|

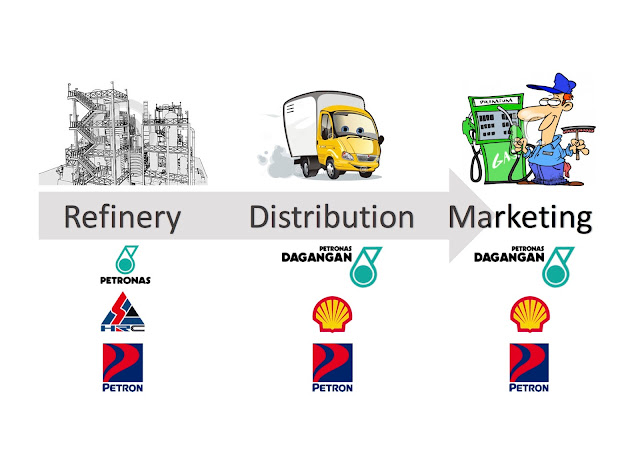

| The downstream operations of O&G for the listed companies in Malaysia |

Petron exists from its acquisition of Exxon Mobil's (merger from the two) retail operations. Caltex is a unit of Chevron and understandably it gets its supply through import. BHP is a smaller unit owned by Boustead where it purchased from BP (British Petroleum).

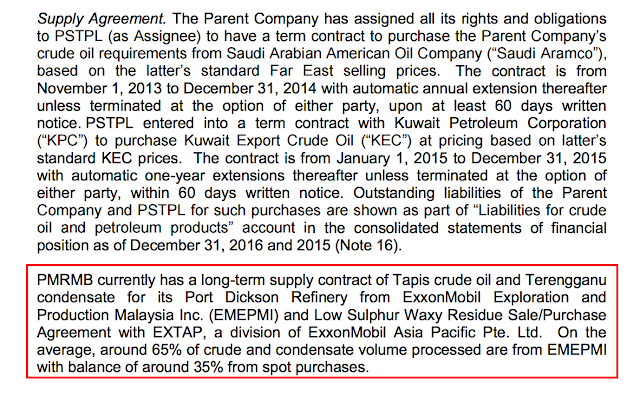

From above, it sounds like it is a crowded market. It is true that it is a crowded market especially if one does not have the supply and support. Hence, I believe that all the players have their own supply support. It is also known that Petron's supply comes from Exxon as highlighted below.

Hengyuan bought the refinery which on paper can produce 156,000 bpd from Shell Refinery. In that exercise, Hengyuan took over a RM1 billion debt from Shell from that operation. In return, Shell which still operates more than 900 petrol station in Malaysia promises purchase contracts so that its supply is guaranteed. What Hengyuan now needs to do is to make sure that its petrol is Euro 4M compliant and it has to meet that deadline by next year.

It is also a known fact that if the sale to Hengyuan did not materialise, Shell could have converted the refinery into a storage facility. That was a drastic business change and this could also mean that Shell was not willing to invest further in Malaysia. Having Hengyuan picking up and willing to invest have changed Shell's direction. It is now buying the refined oil from Hengyuan for its Malaysian operations. This also means that it trust the quality that Hengyuan's produces.

I have also wondered what makes Shell not interested in the refinery but it will continue to operate the retailing business. Like Exxon, it could have also sold the Malaysian retailing arm - but understandably this is not the direction Shell's went for.

That could mean that the IRR is not attractive enough for an oil giant such as Shell but good enough for Hengyuan, a smallish refinery back in China. At the same time as well, Chinese companies are busily acquiring assets overseas and they could have good support from their government.

Although it looks like quite similar, the two exercises - Petron and Hengyuan - have vast differences in terms of post exercise strategy.

Petron will need to obtain the trust from the final retail customer as the brand is not a name which we are familiar with. It needs to work on many things on the B2consumer front. On the other hand, Hengyuan needs to invest more on the refinery - getting good margins from the crack and sell to Shell at a predetermined price (MOPS).

Needless to say Petron, while still needing to get its refinery efficient as well, will have the harder task. The reward however is more fulfilling as it "can control its own destiny" better. The more it gets consumer trusts, the better it will become. As the final price at the pump is now based on a certain formula - largely following MOPS, margin volatility could also be lower for Petron - as it is less dependent on the demand and supply of crude at any point of time as its produce is sold at the final pump price.

Hengyuan on the other hand is like the furniture manufacturer for Ikea where Ikea controls the supply and demand. Raw wood will be supplied by Ikea - the furniture manufacturer will try to manage the costs - and later sell the manufactured furniture to Ikea back. I do not like this kind of position although one can also make good money.

I like the position where one buys the raw crude from Exxon and I determine myself how one sells its finished products. Do I go aggressive by signing more commercial contracts and opening more stations or do I go slower.

At the end of the day, if I sell the produce where my brand is carried that should worth more money. This is like if you are a Nestle and carry your branded products rather than being white labelling company providing processed chilli sauce for Maggi brand - which you think would be more valuable at the end of the day?

Of course, to sell your own brand - it is a different strategy altogether. Hence, I do not think one should do an apple to apple comparison based on a similar PE.

cheoky

great insight

2017-07-17 22:49