How does MCO affect steel industry? Koon Yew Yin

Koon Yew Yin

Publish date: Tue, 13 Jul 2021, 06:17 PM

After I posted my article to advised investors to get out of the stock market as soon as possible, I thought I have nothing more to say. But after I read the Malaysian Steel Association Chairman, Tan Sri William Cheng statement to The Star, which supported my reasons for getting out of the stock market as soon as possible, I have decided to write this useful piece to help investors.

The RM45bil domestic steel sector has been severely impacted by the prolonged Covid-19 led lockdowns with many players unable to operate and fulfil their outstanding orders, despite the current robust export market.

According to Malaysia Steel Association (MSA) president Tan Sri William Cheng, most steel manufacturers are facing tremendous financial losses, especially those operating in Selangor and Kuala Lumpur, the powerhouses of industries and services that contribute over 40% of the country’s gross domestic product (GDP). “Any extension of the enhanced movement control order (EMCO) will have dire consequences on almost all the manufacturers and businesses,” he said.

How does MCO affect the steel industry?

There are 3 principal players in the steel industry:

1 Steel makers

2 Steel products makers

3 Steel products consumers

MCO is movement control order. MCO is affecting all the 3 principal players because workers cannot to go to work.

1 Workers cannot go to the steel factories to make steel.

2 Workers cannot go to the steel products makers to make steel products.

3 Workers cannot go to work in construction companies to work to consume steel products such as steel bars, stell plates, angle iron etc .

As a result, all the 3 principal players, the steel makers, steel products makers and the steel products consumers (construction contractors) cannot make profit.

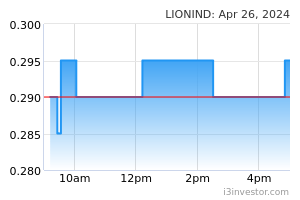

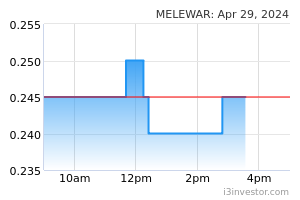

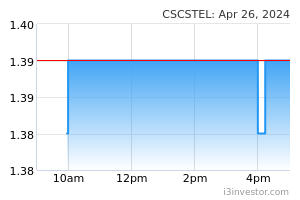

1 Steel makers are Lion Industry, Melewar, CSC Steel etc.

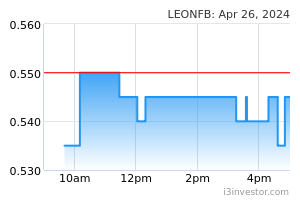

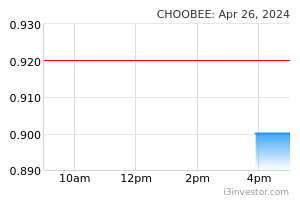

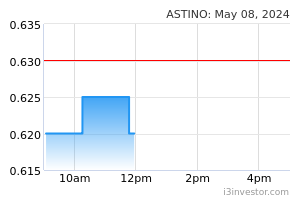

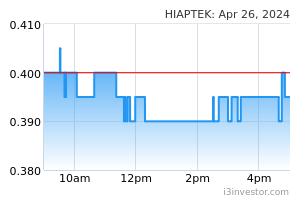

2 Steel product makers are Leon Fuat, Choo Bee, Astino, Haip Teck etc.

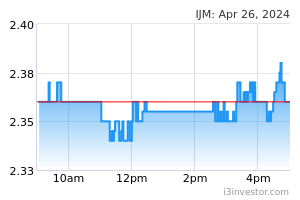

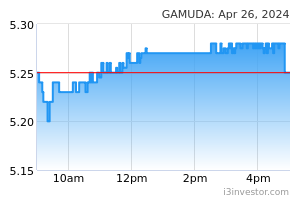

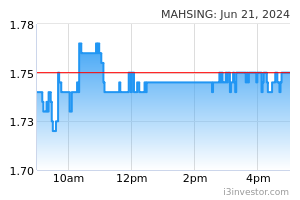

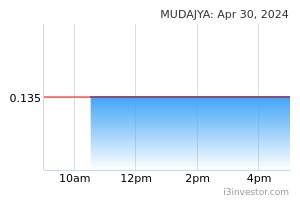

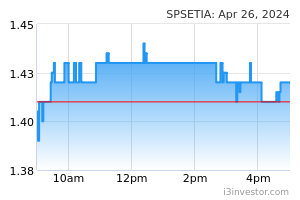

3 Steel products consumers are IJM, Gamuda, Mah Sing, Mudajaya, SP Setia etc

As I said earlier, Covid 19 is affecting everybody’s movement and listed companies. Until Covid 19 pandemic is fully under control, all listed companies will not be able to report increasing profit in the next few quarters.

Among all the stock selection criteria such as NTA, dividend yield, cash flow, debt, healthy balance etc profit growth is the most power catalyst to push up share price.

In fact, MCO affects not only the steel industry. It affects almost all the listed companies. That is why KLCI chart has been dropping in the last 6 months as shown on the chart below.

Investors must not buy shares of steel makers, steel products makers and steel products consumers because all of them cannot report increasing profit in the next few quarters. As I pointed out, MCO affects almost all the listed companies, investors should get out of the stock market as soon as possible.

