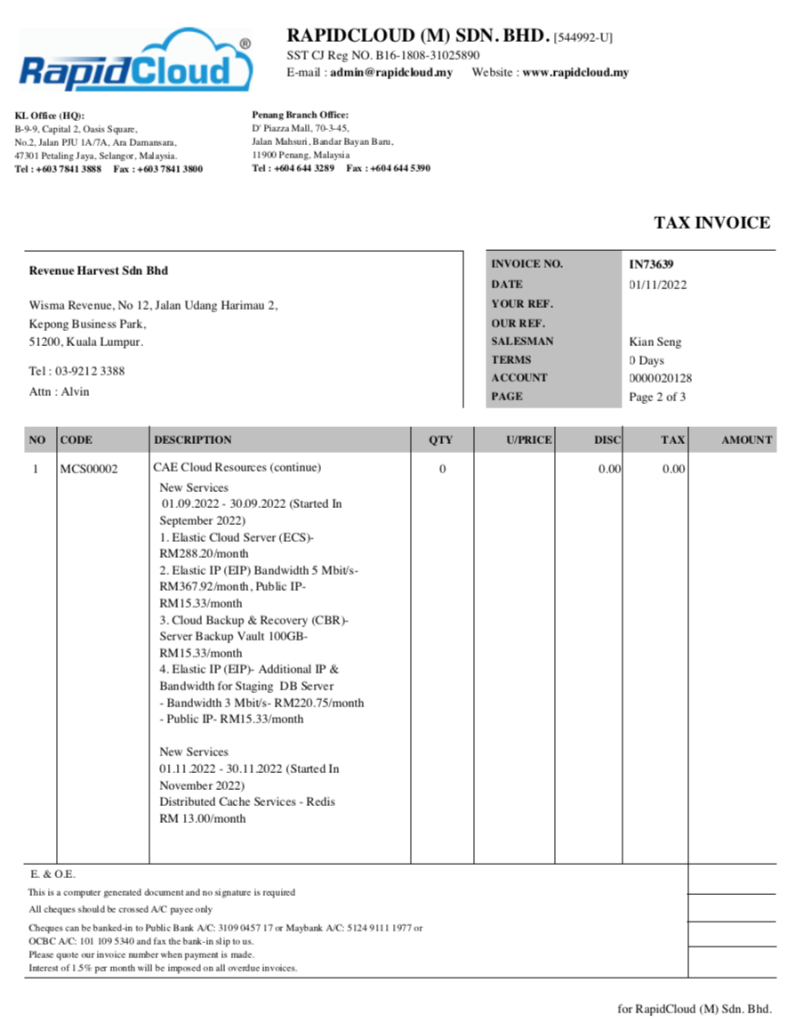

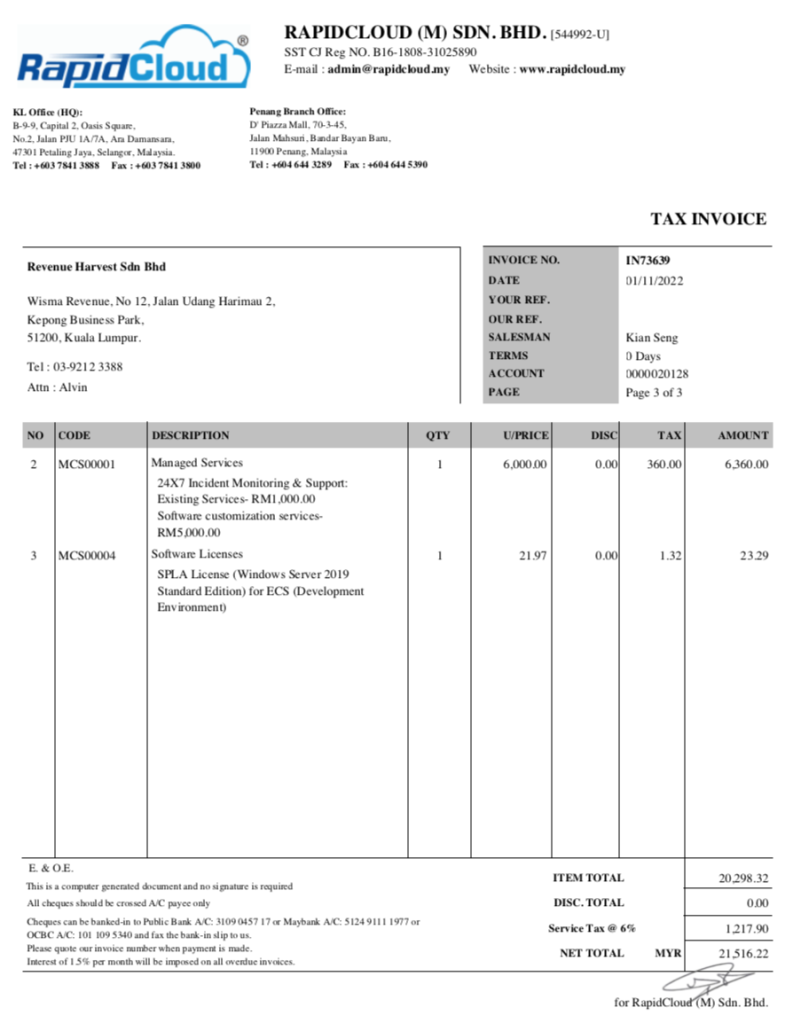

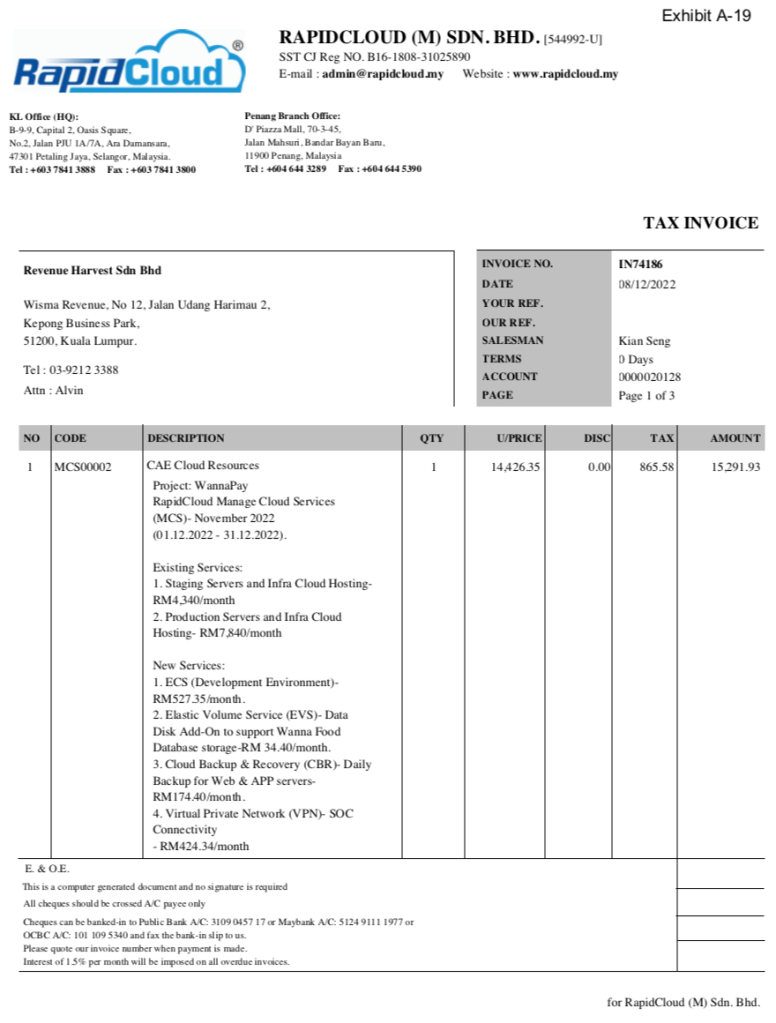

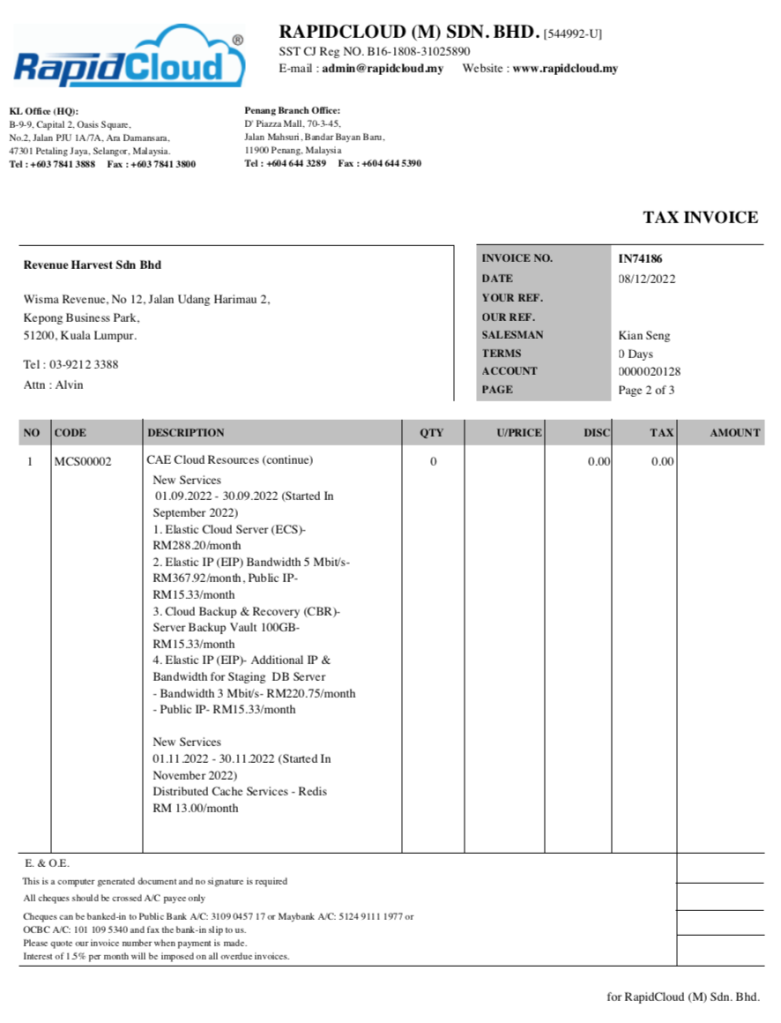

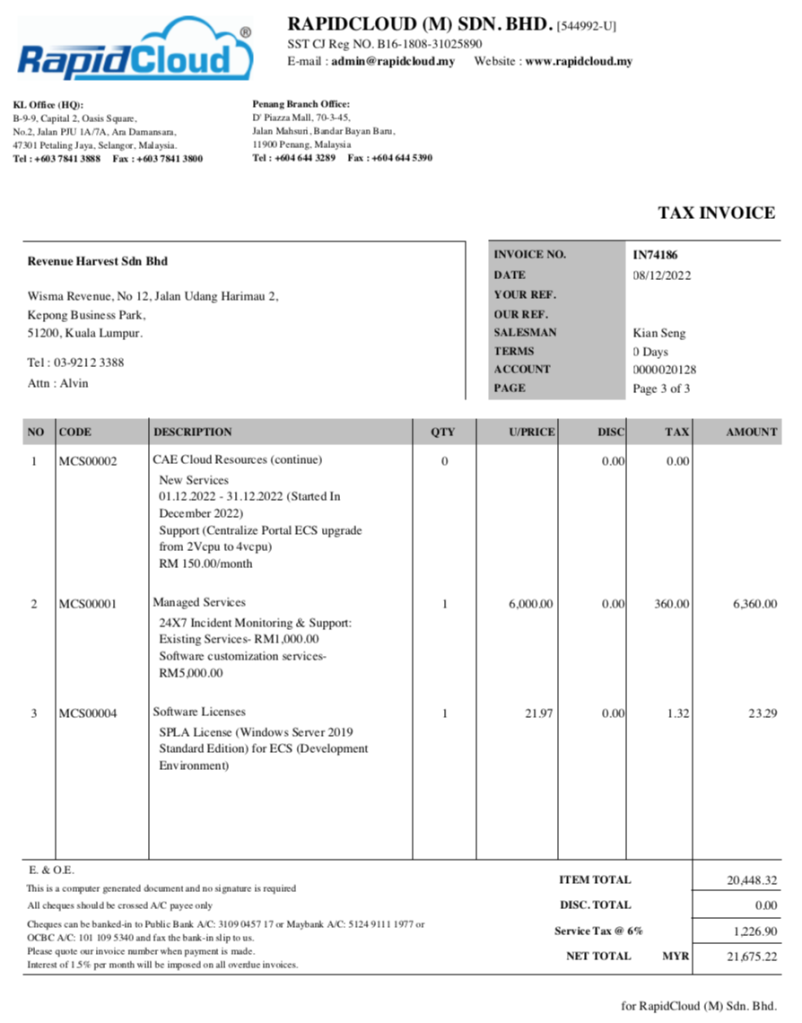

Since July 2021 until present, there is a total of over RM 420K paid to a company called Rapidcloud (M) Sdn Bhd.

A closer look at this company Rapidcloud, reveals that Eddie Ng himself, and another member of board of director of Revenue Group Bhd, Lai Wei Keat are the directors of this company whom the RM 420K was paid to!

Rapidcloud is 100% owned by a company called Work At Cloud Sdn Bhd, SSM search & Experian Search shows that the shareholders of Work At Cloud are Worldory Sdn Bhd, Pama Solutions Sdn Bhd & Exceez Technologies Sdn Bhd.

Worldory is owned by Eddie, his wife Connie, his daughter Felicia and his son Clifford. Wow, whole family inside. Pama Solutions is owned by Wei Keat & another person called Kuon Huei Nei whom many assume is his wife.

