Consistently Profit Making Company Not Necessarily Is Good

RicheHo

Publish date: Tue, 01 Sep 2015, 02:36 PM

I would like to share about London Biscuit Berhad. Its principal activity is manufacturing and trading of confectionery and other related foodstuffs.

It is a profit making company whereby its revenue and net profit are improving from year to year.

However, one of the reasons why I am not interested in this company is because it keeps asking money from third party and raise fund.

- 2011 – Private placement, 10% of paid up share capital, raised RM10.25m

- 2013 – Private placement, 24.35% of paid up share capital, raised RM21.60m

- 2014 - Private placement, 9.9% of paid up share capital, raised RM16.35m

London Biscuit had been raised fund thrice in the past 4 years through private placement.

|

Year |

2011 |

2012 |

2013 |

2014 |

|

Net borrowing, RM |

133,022,425 |

145,709,767 |

179,882,116 |

195,939,083 |

|

Free cash flow, RM |

23,648,053 |

19,135,454 |

27,210,353 |

14,702,322 |

|

Net cash, RM |

(109,374,372) |

(126,574,313) |

(152,671,763) |

(181,236,761) |

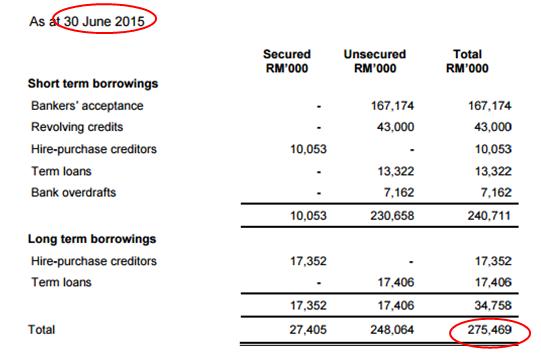

Its borrowing included bankers’ acceptances, term loan, revolving credits and bank overdrafts. Even though London Biscuit had raised fund few times previously from private placement, but its borrowing is still keep increasing! FYI, in annual report 2014, London Biscuit’s borrowing is roughly RM196m. However in June 2015 quarter report, its borrowing had increased up to RM275m! Even though London Biscuit is a profit making company, but compare to its huge borrowing, its net profit of RM14m on FY15 is just too insignificant. Don’t forget that the fund raised from private placement doesn’t categorize into borrowing. So, where is all the money flow?

|

Year |

2011 |

2012 |

2013 |

2014 |

|

Current ratio |

0.94 |

0.58 |

0.62 |

0.61 |

|

Acid test ratio |

0.80 |

0.45 |

0.50 |

0.50 |

|

Net current asset value, RM |

(0.49) |

(0.91) |

(0.95) |

(0.92) |

*Current ratio = Current assets / Current liabilities

London Biscuit is facing a very illiquid situation, which its current ratio less than one! It is very risky as it might not be able to reach its short term financial obligation. FYI, as at 1st of Sept, London Biscuit is only worth RM0.75 in the market while its net current asset value is (RM0.92)!

|

Year |

2011 |

2012 |

2013 |

2014 |

|

Trade receivables |

45,438,856 |

58,687,439 |

78,174,079 |

100,549,335 |

London Biscuit have very huge receivables which I believe it’s not able to collect from its customers! This is one of its major problems. It is not able to turn its receivables into cash. Besides that, its expenses and raw materials cost are very high and it increased from year to year.

|

Year |

2011 |

2012 |

2013 |

2014 |

|

Administrative expenses |

(21,613,633) |

(25,318,354) |

(23,792,000) |

(29,468,032) |

|

Selling and distribution expenses |

(11,347,750) |

(10,808,804) |

(17,656,329) |

(22,592,383) |

|

Total expenses |

(32,961,383) |

(36,127,158) |

(41,448,329) |

(52,060,415) |

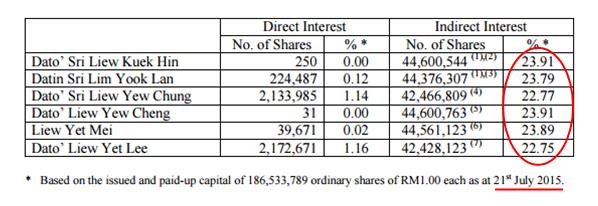

FYI, London Biscuit is managed and controlled by Liew family since year 1994. Surprisingly, the whole Liew family had Dato-ship except the eldest daughter, Liew Yet Lee.