Related Stocks

Market Buzz

2025-01-11

GAMUDA2025-01-11

HIAPTEK2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

IJM2025-01-10

IJM2025-01-10

IJM2025-01-10

IJM2025-01-10

MAHSING2025-01-10

SPSETIA2025-01-09

GAMUDA2025-01-09

GAMUDA2025-01-09

GAMUDA2025-01-09

GAMUDA2025-01-09

GAMUDA2025-01-09

GAMUDA2025-01-09

GAMUDA2025-01-09

IJM2025-01-09

IJM2025-01-09

MAHSING2025-01-09

MAHSING2025-01-09

SPSETIA2025-01-09

SPSETIA2025-01-09

SPSETIA2025-01-08

ASTINO2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

HIAPTEK2025-01-08

HIAPTEK2025-01-08

IJM2025-01-08

IJM2025-01-08

IJM2025-01-08

IJM2025-01-08

IJM2025-01-08

MAHSING2025-01-08

MAHSING2025-01-08

MAHSING2025-01-08

SPSETIA2025-01-08

SPSETIA2025-01-08

SPSETIA2025-01-08

SPSETIA2025-01-07

GAMUDA2025-01-07

GAMUDA2025-01-07

GAMUDA2025-01-07

GAMUDA2025-01-07

GAMUDA2025-01-07

IJM2025-01-07

IJM2025-01-07

SPSETIA2025-01-07

SPSETIA2025-01-06

GAMUDA2025-01-06

GAMUDA2025-01-06

GAMUDA2025-01-06

GAMUDA2025-01-06

GAMUDA2025-01-06

IJM2025-01-06

IJM2025-01-06

SPSETIA2025-01-04

MAHSING2025-01-03

GAMUDA2025-01-03

GAMUDA2025-01-03

GAMUDA2025-01-03

GAMUDA2025-01-03

GAMUDA2025-01-03

GAMUDA2025-01-03

GAMUDA2025-01-03

GAMUDA2025-01-03

GAMUDA2025-01-03

GAMUDA2025-01-03

GAMUDA2025-01-03

IJM2025-01-03

MAHSING2025-01-03

MAHSING2025-01-03

SPSETIA2025-01-02

GAMUDA2025-01-02

GAMUDA2025-01-02

GAMUDA2025-01-02

GAMUDA2025-01-02

GAMUDA2025-01-02

GAMUDA2025-01-02

GAMUDA2025-01-02

IJM2025-01-02

IJM2025-01-02

MAHSING2025-01-01

GAMUDA2025-01-01

GAMUDA2025-01-01

IJM2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

IJM2024-12-31

IJM2024-12-31

SPSETIAMore articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Dec 26, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Dec 13, 2024

Indonesia remains committed to start implementing a 40% mandatory biodiesel mix with palm oil-based fuel, or B40, on Jan 1 next year, its chief economic minister said. Indonesia, the world's largest..

Created by Koon Yew Yin | Dec 12, 2024

Indonesia is the world's largest producer of palm oil, producing an estimated 46 million metric tons in the 2022/23 marketing year. Indonesia also exports over 58% of its production, making it the w..

Created by Koon Yew Yin | Dec 03, 2024

Indonesia is the largest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Discussions

Everyone knows steel industry is operating at 10% capacity only since FMCO but kyy.

#SmartInvestorMyAss

2021-07-14 19:47

Why is not saying this when he was holding leonfb but keep promoting the stock.

2021-07-14 19:59

KYY ask SELL

OTB ask BUY

hmmm...but everyone know KYY is follow OTB jalan punya...

See the games?

2021-07-15 11:55

After reading Uncle's article, it is good to read the following article.

https://www.facebook.com/1238461152861295/posts/6052893511418011/

2021-07-15 16:45

The beauty of KYY is he will post articles after he has sold to tell you you have been conned to buy when he sold!!!

2021-07-15 16:54

Posted by ming > Jul 15, 2021 7:23 PM | Report Abuse

China market:

周四,钢铁板块强势拉升。

业绩表现方面,截至7月15日,钢铁板块内共有29家上市公司发布了上半年业绩预告,抚顺特钢、三钢闽光、新钢股份、柳钢股份等16家公司净利润同比预增超100%,其中,包钢股份预计上半年实现归母净利润约20~28亿元,同比增长2281%~3233%,增幅最大。

近期,多地发布钢铁下半年限产政策,叠加原材料价格见顶回落,钢价触底后出现明显反弹。

对此,中信建投研报称,各区域的限产风声再起,宝武系钢厂以及安徽、江苏、甘肃等地区都进行了相关会议下放指标,要求产量不能高于2020年。考虑到上半年各钢企均有增产,全年产量不高于2020年会导致下半年的减产。此次限产更多的是把指标逐步下放到企业,对完成的节奏没有做过多的规定,如果严格执行,供给端会面临比较大的收缩。

2021-07-15 19:37

On Thursday, the steel sector pulled up strongly.

In terms of performance, as of July 15th, a total of 29 listed companies in the steel sector have issued performance forecasts for the first half of the year. The net profit of 16 companies including Fushun Special Steel, Sangang Minguang, Xingang, and Liugang will increase year-on-year Over 100%, Baotou Iron & Steel Co., Ltd. is expected to achieve a net profit of about 2 to 2.8 billion yuan attributable to the parent in the first half of the year, a year-on-year increase of 2281% to 3233%, the largest increase.

Recently, many places have issued policies to limit steel production in the second half of the year, and the prices of superimposed raw materials have peaked and fallen, and steel prices have rebounded significantly after hitting the bottom.

In this regard, the CITIC Construction Investment Research reported that production restrictions in various regions have resumed. Baowu steel mills and Anhui, Jiangsu, Gansu and other regions have conducted relevant conferences to decentralize indicators, requiring production not to be higher than 2020. Considering that all steel companies have increased production in the first half of the year, the annual output not higher than 2020 will lead to a reduction in production in the second half of the year. The current production restriction is more about gradually decentralizing the indicators to the enterprise, without making too many regulations on the pace of completion. If strictly implemented, the supply side will face a relatively large contraction.

2021-07-15 20:17

ahbah

Investors should SLOWLY over long period of time to accumulate steel stocks as they are cheap now ?

2021-07-14 13:04