Eddie Ng & Lai Wei Keat

For easy reference, the related company name with company registration number as follows:

Rapidcloud (M) Sdn Bhd – 200101009236 (544992-U)

Work At Cloud Sdn Bhd – 201901027075 (1336402-A)

Worldory Sdn Bhd – 201901013041 (1322369-P)

Pama Solutions Sdn Bhd – 201901034006 (1343336-M)

Breach of Trust, Fiduciary Negligence & Major Conflict of Interest

Is the entire board of directors of Revenue Group Bhd aware of this? Did Eddie Ng and Lai Wei Keat declared their interest prior?

If the board approves this, then it means everyone sitting on the board including Brian & Dino is abetting Eddie to take money out from the company. If so, Brian & Dino should also be out from the company.

But according to the employees who gave us this information, they said Brian & Dino is completely unaware of it because when they first discovered it and shared it with Brian & Dino, they were completely shocked about it and immediately asked the employees to quickly investigate further but before any actions could be taken, Eddie has already suspended them.

Which is why the employees decided to gave us this information to be made known to the public as they are unable to reach Brian & Dino after they were arrested by MACC.

And if the board is not aware of this, then it means that Eddie & Wei Keat has deliberately set out to take money from the company, breaking their responsibilities and fiduciary duties as directors of a public listed company.

So again who is the bad guy now?

RESIGNATION OF 2 CFO

This is where the story of the 2 CFO resigning comes into light.

According to the information given to us by the employees and ex-employees, the first resigned CFO Ng Kuan Horng who has been with the company since the IPO decided that he could not continue anymore in assisting Eddie to do all the paper shuffling to help him siphon money out from the company so he decided to resign.

Does this mean that while he resigned, but he is also as guilty?

Then came the second CFO Adron Leow Weng Kiat, whose career is very short-lived. According to sources, after looking into the accounts and seeing what Eddie was doing, he refused to continue and hence he chose to resign as well.

Having 2 CFO resigning can never be good for company. The 2 brothers Brian Ng & Dino Ng were then alerted and they started digging, which then led to the discovery of Eddie Ng’s wrongdoing and subsequently the fight broke out and escalated to what it is today.

The following are all the evidence provided by the employees and ex-employees of Revenue on their finding regarding the related party transaction done by Eddie, his family members including his brother-in-law name Kevin Woo Weng Hong, and also Wei Keat.