- Father – Liew Kuek Hin

- Mother – Lim Yook Lan

- Son – Liew Yew Chung, Liew Yew Cheng

- Daughter – Liew Yet Mei, Liew Yet Lee

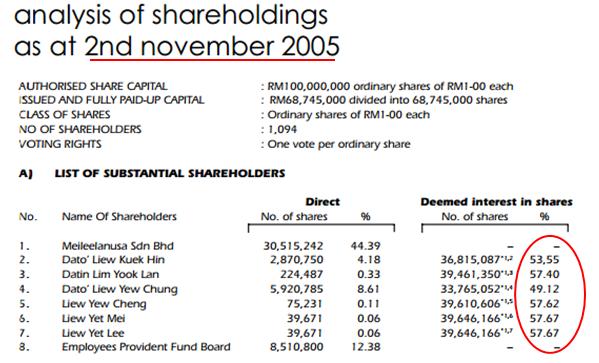

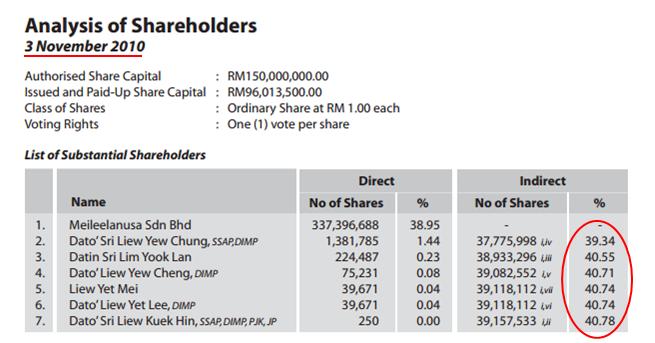

However, Liew family only owned 23.91% of London Biscuit. Even though they are still substantial shareholders, but scrolled back to 5 to 10 years ago, you will found that actually Liew family had slowly disposed off its shares interest portion by portion. On 2005, they still owned 57.73% but on 2010, they reduced it to 40.78% and now they only left 23.91%!

I believe it’s one of their strategies to exit the business whenever the worst scenario happens. London Biscuit currently had a serious financial problem. Once they unable to reach their short-term obligation, they will face a very serious issue.

Besides that, London Biscuit had just declared bonus issue of 1:5 on Jan 2015. The company may take part of retained earnings to clear part of its borrowing but why they choose to declare bonus issue? I believe the management wants to increase the liquidity of the stocks and to boost up the share price, so that they can dispose it more easily at a higher price.

In addition, London Biscuit had also declared ESOS for a period of five years from 2nd January, 2014 expiring on 1st January, 2019. It shall not exceed 15% of the issued and paid-up share capital. FYI, the paid up share capital of London Biscuit for year 2010 and 2015 is as below:

As at Feb 2010 – 87,250,000

As at Jul 2015 – 181,232,699

Is the management trying to dilute the company shares? I will leave it to you to think.

For all the reason above, as for me, London Biscuit is a very risky company even though it is making good profit every year. Everyone will have their own perspective and I might be wrong too. But, I will definitely avoid this type of company.

Just for sharing.

http://rhinvest.blogspot.com/2015/08/consistently-profit-making-company-not.html

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

Nice one. I think KCChong has written extensive warnings about this co. A few things:-

1. Retained earnings cannot be used to clear borrowings. Only cold hard cash can do that.

2. Receivables increasing is problematic, but it needs to be looked at with the context of sales since some companies may report increasing receivables but with increase in sales as well.

Use this metric instead to judge if the company is taking longer to collect its receivables

Days sales outstanding = 365 / (Current Revenue / Avg receivables from current year and prev year)

2015-09-01 16:56

management really creative manipulating their income statement + fabulous sweet talk in reports. So much traps, im so scared.

2015-09-01 17:05

Mr RichHo, most of the local investors are at sea most of the time. Playing the role of a light-house, I ought to express my gratitude to you. You are so youthful but your sharpness in analytical skill out-shine many other stock analysts in whatever research houses.

Keep writing. Your excellent (and near masterpiece) works would at least let the investors, in general, to think thrice before risking their monies in the share market.

- 这是华社的福份...

2015-09-05 05:25

I am not apple-polishing. I know at least one person who still holds on his shares for more than 10 years since the days of his purchases. His 'invested' capital was, and still is, quite a major portion of his life-savings.

2015-09-05 05:35

Thanks glorymas and ckwan11d for the compliment. It is my honor :) I will keep it on with my effort.

2015-09-07 11:30

AC Gan

Apollo & Cocoaland are much stronger than LonBISC..!

2015-09-01 16:31