That discovery will not come very often and once a while, I thought I have seen some resemblance of the same kind of stock or company - but either I was too slow and stupid to make decision or it actually created a false sense of happiness. In any case, we do not need to find a 10 bagger but my believe is to continue to look for a stock which has that similar track.

Petron is a stock which I stumbled upon when reading several comments on the oil retailing stocks. Since then, and over the last 2 - 3 weeks, I have taken an interest to understand the petroleum retail business after at first looking at Petron Malaysia's financials for the first time (in detail).

I am not an expert in oil and gas businesses, however I believe I am good enough with my observation as well as investment research if I put enough efforts to understand the business.

[I had a similar stock which I had bought - PDB probably back in 1996 (or sometime around then), I had the stock for around RM3. Again, I did not wait long enough to reap its RM24 today (and a lot more of its dividends). During then, also I was way too raw to understand these kind of businesses.]

In mentioning oil and gas, actually Petron - unlike companies like Icon Offshore, UMW O&G, Bumi Armada etc. etc. - is in a much different type of business. It is in the retailing business which Lazada, Amazon or 11street cannot replace. (It can be threatened by Tesla or BYD though)

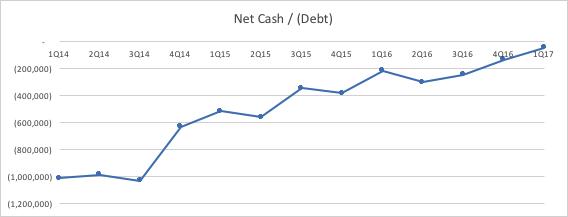

Just to get things started, what makes me spending time to look at Petron is basically because of the below - its net cash or debt position over a short period of time. Of course in investment, it is not as simple as that, but the below signifies strong and consistent free cashflow.

|

| Net Debt improved dramatically from RM1 billion in 1Q14 to almost no debt now |

Before, we even look at numbers in detail - many would have (as well as me), been wondering why would I invest into a Philippines controlled oil and gas company where firstly the country does not even have a strong O&G industry.

Then, as I have seen what really happened to BP (which turned into BHP, under Boustead) as well as Projet (if anyone remembers - which was later sold to Shell) - the same could happen to Petron. It is not an easy business. This is not entirely a technology business but involves operational execution strength and marketing - which is what San Miguel, the parent company of Petron is strong at.

One may also say that Petron is also doing refinery then retailing. Correct. That is one of the concerns, but it seems that it is able to cope well. Its 88,000 barrel/day refinery in Port Dickson is smaller than competitors like Petronas (obviously) and Hengyuan (bought from Shell) at 156,000 barrel. However, it manages to bring back profitability from the refinery - which is important.

What is questionable is that why was it Esso which sold the entire business (refinery and retail) to Petron back in 2012 could not really make much money from this refinery - but Petron could as it has shown especially over the last 8 quarters.

|

| Petron has turnaround from losses in 2013 - 2014 to strong profits over last few quarters |

That answer lies in them being "focused" and the Malaysian market being not big enough. However, what is not big enough for Esso is big enough for San Miguel. In the era of consistent and extreme competition, the big giants can only focus on few things that they think they can be better and make much more money than others. ExxonMobil, Shell and BP are strong in exploration and pretty much the upstream business - an area which not all players can be deemed to be good at. Beyond technology, it is also involving geo-political relationship. Why would then, a CEO of Exxon-Mobil be given a Secretary of State position...

At the same time, as many would know - this business is getting challenged from the shale guys (using a different technology and business model). They are also being challenged from the alternative energy guys such as solar, battery technologies, wind, biofuel etc. Hence, downstream, refining especially is the least of their problem.

It is like manufacturing to Apple and Google.

Petron actually was having a similar deal back in 1973 when Esso sold its business to the government of Philippines. Today, Petron is the largest petrol station operator in Philippines with 40% of market share and operating 1900 stations. In Malaysia today, Petron has close to 600 by now being the 3rd largest player after Petronas (1000+) and Shell (900+). That 600 stations over time, however may bring in very significant return to San Miguel group as one must note that Malaysian oil consumption is about 600,000 barrels a day while in Philippines it is below 300,000 (if I am not wrong).

With that backdrop, more importantly to us investors, Petron is willing to invest in a competitive ground with the backdrop having players like Petronas and Shell. It is growing at a pace of 30 - 50 stations a year now while the likes of Shell is growing in teens. Caltex (400+ stations) and BHP are even further behind, if I am not wrong.

Although the petrol retailing business is growing at just an average 3 - 5% yearly, Petron is probably the ones that has the highest growth. Fighting against negative perceptions in the first few years of its operations, it is now growing faster than Shell and Petronas (which I will show in my future article). This is probably as I believe, the other guys have a larger giant to slay. Shell, Caltex have much bigger agenda to worry about than Malaysia's petrol station business while Petronas will continue to worry over the low oil price environment and its revenue contribution to the government. BHP? Well nothing much to say. Maybe not so competent.

Further from the very nice cashflow which I shown above, Petron is now trading at just below RM2 billion (RM7.25) market capitalisation. Against the significantly bigger giant of about 2.6x revenue larger, Petronas Dagangan - it is really cheap as PDB is now trading at RM24 billion market capitalisation. Translating into PE over last 12 months, it is even a nicer story. Nevertheless, I am also careful over the fluctuation in the oil price which will have some impact to the bottomline numbers - hence I am not reading too much into the profit numbers over the last 2 - 3 quarters. I believe the rise and drop in oil price has some impact as it has certainly has some inventories to hold. When oil price drops, the inventory value will drop, vice versa.

Over time, however this should not be an important benchmark - as we cannot do a projection over the price of oil into the future. The more important benchmark is whether their refinery is creating a healthy margin and secondly - is it able to sell through its petrol pumps as most of the oil that it refines - goes to the pump - if not mistaken. THAT, over the last 2 years have shown mark improvement for Petron - and it is a very important denominator for this business.

I know, I am a bit late in the game - as Petron climbed from around RM5 - RM6 last year - at its current valuation and if it is manages to continue its growth momentum, this is not expensive at all. In fact, it is cheap.

(Over next articles, I may want to discuss the impact of technology - electric cars etc. and introduce more financial numbers towards this business. Obviously, I do not have all the answers.)

soojinhou

I saw the magnificent fcf too, and that attracted me to Petron. Over the past 4-years, oil price gone through ups and downs, but Petron is still able to generate plenty of cash. Why Shell and Exxon sold? My guess is that their business in Malaysia is only a tiny spec in their entire global empire. However, the new owners are from the 3rd world and they are definitely more hungry and eager to compete. I would say, probably even keener competitor than Petronas. Big oil doesn't care about the profit from their retailing, which is just a drop in the ocean, but hell that drop is pretty darn big to a company like San Miguel.

2017-06-30 18:39