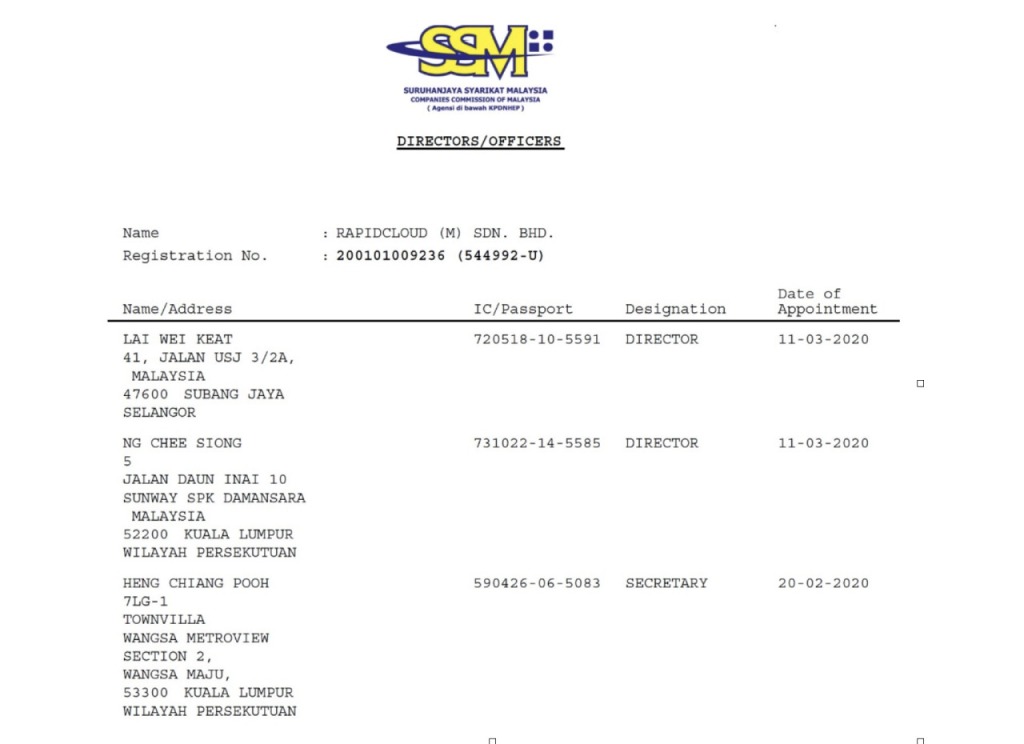

SSM Search of Rapidcloud (M) Sdn Bhd, showing Eddie Ng & Lai Wei Keat as the directors since 2020

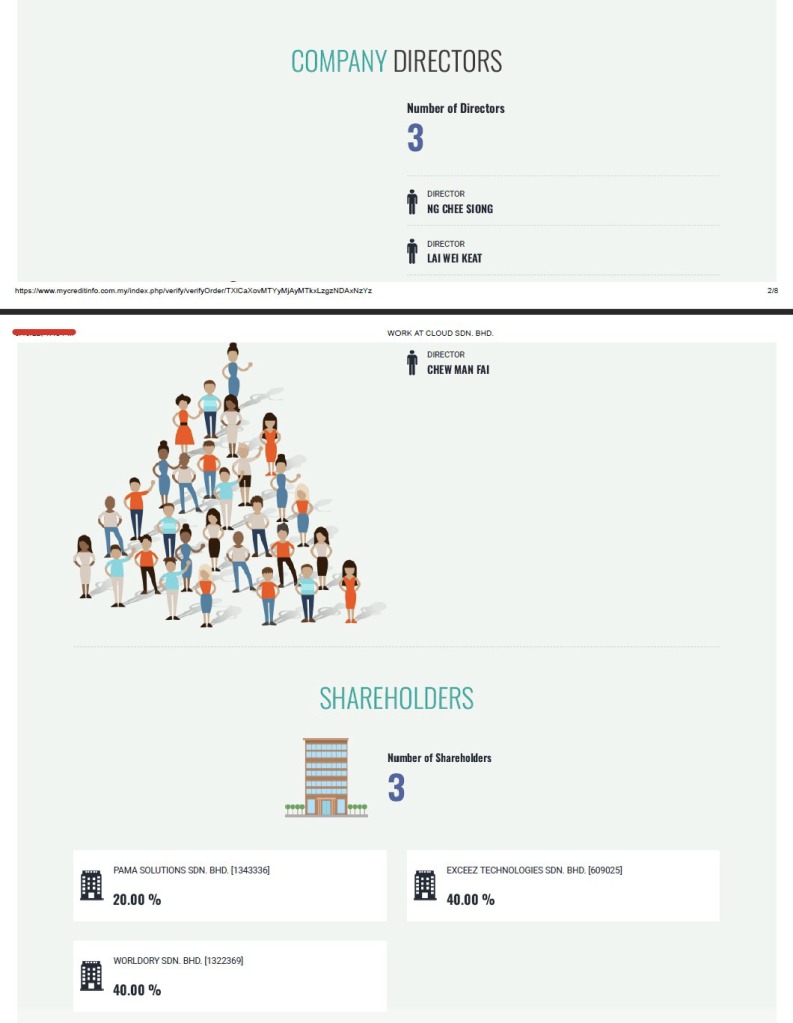

Experian Report of Work At Cloud Sdn Bhd, showing Worldory Sdn Bhd owned by Eddie and his family, and Pama Solutions owned by Wei Keat are shareholders

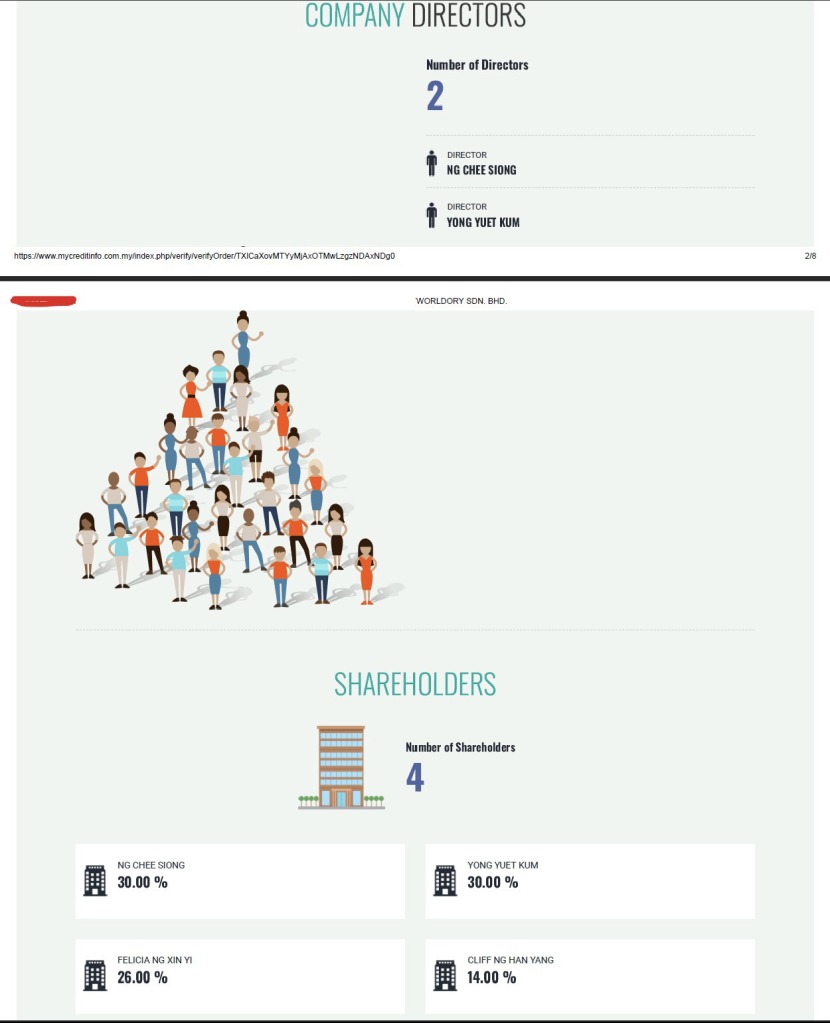

Experian report of Worldory Sdn Bhd, showing Eddie himself, is wife Connie Yong, his dauther Felicia and son Cliff as shareholders. Worldory is a shareholder of Work At Cloud, who owns 100% of Rapidcloud which received the RM 420K from Revenue Group with Eddie’s brother-in-law Kevin Woo as one of the signatories

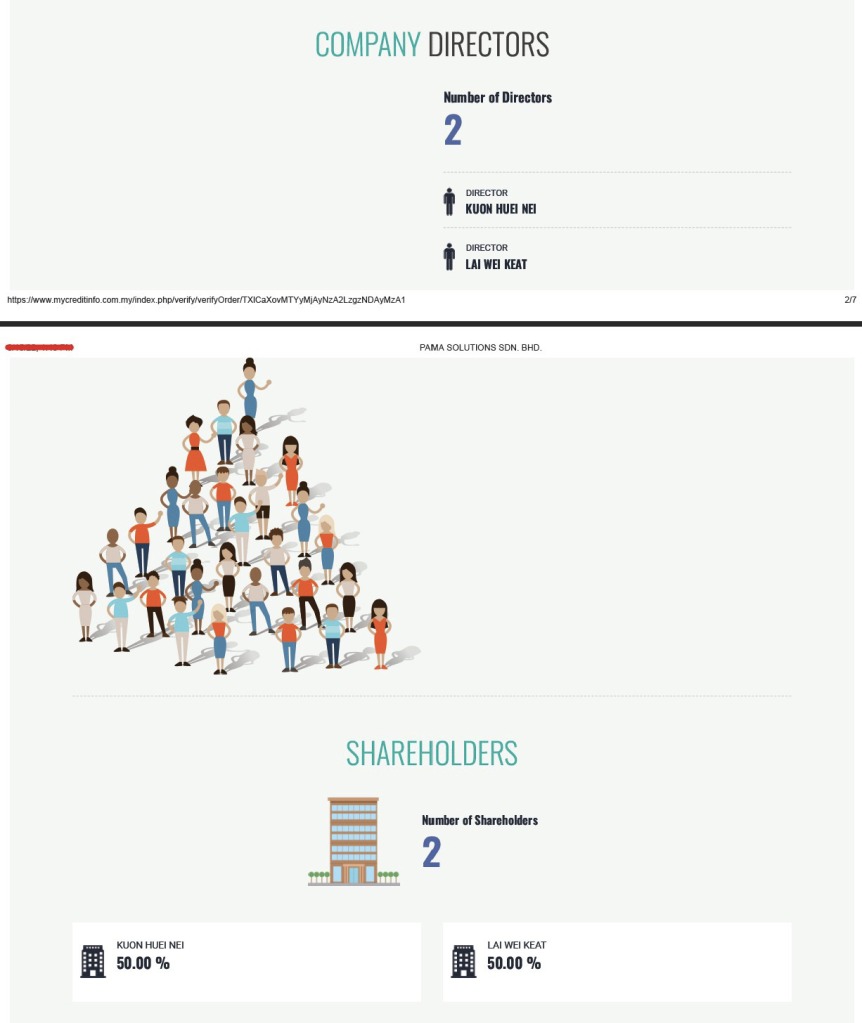

Experian report of Pama Solutions Sdn Bhd, showing Lai Wei Keat and presumely his wife as the shareholdes. Pama Solutions is a shareholder of Work At Cloud, who owns 100% of Rapidcloud which received the RM 420K from Revenue Group with Eddie’s brother-in-law Kevin Woo as one of the signatories.

Woo Weng Hong, or known as Kevin Woo is the brother-in-law of Eddie Ng

Ng Kian Seng, the ex-CTO for Revenue Harvest Sdn Bhd, is now the GM for Rapid Cloud where both Eddie Ng & Lai Wei Keat are directors and shareholders

Ng Kian Seng, ex-CTO of Revenue Harvest & Kevin Woo, Head of Operations & also brother-in-law of Eddie Ng

We were told that this Ng Kian Seng whom previously was hired to be the CTO for the subsidiary Revenue Harvest could not perform at all, and did not had the backing and support of the technology team in the company.

Again, doesn’t take a genius to figure out what is exactly happening here.

Summary of all payments that has been made from Revenue to Rapidcloud since the beginning

According to sources, the first CFO who resigned Ng Kuan Horng designed the payments to be small so that it is not easy to be detected by Brian Ng who oversees the group finance and operations, just to test and see whether anyone notices.

Perhaps due to guilt or maybe Eddie didn’t pay him enough we don’t know, but he eventually resigned.

However, when the second CFO came in and started questioning this, he decided not to continue upon discovery of this and choose to resign instead.

The following are all the invoices since the beginning of the payment

If you managed to scroll until here, we presume that you’ve looked at all the hard evidence already.

Even we ourselves got a bit of eye sore when we were going through all of it.

So, once again, who is the real bad guys inside Revenue?

In the next post, we will be sharing who are the rest of the people that is abetting Eddie inside Revenue to try to suck money out from the company.

Yours truly,

V

revenue-insider@tutanota.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Revenue Inside

Discussions

written by datuk david goh , operator behind dino and bryant, pledging support in exchange of controls in revenue to move into property development, haha

2023-02-06 02:10

We don’t know who is the bad apples. Let MACC investigate and catch them all.

2023-02-06 17:22

Nowadays, in Internet era, can’t believe anyone. We don’t know who is the bad apples. Let MACC investigate and catch them all.

2023-02-06 17:23

Why don't submit this material to MACC for action? Are we expect MACC to come to forum to collect evidence nowsaday?

2023-02-07 16:49

To be honest, I would not imagine that the fight for power in the group would go to such drastic level, as to some inside-insider information was published to the public.

There was one article in particular that highlighted that there are suspicious related party transaction to a company called RapidCloud (M) Sdn Bhd, where the ultimate beneficiary would be Datuk Eddie Ng Chee Siong.

I think that the article provided much info on the transaction with RapidCloud (M) Sdn Bhd, but I still have my doubts on it.

1. According to the article, the author mentioned that Brian Ng Shih Chiow and Dino Ng Shih Fang is completely unaware of the transaction made with RapidCloud (M) Sdn Bhd. I mean, really?

It is very hard to believe the two brothers are completely unaware of the transaction.. to be honest, if they are unaware, then it is their negligence, which is very disappointing as they themselves are the major shareholders of the company.

2. The article had also mentioned a total transaction value of RM356,894.27 billed to Wannapay Sdn Bhd by Rapid Cloud (M) Sdn Bhd. It is a very strange and weird to say the person who was in-charged of finance did not know about this.

Anyway, since the issue of related party transaction (RPT) was mentioned… yours truly here wore student hat and downloaded the bursa guideline (link here) and look up the section on RPT. Ok, the threshold for reporting RPT is RM500,000 according to bursa… so these transactions below the reporting amount and do not need announcement.. hmm, this explain why it is not disclosed in the annual report.

Also, my own research on the company had shown that RapidCloud (M) Sdn Bhd had RM4.2 million in revenue for their financial year 2021 on CTOS.

2023-02-07 18:48

I think any novice person like me can buy the report to study also lol, and I got inspired by the article.

Anyway, the transaction with Wannapay Sdn Bhd stands below 10% of RapidCloud (M) Sdn Bhd total revenue. Now, this is an important point.. this means >90% of sales come from other customers. Further check on the company website says that RapidCloud has been in existence since 1999 and has provided solutions to over 46,000 clients. You can check out the website here.. look like this is a legit company.. not a RM2 company set up to solely serve Revenue. So it could just be ordinary business transactions at arms length. Agree? Now come to think abt it, the author didn’t mention in the article what law was broken..

Well, I do not know if the value of the cloud server and other services provided are at market rate, discounted or premium, readers please let me know if you know the market rate.

3. Art of distraction?

If you work the article backwards, the writing seems to have the intention to increase the odds of winning for the two brothers prior to the EGM. To me, that is questionable, but I will still attend the EGM.

To me, and perhaps to all minority shareholders, the most critical part of the whole EGM is actually on the diversification into property. Once it is approved, then Revenue can participate in any construction and property related activities lol, then definitely I’m not holding the shares anymore.

Please do not attack me as I’m just stating some of the observations from the article that does not make sense to me, see you at the EGM. Let’s vote and make our voice heard!

A Revenue investor who is holding 100,000 units and continues to pray for share price to recover.

2023-02-07 18:48

speakup

MACC sila tangkap!

this is a closed case. this is black & white close case. issue warrant of arrest & tangkap now!

2023-02-05 22:36